Bitcoin Surpasses $123K, Signaling Confidence in Crypto Infrastructure

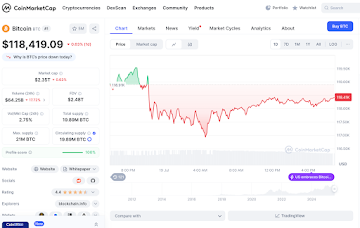

The broader crypto market simply crossed the $4 trillion mark, with Bitcoin buying and selling above $118,000 and Ethereum over $3,500. This surge isn’t simply hypothesis—it’s infrastructure-driven. Establishments are getting into the house, and laws just like the U.S. GENIUS Act is boosting readability.

This surroundings favors foundational platforms like OpenFundNet, which supply tangible utility, validator-driven belief, and scalable incentive techniques for decentralized fundraising.

Supply: Coinmarketcap – Bitcoin

The Web3 Shift: Fundraising Will By no means Be the Similar

Capital elevating is evolving quick. Within the age of Web3, energy is shifting away from centralized VCs and opaque platforms towards clear, borderless, community-powered ecosystems. Creators, builders, and buyers are trying to find instruments that don’t simply mimic conventional techniques—however exchange them.

However how do you design a funding mannequin that really works for everybody? That rewards contributors, scales globally, and protects high quality? OpenFundNet could possibly be that reply.

Why OpenFundNet Is Designed for Scale

Most Web3 fundraising instruments nonetheless behave like Web2: excessive charges, gatekeepers, and restricted world attain. OpenFundNet flips that script with zero platform charges, real-time token emissions, and governance powered by validators and nominators.

It’s not simply tech innovation—it’s infrastructure tuned for the following wave of builders and backers, making it some of the compelling platforms getting into the 2025 cycle.

Validator Methods > Enterprise Capital

Previous-world fundraising meant pitch decks to buyers in fits. Now, OpenFundNet distributes that decision-making energy by means of its validator mechanism. Validators evaluation and rating tasks, incomes rewards for accuracy. Nominators again trusted validators, including accountability and strengthening the sign.

It’s a better, decentralized method to floor high quality—and reward those that assist. Bias is eliminated. Benefit shines.

Every day Token Emissions Drive Actual-Time Rewards

What retains momentum alive in a funding ecosystem? Exercise and incentives. OpenFundNet injects 270,000 tokens every day into the system, rewarding backers, validators, and nominators.

Not like different platforms that reserve development for insiders, OFNT’s every day emissions mannequin ensures members are constantly rewarded—particularly within the early phases. With a halving each two years, the availability curve additionally introduces deflationary shortage.

Zero Charges = True Accessibility

Charges kill innovation. Whether or not it’s 5% or 20%, they punish small tasks and forestall risk-takers from even making an attempt. OpenFundNet removes all platform charges—for creators, validators, and backers.

That’s not simply user-friendly—it’s structurally disruptive. If you take away price boundaries, you unlock world participation, particularly in rising markets the place each token counts.

Decentralized Governance That Really Works

It’s not sufficient to say you’re “community-led”—you need to show it. OpenFundNet permits token holders to vote on main protocol modifications, funding parameters, and new options.

This on-chain governance system turns customers into stakeholders. Validators and nominators aren’t simply supporting roles—they’re architects of the ecosystem. And that’s how community results compound.

The 2025 Crypto Thesis: Utility and Infrastructure Rule

2025 isn’t about meme cycles—it’s about platforms that do actual work. With Solana-based apps rising, ETH L2s scaling, and Bitcoin ETFs flowing into the market, buyers at the moment are specializing in tasks that provide real-world worth.

That’s the place OpenFundNet stands out. It’s not one other hype coin. It’s a zero-fee, validator-governed, daily-yield protocol fixing a core downside: decentralized fundraising at scale.

What the Future Seems to be Like

Quick ahead to late 2025. Probably the most viral crypto startups? Launched by way of OpenFundNet. Validators? Handled like digital popularity banks. Nominators? Incomes passive returns.

And the large Web2 crowdfunding platforms? Nonetheless debating how you can “combine Web3” whereas OFNT has already powered billions in decentralized raises. If OpenFundNet executes even 50% of its roadmap, it gained’t simply compete—it is going to dominate.

Now’s the Time: Stake Early, Win Lengthy-Time period

Crypto strikes quick. The most effective alternatives usually belong to early adopters. With zero charges, real-time token rewards, and validator-led governance, OpenFundNet is engineered for breakout development.

If you happen to imagine in a Web3 future the place customers again the most effective concepts—and earn from it—then OFNT isn’t simply value watching. It’s value backing.

Be a part of the OpenFundNet Token Presale and Neighborhood

Web site: https://presale.openfundtoken.io/

Whitepaper: OpenFundNet Token Whitepaper PDF

X: https://x.com/openfundnet

Telegram: https://t.co/JmozQ7JNh9

Discord: https://t.co/sOlHuqdzag

Disclaimer: This can be a paid publish and shouldn’t be handled as information/recommendation. LiveBitcoinNews shouldn’t be chargeable for any loss or injury ensuing from the content material, merchandise, or providers referenced on this press launch.