At a latest Bitcoin convention in Las Vegas, there have been so many authorities and TradFi attendees that Bitcoin purists are beginning to fear they’re shedding their peer-to-peer digital money system to the “fits.”

From BlackRock’s preliminary transfer for a spot Bitcoin exchange-traded fund in the summertime of 2023 to US President Donald Trump’s embrace of crypto, all indicators point out the establishments are lastly right here.

“The years of Bitcoiners clamoring for ‘institutional buyers’ and pursuing worth appreciation extra proactively than privateness, self-custody, and different cypherpunk beliefs have led to Bitcoin quickly changing into simply one other TradFi instrument,” Cake Pockets vice chairman Seth For Privateness tells Journal.

Nonetheless, Darius Moukhtarzade, a crypto analysis strategist at spot Bitcoin ETF issuer 21Shares, factors out that there are advantages and downsides to the union.

“Institutional adoption brings scale, credibility and infrastructure maturity, thus enhancing liquidity, decreasing volatility and driving compliance readability,” he says. “But it surely additionally introduces custodial danger, potential censorship and ideological drift.”

Maybe the growing affect of conventional establishments was inevitable as Bitcoin grew right into a $2 trillion asset. However are the establishments influencing Bitcoin, or is it the opposite means round?

Issues with TradFi’s embrace of Bitcoin

Bitcoin was created in its place digital monetary system that eliminated the sorts of centralized energy discovered within the legacy monetary system, comparable to the facility of the central financial institution to inflate the cash provide and the flexibility for banks to entry private monetary knowledge.

The pseudonymous creator of Bitcoin, Satoshi Nakamoto, explicitly wrote about many of those points.

However with TradFi’s rising curiosity in Bitcoin as a impartial, apolitical retailer of worth, many of those centralized factors of contact are starting to creep into the Bitcoin community.

Seth For Privateness says he’s involved in regards to the lack of privateness on the Bitcoin community in the present day, significantly because it was a key cypherpunk philosophy that prompted the creation of Bitcoin within the first place.

“The first situation is that the incentives of the community are altering,” Seth For Privateness provides.

“If the vast majority of the cash and affect in Bitcoin has a perverse monetary incentive to take away privateness of the person and retain energy for themselves, we’re prone to see much less funding and sources being poured into enhancing Bitcoin’s privateness or self-custodial tech.”

Nonetheless, Citrea co-founder Orkun Mahir Kilic takes a extra balanced view.

“Bitcoin itself is inherently proof against exterior affect,” Kilic tells Journal. He says the connection is reciprocal and that TradFi is starting to acknowledge the worth of Bitcoin.

“That stated, they not often interact with Bitcoin in its purest kind (e.g., self-custody). As a substitute, they usually undertake custodial options, which in flip creates demand for centralized and custodial instruments. This demand influences builders to concentrate on constructing such instruments, thereby making a cycle of mutual affect.”

Bitcoin is long run cooked if it really shifts from “not your keys, not your cash” to this “democratization of entry” narrative pushed by Saylor and Wall Road monetary engineers. pic.twitter.com/PBeO01nWt4

— Beanie (@beaniemaxi) Could 29, 2025

Kilic’s Citrea, which is constructing a zero-knowledge tech-based layer-2 (L2) community on high of Bitcoin, needs to assist scale the adoption of Bitcoin in a means that permits holders to retain possession of their non-public keys, in contrast to ETFs and Bitcoin treasury firms, which don’t provide actual custody of Bitcoin.

“If a majority of individuals depend on custodians or ETFs, transactions will happen at that layer with out ever touching Bitcoin’s mainchain.”

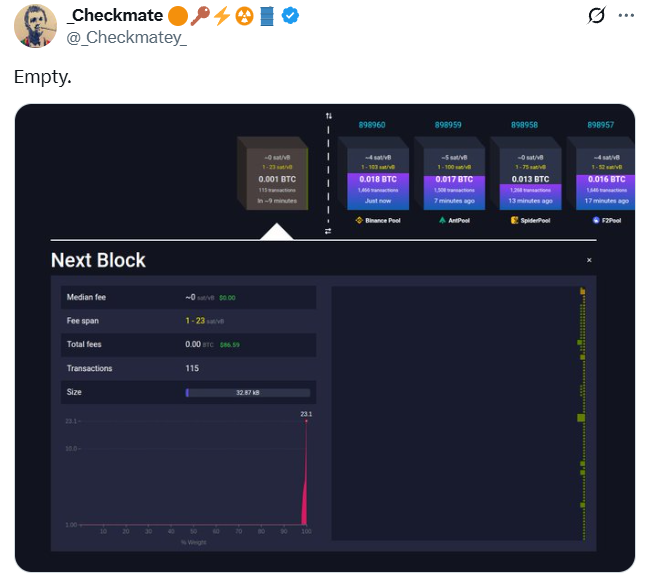

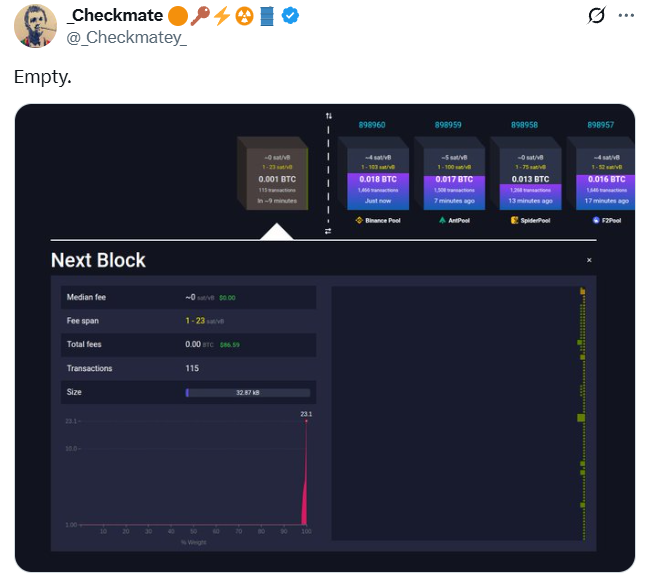

“This lack of onchain transactions means fewer transaction charges, which can grow to be a crucial situation as block rewards proceed to halve, he says.

Many observers have seen that blocks have been considerably empty these days, regardless of Bitcoin hitting new all-time highs and “spam” use instances comparable to Inscriptions.

Kilic provides that there are additionally well-documented dangers that include centralized custody, comparable to with FTX and BlockFi, which went bankrupt in 2022.

Bitcoin and TradFi are evolving collectively

Moukhtarzade from 21Shares agrees with Kilic that the affect goes each methods.

“It’s a bidirectional dynamic,” Moukhtarzade says. “Bitcoin has undeniably formed narratives in TradFi and coverage circles, from El Salvador’s authorized tender transfer to the worldwide ETF race pushing establishments and governments to take it significantly. On the similar time, TradFi’s entry through ETFs and controlled custody options is influencing Bitcoin’s perceived legitimacy and utility, particularly for institutional portfolios.”

“We’re witnessing convergence: Bitcoin is forcing TradFi to evolve, whereas TradFi is institutionalizing Bitcoin.”

Bitcoin purists, nevertheless, don’t like the thought of bringing the identical previous custodians again into the combination. Nonetheless, Moukhtarzade argues that large-scale institutional merchandise want regulated custodians to satisfy compliance, safety and investor safety requirements.

“Whereas this introduces a level of custodial centralization, these platforms additionally endure rigorous audits, make use of best-in-class chilly storage, and are held to a excessive fiduciary customary, one thing that’s not assured in retail self-custody.”

Learn additionally

Options

Yr 1602 revisited: Are DAOs the brand new company paradigm?

Options

Unforgettable: How Blockchain Will Essentially Change the Human Expertise

Moukhtarzade says issuers comparable to 21Shares and the remainder of the ecosystem have a duty to protect Bitcoin’s foundational values, provide technical neutrality, and assist person alternative.

“Long run, we imagine various custody fashions from ETFs to decentralized custody protocols ought to coexist, empowering customers throughout the spectrum from passive holders to lively community contributors,” he provides.

Not good, however a greater system total

So, what occurs going ahead? For now, there’s a widening division between Bitcoin purists and people open to TradFi centralization.

As Journal famous earlier this yr, there’s an argument that centralized TradFi will find yourself consuming a lot of the exercise that’s presently thought of decentralized finance (DeFi).

Some say a worst-case state of affairs can be a Bitcoin equal of Franklin D. Roosevelt’s Govt Order 6102, which prohibited residents from hoarding gold.

However conventional monetary establishments and the governments that regulate them even have good causes to assist a decentralized Bitcoin, whether or not or not it’s for shielding the asset’s underlying worth proposition out of greed or just incomes votes from native constituents.

The optimistic features of TradFi’s involvement in Bitcoin can’t be ignored both. Regardless of the centralization concerned with ETFs and different custodial choices, in addition they successfully permit thousands and thousands of individuals to achieve Bitcoin worth publicity with out having to pay an onchain payment or find out about wallets and seed phrases.

“[Things] can quickly change as mining turns into extra industrialized and controlled, governments pursue prosecution towards open supply builders, and far more,” warns Seth For Privateness. “Fortunately, there are ‘shadowy tremendous coders’ who will preserve constructing highly effective instruments regardless, nevertheless it’s nonetheless one thing to keep watch over.”

Learn additionally

Options

Secrets and techniques of crypto founders below 25 who’re making financial institution

Options

How do you DAO? Can DAOs scale and different burning questions

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Kyle Torpey

Kyle Torpey has been protecting Bitcoin and crypto since 2014. Notably, he lined Bitcoin’s blocksize conflict at Bitcoin Journal and Forbes. Through the years, his work has additionally been printed in Fortune, Vice, Investopedia, and plenty of different media shops