- LINK is up almost 60% in a month, breaking key resistance ranges with whales shopping for over 8 million tokens.

- On-chain whale exercise spiked massively, with massive transactions up 1,400%, signaling continued confidence.

- Regardless of overbought RSI and a few alternate inflows hinting at profit-taking, momentum stays with the bulls—$23 is likely to be subsequent.

Chainlink’s making waves once more—and this time, it’s not only a fluke bounce. The token’s blasted via a key bullish sample, retested the breakout like clockwork, and simply saved climbing. Momentum? It’s positively leaning bullish.

However right here’s the actual kicker: whales are nonetheless shopping for, even after LINK’s already run up almost 60% in a month. That sort of confidence doesn’t present up every single day.

Huge Fish, Huge Strikes

In response to a well known voice on X, whales have scooped up greater than 8 million LINK tokens over the previous 30 days. That’s not a small wager. And through that very same interval? LINK jumped from $12.33 to $19.40, smashing via resistance zones like that descending trendline and the notoriously cussed $18 degree.

At press time, LINK was up one other 9% in 24 hours, sitting close to $19.41. Quantity additionally picked up—buying and selling exercise rose 6.5% in comparison with the day earlier than. Clearly, retail merchants are catching on too.

Whale Exercise Is By way of the Roof

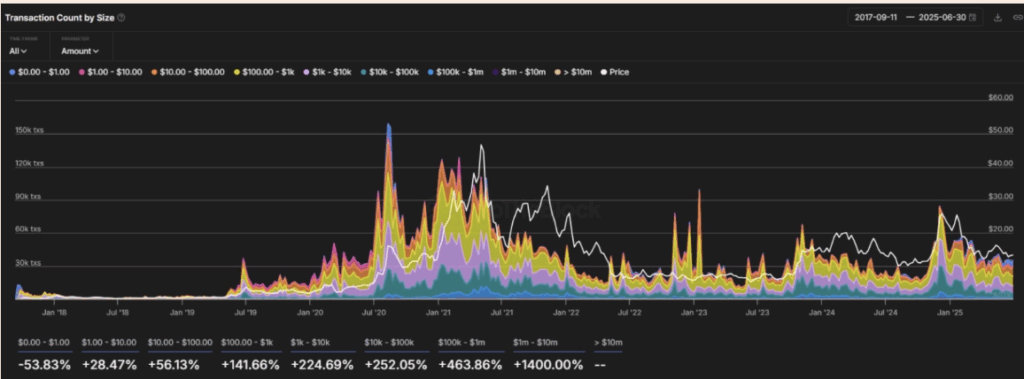

Digging into the on-chain stuff, information from IntoTheBlock reveals a loopy spike in massive transactions. Transfers within the $1M to $10M vary surged over 1,400%, and even the $100K–$1M bracket noticed a 463% enhance.

That sort of quantity doesn’t often come from retail merchants messing round. It’s good cash—they usually appear to be gearing up for extra upside. If something, this helps the concept LINK’s breakout was the actual deal, not just a few random pump.

What’s Subsequent for LINK?

Technically talking, LINK’s breakout adopted a textbook double-bottom sample, which is often bullish. If this pattern holds up, we could possibly be a 20% rally that places LINK close to $23. However—and it’s an enormous however—LINK wants to remain above $18 and keep away from any severe dips in sentiment.

One crimson flag, although: the RSI is hovering round 82, which is deep in overbought territory. That doesn’t imply a crash is coming, however some short-term cooling off wouldn’t be shocking both.

Exchanges Are Seeing Extra LINK Deposits

Right here’s the twist: in keeping with CoinGlass, exchanges simply noticed about $1.74 million value of LINK deposited within the final day. That is likely to be some holders on the point of take earnings. If too many individuals begin promoting, it might dampen the rally—a minimum of briefly.

Nonetheless, wanting on the complete image—whale exercise, technical breakout, rising quantity—the bulls appear to be steering this ship for now. If LINK can break previous $20 cleanly and maintain its floor, the subsequent leg up might come prior to anticipated.