In short

- Block turns into the second crypto-facing agency within the S&P 500 index, two months after Coinbase.

- For over a yr, Block has allotted 10% of its month-to-month revenue from Bitcoin companies to buy further Bitcoin.

- Trade observers say regulatory shifts are serving to push crypto corporations into mainstream acceptance.

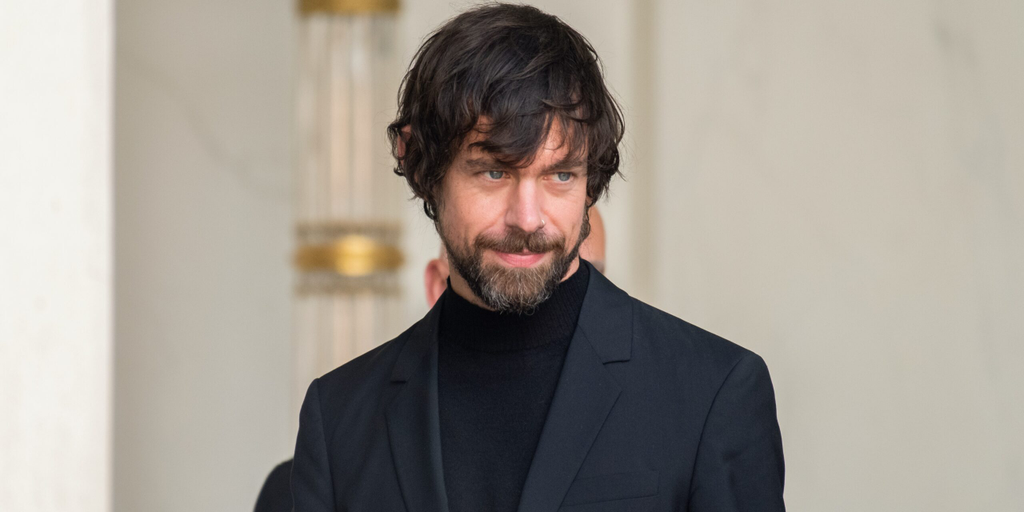

Block Inc., the fintech firm led by Twitter co-founder Jack Dorsey, is ready to hitch the S&P 500 this week, marking the second crypto-facing agency to be added to the index in lower than a yr.

Block’s transfer follows Coinbase’s addition to the index in Might, when it changed Uncover Monetary Providers. Block will change Hess Corp.

It’s anticipated that Dorsey’s firm will probably be listed on Wednesday, the corporate introduced on Friday, changing Hess Corp, an oil and gasoline agency being acquired by Chevron.

The S&P 500 is a extensively adopted U.S. fairness index that features 500 of the most important publicly traded firms by market capitalization.

Firms should meet standards on profitability, liquidity, and buying and selling quantity to qualify, making Block’s inclusion a marker of its monetary and operational maturity.

Whereas Coinbase is a pure-play crypto alternate, Block integrates Bitcoin into its broader fintech ecosystem, providing publicity by way of shopper and merchant-facing merchandise.

Nonetheless, Block is without doubt one of the first few firms to undertake a Bitcoin Treasury technique, and is listed as one of many prime ten public firms holding Bitcoin on their steadiness sheets.

“Block’s S&P 500 inclusion is simply one other instance of how crypto firms are actually changing into a mainstream staple of markets,” Robbie Ferguson, co-founder and president of blockchain infrastructure developer Immutable, advised Decrypt.

Citing examples similar to stablecoin issuer Circle’s U.S. public debut, in addition to the elevated curiosity amongst monetary establishments, Ferguson observes a “wholesale change” the place crypto-facing corporations have gotten accepted in conventional finance, at the very least within the U.S. and North America, because of regulatory developments.

Last week, President Trump signed the GENIUS Act into legislation, mandating federal companies to help the adoption of blockchain applied sciences similar to stablecoins and classify sure digital belongings as important infrastructure.

Stablecoins are digital belongings pegged to the U.S. greenback that provide an anchored medium for buying and selling and settlement between crypto and fiat currencies

Through the years since its institution as Sq. Inc., Jack Dorsey’s Block has developed and enabled Bitcoin purchases and transfers through Money App, launched a self-custody pockets, and holds over 8,500 BTC on its steadiness sheet, in response to information from Bitcoin Treasuries.

It additionally funds open-source Bitcoin improvement by way of Spiral and is constructing decentralized id and infrastructure instruments below its TBD division.

Block’s inclusion within the benchmark index “isn’t only a steadiness sheet play, it is a model pillar,” Grasp Huang, CEO of quantitative buying and selling agency Kronos Analysis, advised Decrypt. The transfer “indicators TradFi’s rising belief in crypto-aligned firms and the regular adoption of blockchain-backed infrastructure,” he added.

In April final yr, Block launched a Bitcoin funding “blueprint” that enables it to routinely allocate 10% of its gross revenue from Bitcoin-related merchandise into Bitcoin every month. Block frames its technique as a part of a broader mission of “international financial empowerment.”

Day by day Debrief E-newsletter

Begin each day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.