Ethereum has continued its spectacular climb, with its value now at a 7-month excessive of $3,745. The altcoin surged 27% over the previous week, gaining momentum as traders aggressively accumulate ETH.

Whereas the market reveals robust indicators of development, this speedy tempo is pushing Ethereum towards a saturation level that would decide its subsequent transfer.

Ethereum Buyers Accumulate Closely

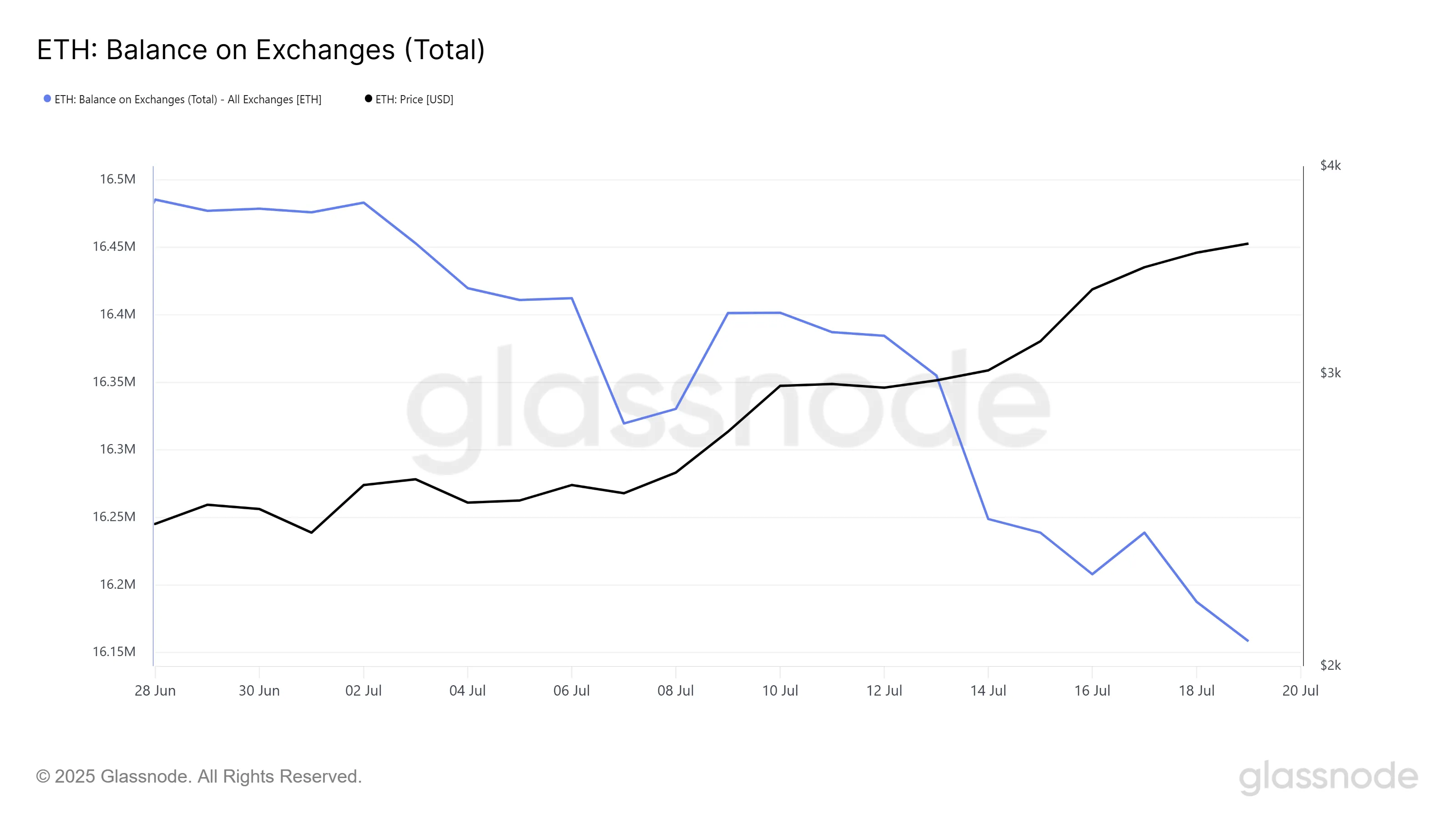

For the reason that begin of July, the stability of Ethereum on exchanges has dropped by over 317,000 ETH. This quantity, valued at greater than $1.18 billion, displays the size at which traders are withdrawing their holdings, decreasing out there provide.

The decline signifies robust confidence that the worth will proceed rising.

This accumulation pattern is driving the rally, as demand outweighs provide. Such aggressive habits means that many market contributors consider ETH may quickly breach $4,000, including extra bullish stress to its value trajectory.

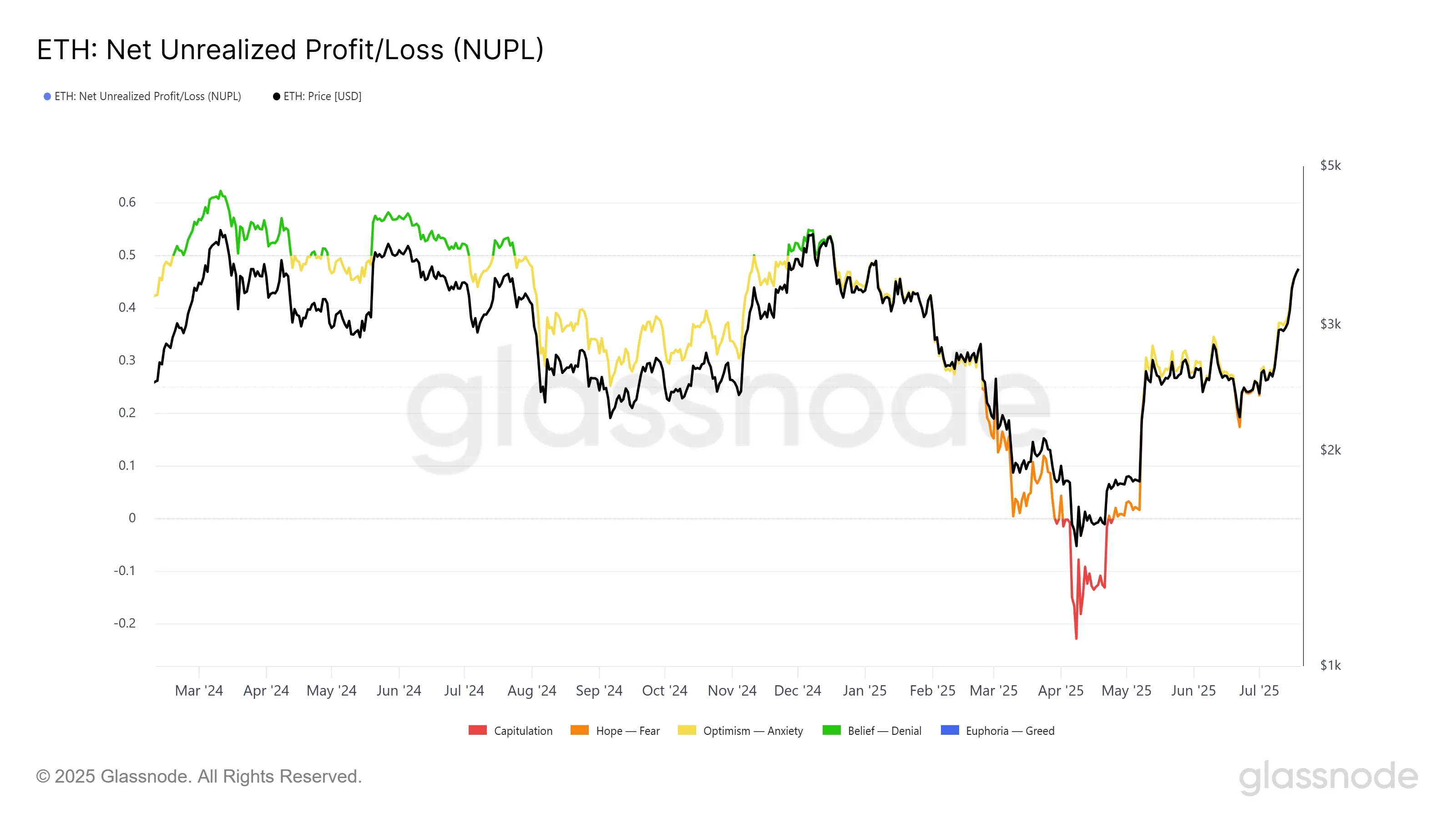

Ethereum’s Community Worth to Transactions (NUPL) ratio is now approaching the “Perception-Denial” zone. This metric alerts whether or not traders are in revenue and helps determine potential reversal zones.

Traditionally, each time NUPL entered this space, Ethereum’s value skilled a short-term correction.

The assumption-denial degree usually acts as a saturation level the place optimistic traders start to safe earnings. If Ethereum crosses $4,000, this psychological degree might set off important promoting stress.

This sample has repeated over the past 16 months and will repeat if ETH’s bullish run continues with out correction.

ETH Worth Could Not Rally Sharply

On the time of writing, Ethereum is buying and selling at $3,745, simply 6.8% shy of hitting the $4,000 mark. This degree has acted as a powerful psychological resistance in earlier bull runs. The present rally places ETH in a stable place to check this barrier within the coming days.

Nevertheless, if the market enters a section of profit-taking, Ethereum may fail to interrupt by way of $4,000. A ensuing pullback might ship the worth right down to $3,530. Dropping this assist may prolong losses to $3,131, wiping out latest beneficial properties and confirming the onset of a short-term reversal.

On the flip aspect, if accumulation continues to dominate, Ethereum may invalidate the bearish outlook. A clear break above $4,000 would assist the continuing uptrend, enabling ETH to push towards new highs.

This state of affairs relies upon largely on the energy of investor conviction and broader market cues.

Disclaimer

According to the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.