Welcome to Commerce Secrets and techniques — Bitcoin and Ethereum worth predictions from prime analysts, together with choices knowledge, sentiment evaluation and prediction markets to find out what they will inform us in regards to the months and years forward.

Ether a ‘prime conviction decide’ that’s set to go on mammoth 160% rally

Ether will skyrocket 160% from its present worth of $2,570 earlier than the tip of this yr, predicts crypto yield era agency Tesseract CEO James Harris.

“We forecast ETH at $6,500 by end-2025, assuming continued development in ETH staking participation, increased gasoline consumption from layer 2 functions, and no important regulatory headwinds particular to Ethereum,” Harris tells Journal. “Ethereum is one in every of our prime conviction picks amongst large-caps.”

Harris factors to the over $1 billion in inflows to identify Ether exchange-traded funds in the USA in June and the current arduous fork as bullish components. “The Pectra improve has improved layer 2 scaling options, fueling ecosystem development,” he mentioned.

“With wholesome institutional inflows and standing as essentially the most staked and utilised digital asset, Ethereum is on monitor for a run in H2.”

However 10x Analysis’s Markus Thielen provides a extra sobering evaluation.

“At 10x Analysis, we maintain a reasonably bullish outlook for crypto this month, pushed largely by sturdy post-July 4 seasonality that would carry Ethereum towards $2,800 within the brief time period,” Thielen tells Journal.

“Nevertheless, we consider the continuing lack of person exercise stays a structural overhang for ETH, and the case for treasury adoption is way weaker than it’s for Bitcoin,” he says.

Because of this, his outlook is bearish for the rest of the yr. “We’ve maintained a bearish stance on Ethereum for over a yr and proceed to take action, setting a year-end goal of $2,300,” he says.

“That mentioned, potential developments in stablecoin adoption — significantly in the event that they leverage Ethereum’s infrastructure — might shift the narrative. For now, nevertheless, we proceed to favor Bitcoin because the higher-conviction play,” he says.

‘Robust sense’ Bitcoin will attain new ATH earlier than July shut

Unity Pockets chief working officer James Toledano tells Journal he’s bought a intestine feeling that Bitcoin will smash by means of its present all-time excessive of $111,970 by the tip of the month. (Prediction markets agree, however choices knowledge suggests in any other case, see under).

“My sturdy sense, and that’s all it’s, based mostly on present momentum, is that Bitcoin has the potential to succeed in a brand new all-time excessive by the tip of July,” Toledano tells Journal.

“If macroeconomic components enhance, equities proceed to rise, and geopolitical rigidity abates, it’s potential that it might cross $120K in July. However that is very optimistic,” he says.

Breaking the ATH requires a comparatively small transfer, however a surge to $120,000 requires an 11.15% improve from Bitcoin’s worth of $108,190 on the time of publication.

Toledano factors to the practically $5 billion in web inflows into US spot Bitcoin ETFs over the previous 15 buying and selling days as an indication of sturdy institutional momentum — and a key sign of potential upward worth motion within the close to time period.

Bitcoin’s means to carry “agency and regular” amid the transient struggle between Israel and Iran is one other promising signal.

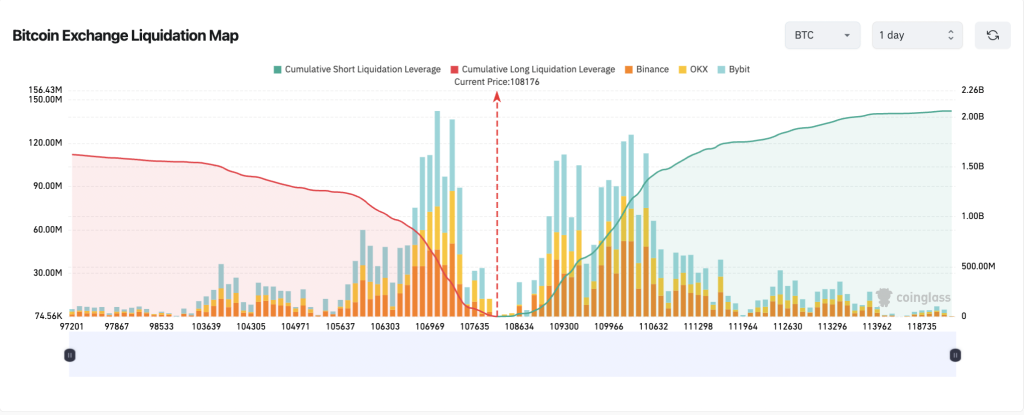

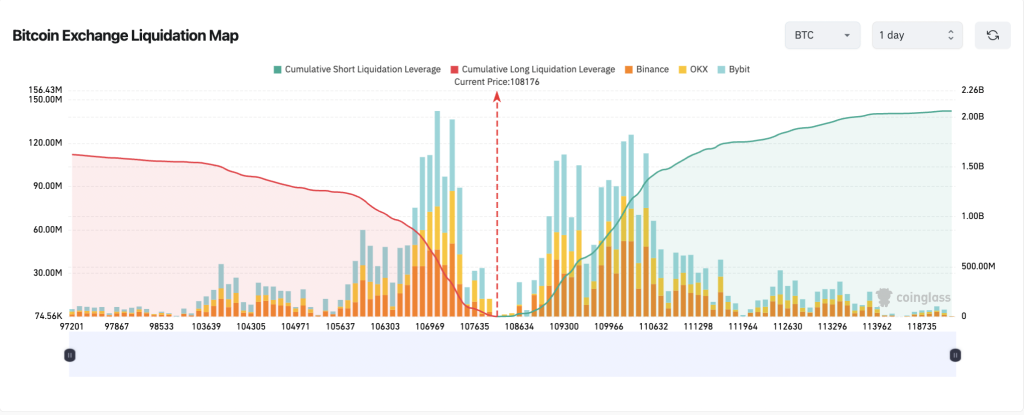

Nevertheless, crypto dealer Daan Crypto Trades warns that Bitcoin must preserve its momentum because it approaches its all-time excessive, as a drop again under $108,000 might set off a bearish downtrend.

“You don’t need to see this deviate again under $108K once more at this level,” Daan mentioned.

Dogecoin lacks ‘bullish setting,’ 50% drop potential

Dr. Sean Dawson, head of analysis at onchain choices protocol Derive, sees a dark outlook for Dogecoin within the coming weeks, the ninth-largest cryptocurrency by market capitalization.

“Brief time period, I’m fairly bearish,” he tells Journal. Whereas he had initially warned of a “violent week of volatility” tied to former US President Donald Trump’s looming tariff deadline, the extension to August hasn’t modified his broader outlook.

“Memecoins like Dogecoin, which thrive on speculative optimism, are likely to underperform in environments dominated by macroeconomic uncertainty.”

He says his Dogecoin outlook is additional clouded by persistent inflation issues and fading hopes for a Federal Reserve charge lower this month, with odds sitting at round 5%.

“Property like DOGE traditionally rip up throughout occasions of low charges, so muted projections on this entrance don’t bode properly for this asset,” he says.

Dawson additionally factors to mounting indicators of concern within the choices marketplace for Dogecoin.

“Implied choices markets on DOGE are signalling considerably bearish sentiment,” he says.

“Put costs are considerably increased than calls, indicating that merchants are prepared to pay excessive costs to insure their DOGE holdings, signalling important concern and uncertainty forward,” he provides.

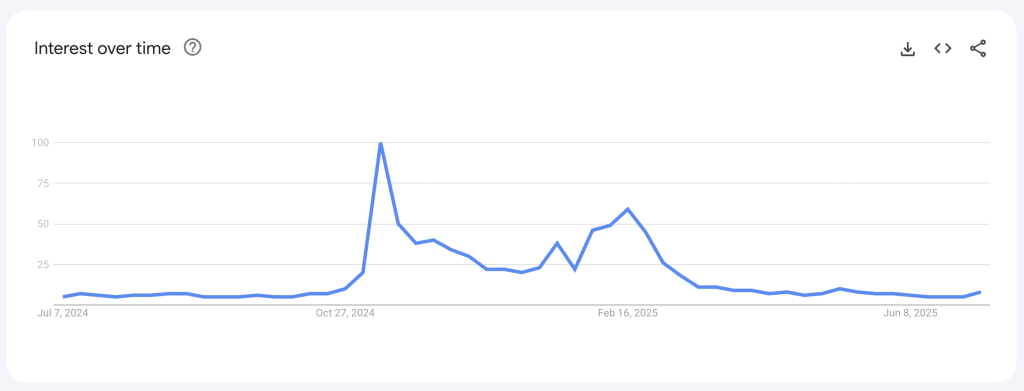

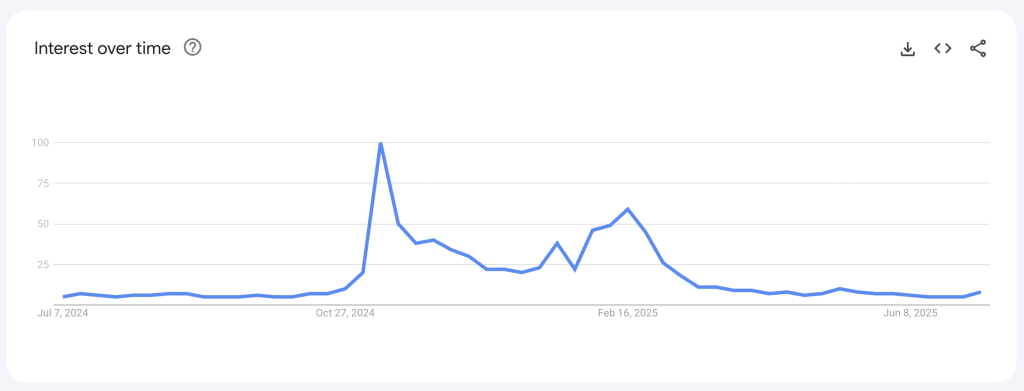

Making issues worse, retail curiosity is drying up. “Curiosity on Google search is down considerably for the reason that final peak in February this yr,” he says. “Since there’s a sturdy relationship between curiosity and worth appreciation on DOGE, the present ranges of consciousness don’t recommend a bullish setting,” he provides.

Dawson believes it’s probably Dogecoin will keep “beneath stress” or pattern sideways all through July. He says a retracement towards $0.085 remains to be on the desk — a roughly 50% drop from its present worth of $0.17 on the time of publication.

Nevertheless, he says Dogecoin might journey a “wave again into speculative favor.”

“Historic cycles recommend DOGE tends to lag behind BTC/ETH rallies, however can spike violently as soon as meme momentum returns,” he explains.

Learn additionally

Options

Why Grayscale’s New Digital Forex Advert Might Carry Crypto Investing To Hundreds of thousands

Options

Banking The Unbanked? How I Taught A Whole Stranger In Kenya About Bitcoin

What the derivatives markets are saying about Bitcoin and Ethereum

Onchain choices protocol Derive founder Nick Forster tells Journal that futures merchants are pricing in a 40% probability of Bitcoin topping its $111,970 all-time excessive by the tip of July. “Merchants are levering up anticipating BTC to succeed in new highs,” Forster says.

There’s a 15% probability that Bitcoin retains surging and faucets $115,000 by the tip of July.

There’s a 13% probability Bitcoin will drop under $100,000 earlier than the month-end. Forster says this might grow to be extra possible if geopolitical tensions flare up once more within the Center East or if the FOMC raises rates of interest in July. “However these appear fairly unlikely at this stage,” Forster says.

As for Ether, future merchants are pricing in a 12% probability of Ether topping $3,000 by the tip of July. There’s a 35% probability that Ether settles above $2,700 by the tip of July.

There’s additionally a ten% probability Bitcoin surpasses $140,000 by the tip of September and 12% probability Ether surpasses $3,500 by the tip of September.

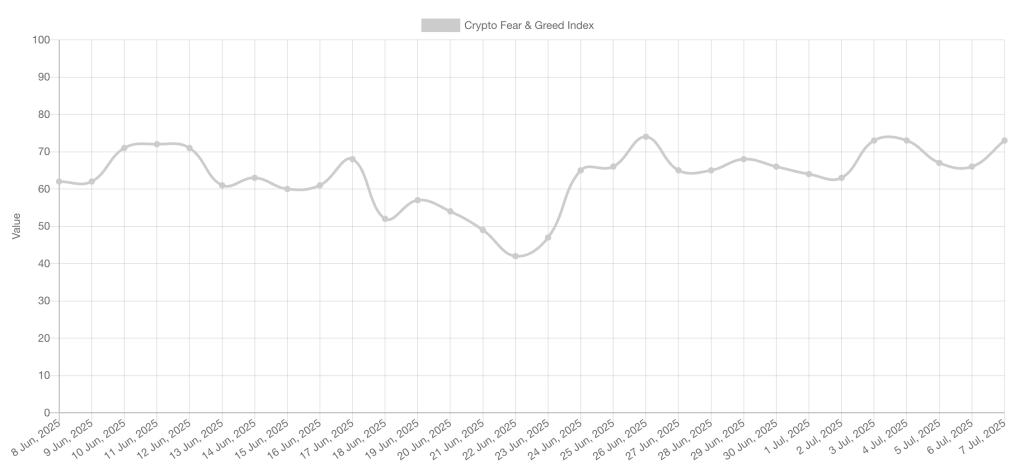

Santiment knowledge: Bitcoin sentiment reaching ‘euphoric ranges’

Santiment analyst Brian Q says Bitcoin crowd sentiment is reaching “euphoric ranges” — a sign that would spell bother forward.

“Social media sentiment for Bitcoin is overwhelmingly bullish,” he says, noting that optimistic Bitcoin social media commentary has hit a four-week excessive.

Historical past suggests warning at these ranges as bullishness is commonly adopted by short-term worth corrections when “FOMOers get punished.”

“Be cautious when crowd sentiment turns into euphoric,” he says. “Excessive greed is commonly a sign to grow to be extra defensive.”

Counterintuitively, the extra muted sentiment round Solana provides alternatives.

“This lack of hype suggests it’s flying beneath the radar and should have room to run with out the burden of crowd expectation, making it a possible ‘sneaky decide’ for a rally,” he says.

Solana is buying and selling at $152 on the time of publication, down 48% from its January peak of $293.

Q says, “A basically sturdy undertaking with quiet social media channels may be a wonderful alternative to enter a place earlier than widespread FOMO begins,” he provides.

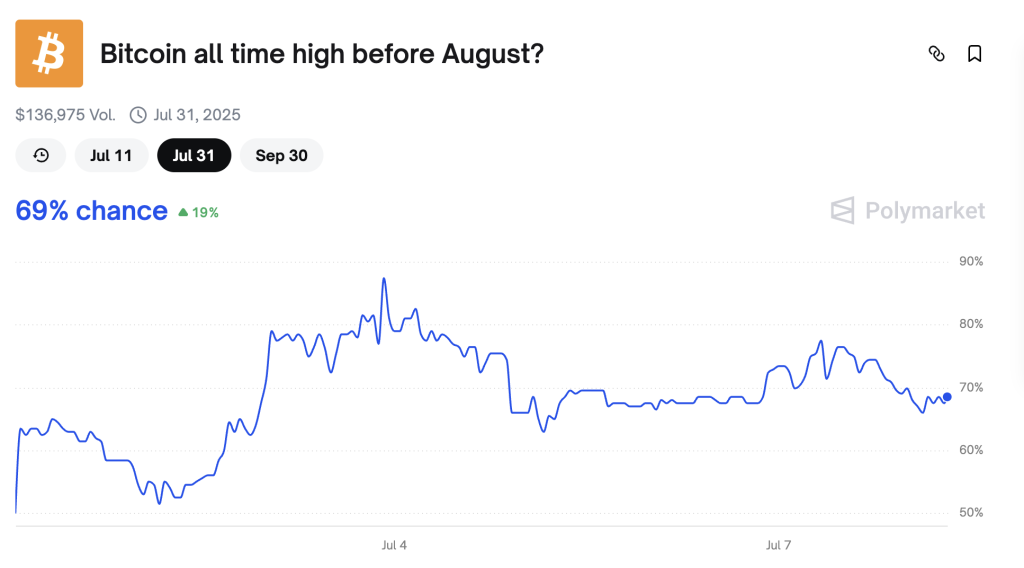

What the prediction markets are saying

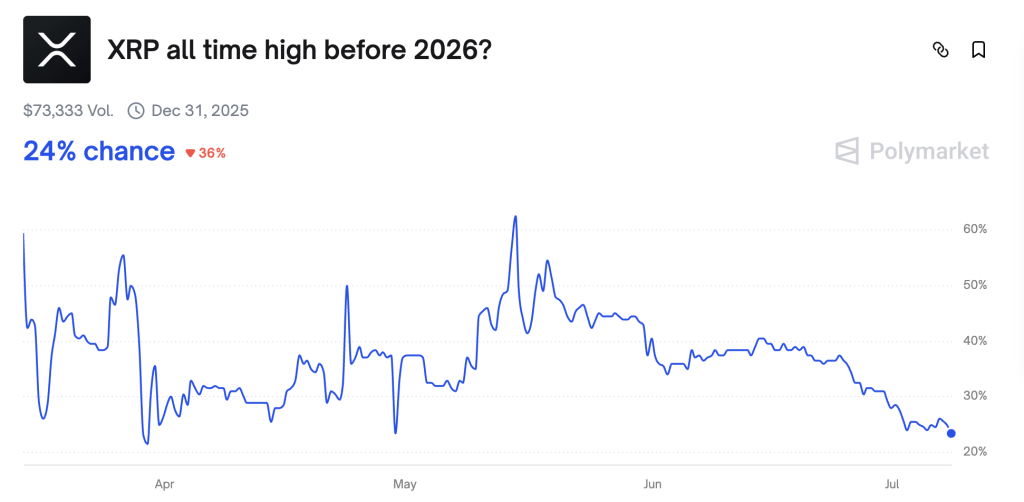

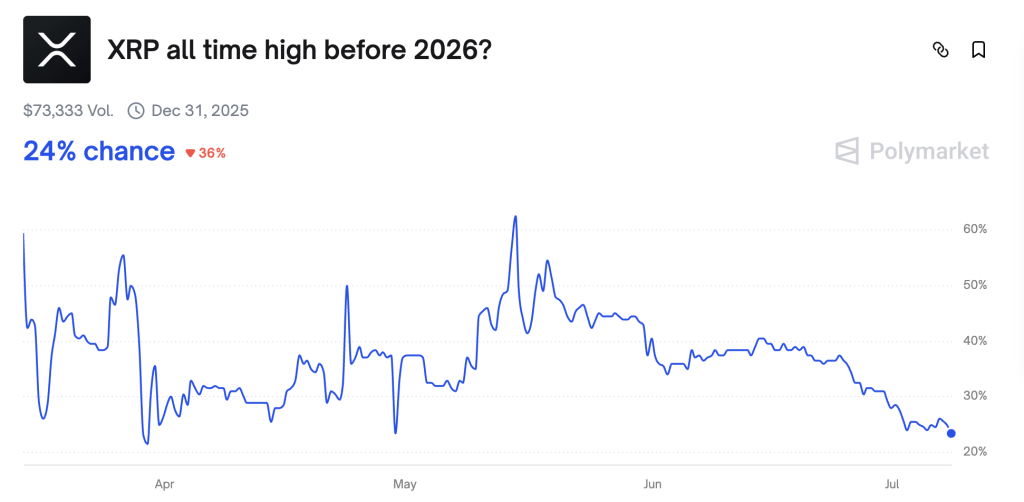

Prediction markets recommend Bitcoin will probably hit new highs this month, however confidence continues to dwindle for year-end bets on Solana, XRP and Ethereum.

Bitcoin has a 69% probability of breaking its present all-time excessive of $111,970 by July 31, in keeping with crypto prediction platform Polymarket.

However Polymarket’s odds of different main cryptocurrencies reaching new all-time highs by the tip of the yr have declined for the reason that June Commerce Secrets and techniques Column.

Solana now has only a 22% probability of surpassing its earlier peak of $293 by the tip of 2025, down 5% from its odds final month, regardless of its worth barely rising 2.53% over the interval.

XRP’s odds of hitting a brand new all-time excessive by year-end have additionally slipped 13% this month, all the way down to 25%. XRP has but to prime its 2018 excessive of $3.40 and noticed a 4.61% worth improve over the previous month.

Ethereum has 22% odds of breaking its all-time excessive of $4,878 this yr, down 2% from its odds final month.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Challenge.