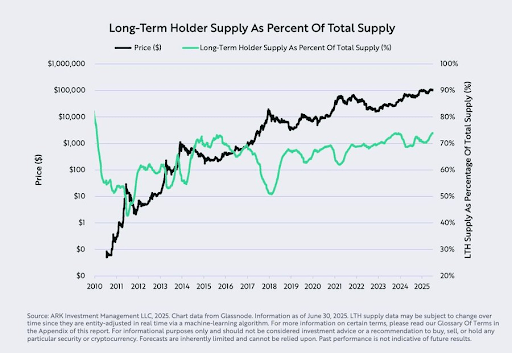

The share of Bitcoin’s long-term holders’ provide has reached a 15-year excessive, offering a bullish outlook for the flagship crypto. Asset supervisor Ark Make investments highlighted this improvement in a current report and defined what this might imply for BTC going ahead.

Bitcoin Lengthy-Time period Holders Provide Hit 74%

In response to the Ark Make investments report, the long-term holders’ provide has reached 74% of Bitcoin’s complete provide, marking a 15-year excessive for this metric. The asset supervisor famous that this pattern signifies rising market conviction in BTC’s function as a retailer of worth or “digital gold.” These long-term holders consult with addresses which have held for 155 days or longer.

Associated Studying

This improvement comes at a time when Bitcoin is witnessing large demand from institutional traders by means of the ETFs and treasury firms. These traders are thought of higher ‘diamond-hands’ than retail traders, which implies that this metric may preserve rising, with long-term holders gaining extra management of BTC’s complete provide.

This institutional shopping for has additionally pushed the Bitcoin value to a number of all-time highs (ATHs) this yr, with BTC reaching as excessive as $123,000 final week. The flagship crypto seems to nonetheless be in value discovery, as ETFs led by BlackRock and treasury firms, led by Saylor’s Technique, proceed to build up at an unprecedented tempo.

Cathie Wooden’s Ark Make investments is extremely bullish on the Bitcoin value, predicting that it may attain $1.5 million by 2030. They anticipate BTC to achieve this goal because of the rising institutional funding and world recognition of Bitcoin’s capacity to function a retailer of worth. In a CNBC interview, Cathie Wooden additionally doubled down on this prediction.

She defined that they anticipate BTC to take a big share from gold or develop the shop of worth market. Wooden added that establishments are nonetheless simply testing the waters regardless of the huge accumulation up to now. As such, she nonetheless expects an increase in adoption for these firms. In the meantime, solely about 1 million unmined Bitcoins are remaining.

Different Bullish Metrics For BTC

The Ark Make investments report additionally revealed that world liquidity per bitcoin reached a 12-year excessive. This metric reached this excessive with $5.7 million in world M2 provide per BTC in circulation. The asset supervisor remarked that this ratio may proceed to rise given Bitcoin’s diminishing future provide progress and the continued enlargement of worldwide liquidity.

Associated Studying

In the meantime, in June, Bitcoin managed to carry above the assist between $96,000 and $99,000 and is now properly above these ranges. $98,888, $96,278, and $71,393 are BTC’s short-term holder value foundation, 200-day transferring common, and on-chain imply, respectively, which is why this improvement is bullish for the flagship crypto.

On the time of writing, the Bitcoin value is buying and selling at round $19,100, up within the final 24 hours, in keeping with knowledge from CoinMarketCap.

Featured picture from Pixabay, chart from Tradingview.com