Alongside XRP’s robust value rally in July, its ecosystem additionally set a number of noteworthy information.

These information could sign a turning level for XRP. In addition they reinforce the altcoin’s elementary development drivers. What are these elements? This text breaks them down intimately.

XRP Ecosystem Units New Data in July

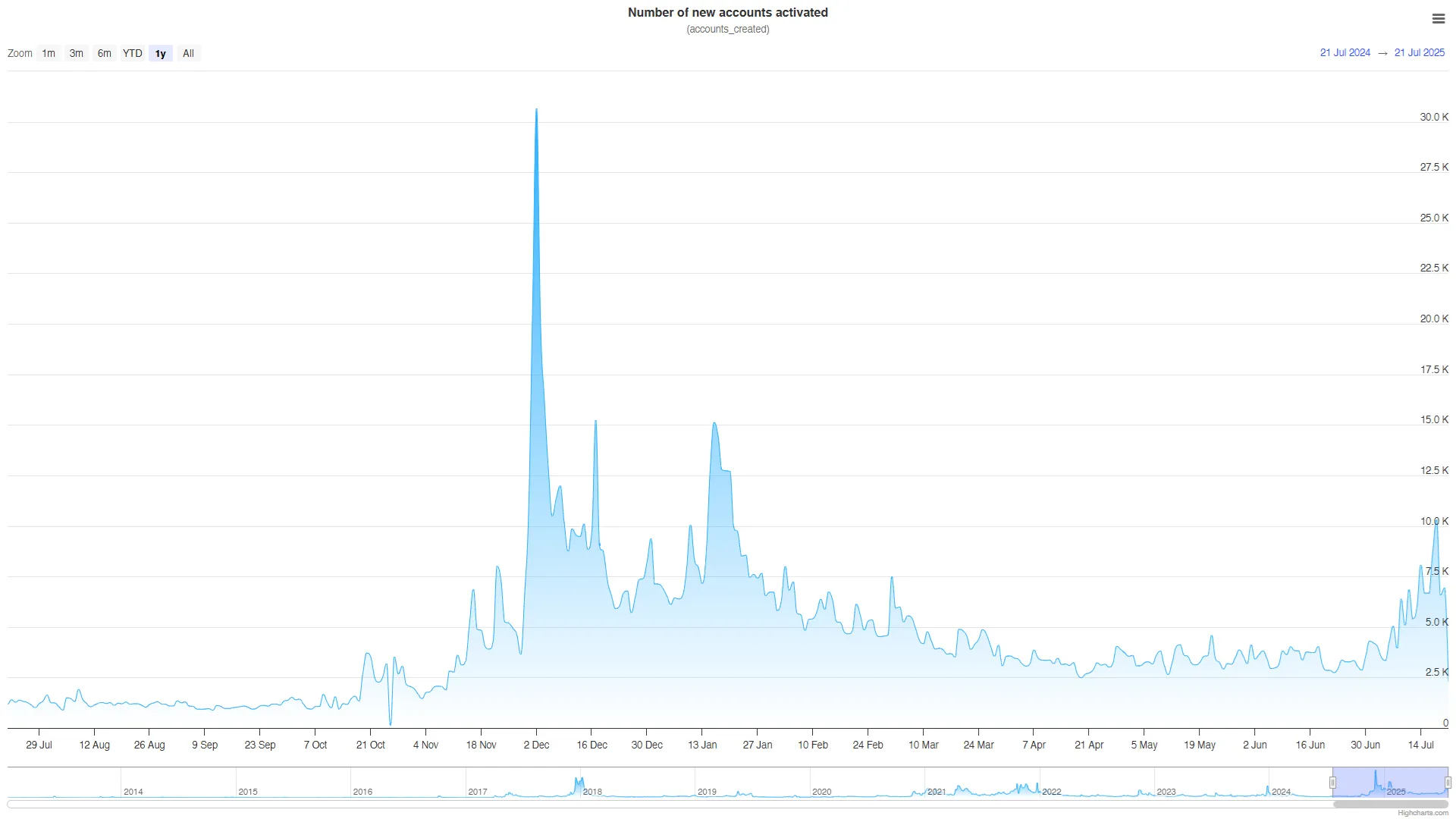

The primary and most evident signal of XRP’s development is the variety of new accounts activated on XRPL. Based on knowledge from XRPScan, the variety of new accounts surpassed 10,000 on July 18, marking the best each day complete since February.

Though this quantity hasn’t damaged the all-time each day file—over 30,000 in December 2024—it has steadily elevated all through July. This development reveals that XRP is attracting new buyers. Lots of them could turn into long-term holders.

As well as, the variety of each day energetic pockets addresses surpassed 50,500. That’s a 100% enhance from the earlier month and the best since February.

One other notable file is the full worth locked (TVL) on XRPL. It lately hit an all-time excessive (ATH), exceeding $92 million. Most of this development got here from XRPL’s decentralized change (DEX).

This quantity stays modest in comparison with TVLs on different blockchains. Nonetheless, it marks the primary breakout after practically a yr of stagnation.

Furthermore, Ripple’s official XRPL EVM Sidechain Mainnet launch in early July created new alternatives to lock worth in liquidity swimming pools. This straight helped enhance the DEX’s TVL.

XRP Dominance Rises Above 5%

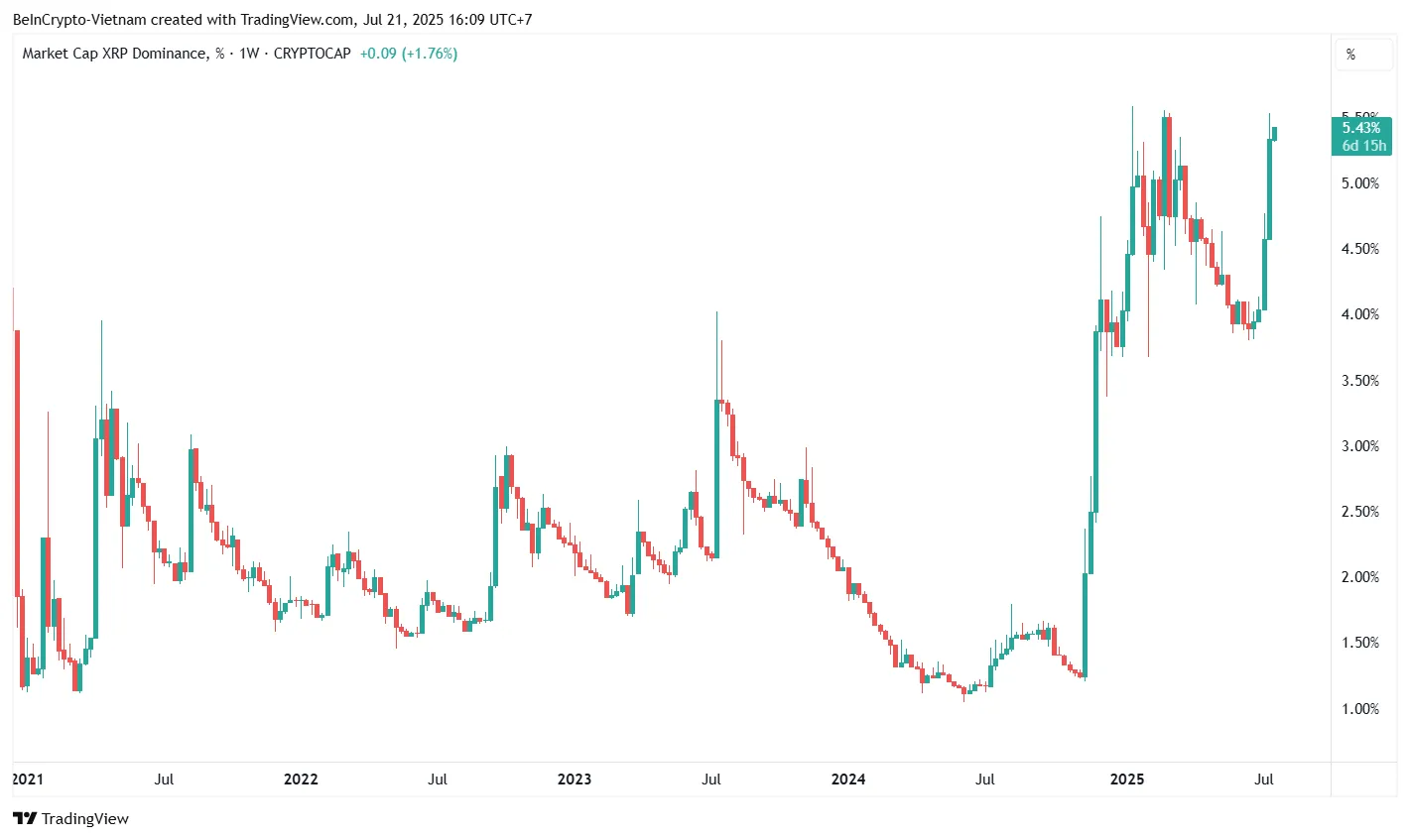

Lastly, the XRP Dominance (XRP.D) index has climbed above 5%. It’s now close to its 2025 excessive and will rise even additional.

This index displays how a lot buyers prioritize XRP relative to the full crypto market cap.

Some buyers count on XRP.D to achieve 15% in 2025. Others hope it might climb to 30%, because it did in 2017. All these indicators level to 1 factor: new capital is flowing into XRP.

With a market cap of over $211 billion, XRP now ranks #78 globally by market capitalization, surpassing Shell, Blackstone, and Siemens.

Nonetheless, latest evaluation from BeInCrypto warns that XRP futures have reached an all-time excessive. On the similar time, indicators of short-term profit-taking have emerged. These might pose short-term liquidation dangers for over-leveraged positions.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.