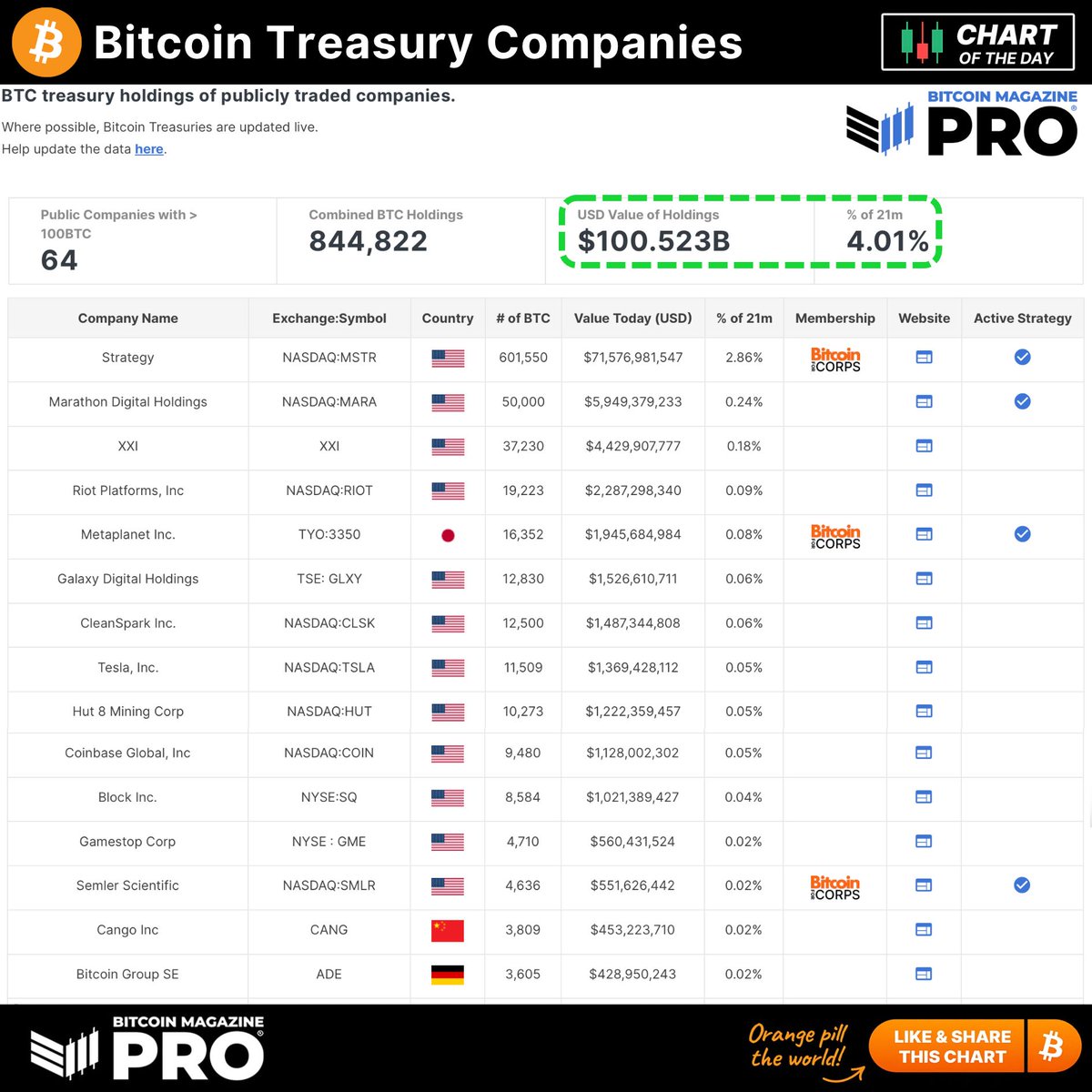

Based on new knowledge shared by Bitcoin Journal Professional, publicly traded corporations now collectively maintain over 844,822 BTC, valued at greater than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

This represents greater than 4% of all Bitcoin that may ever exist, underscoring a strong shift in treasury technique throughout the company panorama.

Technique leads with over 600,000 BTC

Michael Saylor’s Technique (NASDAQ: MSTR) stays the undisputed chief, holding 601,550 BTC price greater than $71.5 billion—accounting for two.86% of the entire Bitcoin provide. Marathon Digital, XXII, Riot Platforms, and Metaplanet spherical out the highest 5, every holding between 16,000 and 50,000 BTC.

Metaplanet, usually dubbed “Asia’s MicroStrategy,” has quickly elevated its BTC place, whereas different corporations like Tesla, Coinbase, and Block proceed to take care of sizable reserves as a part of their long-term steadiness sheet methods.

1 million BTC by year-end?

With present momentum accelerating, Bitcoin Journal Professional poses the query: May publicly listed corporations collectively surpass 1 million BTC in holdings by the top of 2025? As extra firms search hedges towards fiat depreciation and regulatory readability improves, such a milestone could also be nearer than anticipated.

The shift highlights Bitcoin’s transformation from a speculative asset to a core strategic reserve. From tech giants to miners and FinTech innovators, public corporations are more and more treating Bitcoin as a monetary spine quite than a fringe experiment.

With over 4% of Bitcoin’s fastened 21 million provide now sitting in company treasuries, the development suggests deepening institutional conviction—and rising shortage for retail and late institutional adopters alike.