- XRP presents extra direct upside tied to real-world adoption by banks and establishments; stable, however unlikely to 10x in a single day.

- Chainlink might develop alongside broader crypto infrastructure, benefiting from adoption behind the scenes—however it’s a bumpier trip.

- Neither is a “get wealthy fast” play, however each have room to develop if crypto’s institutional shift retains accelerating.

The crypto market’s buzzing with prospects once more, and two acquainted names—XRP and Chainlink—are pulling a number of investor consideration. With costs climbing and use instances increasing, people are asking the apparent: May one among these really be the funding that flips your portfolio the other way up—in a great way?

Let’s be actual although—millionaire-maker investments? They’re uncommon. However that doesn’t imply these two cash don’t have stable potential.

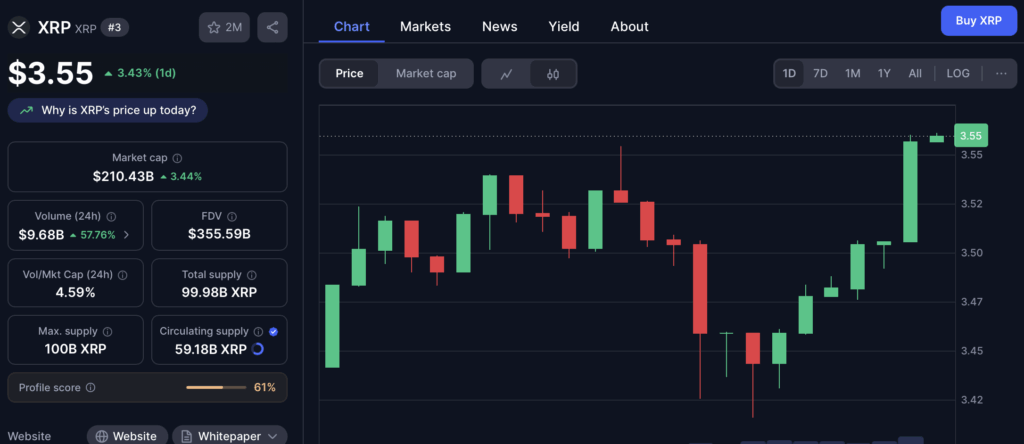

XRP Appears to be like Strong… However Don’t Anticipate a Moonshot

Proper now, XRP is buying and selling round $3.35, with a market cap flirting with $200 billion. For it to 10x from right here, you’d be a $2 trillion valuation—just about in Bitcoin territory. Not not possible, positive, however… that’s a giant ask. Even should you dropped $10K into it right now, you’d come up simply shy of millionaire standing.

Nonetheless, XRP has some muscle. It’s geared towards institutional traders, the sort that handle huge swimming pools of money and are continually in search of quicker, cheaper, extra environment friendly methods to maneuver cash. Ripple, the corporate behind XRP, has constructed this factor with compliance in thoughts, aiming for clean crusing with banks and large finance.

That’s not small. The XRP ledger cuts down on cash switch charges, trims trade prices, and opens up yield choices for people managing stablecoins. So, if there’s a gradual wave of conventional capital coming into crypto? XRP’s proper within the splash zone.

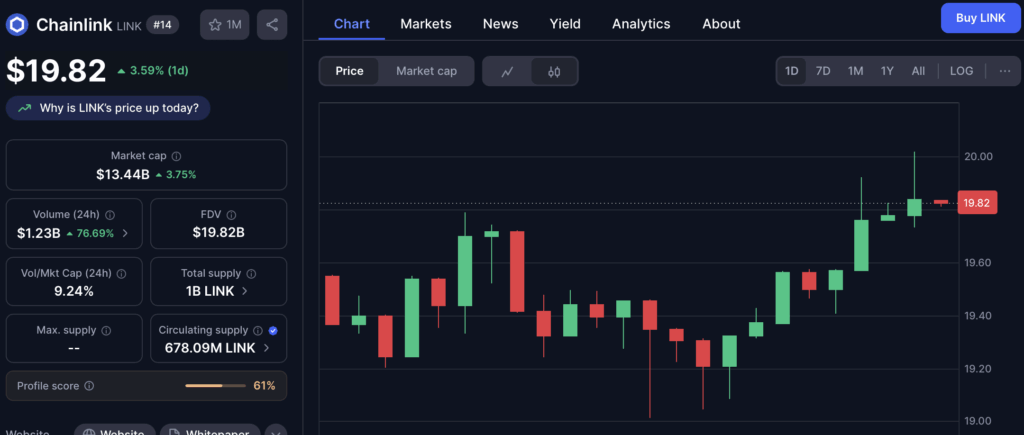

Chainlink’s Gradual Burn May Nonetheless Be Large

Chainlink, priced round $17, is working a complete totally different angle. It’s mainly the info layer for blockchains—a system of “oracles” that feed real-world information into good contracts. Suppose: costs, rates of interest, even climate knowledge (significantly).

It’s sitting on a $11 billion market cap, so yeah, a 10x leap solely asks for one more $100 billion in worth—not precisely a moonshot within the grand scheme of issues. However the problem with LINK is that its demand isn’t fairly as direct. Customers of Chainlink companies (banks, devs, apps) don’t have to carry large baggage of LINK to make use of the community.

So value appreciation actually hinges on whether or not staking rewards and charge mechanisms maintain scaling. In the event that they do? Chainlink may very well be accumulating tiny tolls on a lot of worldwide worth circulation. It’s extra like betting on infrastructure—much less flashy, however generally extra sturdy.

Which One’s the Higher Guess?

In the event you’re chasing regular positive factors with much less noise, XRP is likely to be the transfer. It doesn’t want to overcome the complete finance world—simply catch a significant chunk of it—and the upside might nonetheless be fairly stable. Ripple is aware of its viewers, and in the event that they maintain nailing product-market match with compliance-hungry establishments, that would gas some good development.

Alternatively, Chainlink’s worth is a little more delicate. But when decentralized apps and tokenized belongings go mainstream, LINK may very well be one of many key gamers behind the scenes, pulling in income by the second. It gained’t be a clean trip, although. Anticipate bumps.

Backside line? Neither coin’s prone to flip a $500 gamble right into a Lamborghini. However each might nudge your portfolio in the proper course—particularly should you’re taking part in the lengthy sport and never simply hoping for in a single day riches.