- Aave’s DAO treasury simply hit an all-time excessive of $125M, marking a 123% yearly bounce.

- ETH’s rise may drive elevated borrowing, boosting Aave’s payment income and utilization.

- On-chain exercise is ticking up, hinting at early momentum for a possible breakout.

Should you’re watching DeFi proper now, Aave [AAVE] simply threw out a giant sign—it’s not one to disregard. On July twentieth, the protocol’s DAO treasury (excluding its personal AAVE tokens) climbed to a record-smashing $125 million. Yep, that’s a wild 123% enhance in comparison with the place it was only a yr in the past.

And it’s not simply the quantity that’s turning heads—it’s how they received there. This treasury growth reveals that Aave is aware of how you can stack income and maintain onto worth, even when the crypto waters get uneven.

Now, let’s peek below the hood: 44% of Aave’s DAO treasury sits in stablecoins, 41% is locked in ETH, and the remainder—about 15%—is sprinkled throughout numerous DeFi tokens. It’s a sensible combine. Balanced, however nonetheless absolutely plugged into the crypto present. No reckless aping, simply tactical allocation.

Why ETH’s Rise May Be Aave’s Enhance

So right here’s the place it will get much more attention-grabbing—Ethereum. ETH’s been on a tear recently, and that momentum may critically energy up Aave. Traditionally, when ETH rallies, people get extra lively with borrowing. And the place do they go? Platforms like Aave, which lets them borrow towards ETH as collateral.

As that borrowing demand spikes, Aave earns extra in protocol charges—and people charges? They go straight into bolstering its worth. Mainly, ETH pumping = extra motion = extra revenue for Aave. A fairly tidy suggestions loop, if you happen to ask me.

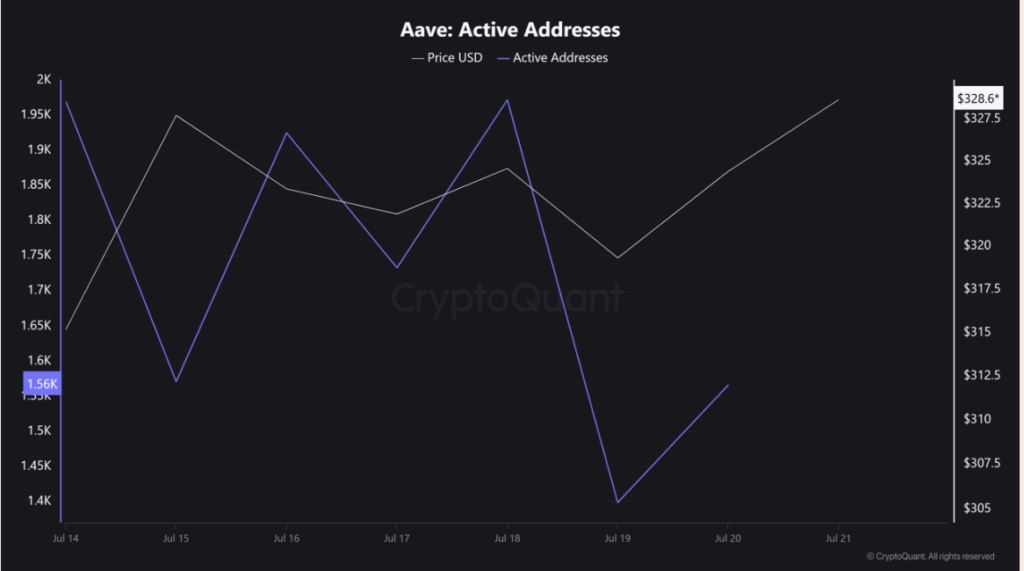

And it’s not simply hypothesis. In keeping with Token Terminal, Aave’s seen a noticeable uptick in lively addresses during the last 24 hours. It’s not moon mission stuff but, however rising on-chain exercise normally means one thing’s brewing.

One thing’s Stirring—However Is It the Breakout?

Look—it’s nonetheless a bit early to name a full-blown breakout. However the items? They’re falling into place.

You’ve received a treasury flexing onerous, ETH lighting up the charts, and person engagement beginning to bubble. If Aave leans into this—perhaps rolls out some good upgrades or tweaks incentives a bit—it may critically take off from right here.

So, preserve it in your radar. As a result of when all the basics line up like this, issues can transfer quick in DeFi.