A dormant Bitcoin pockets linked to Elon Musk’s SpaceX transferred over $153 million in BTC simply days earlier than Tesla’s second quarter (Q2) earnings report.

Merchants and buyers stay hopeful that the electrical automotive maker might have added to its Bitcoin portfolio in Q2.

SpaceX Unexpectedly Strikes $153 Million in BTC After 3 Years

On-chain analytics platform Lookonchain revealed that SpaceX moved 1,308 BTC to a brand new, unidentified pockets after greater than three years of inactivity.

The pockets’s final outbound transaction dates again to June 10, 2022. Based mostly on this, the most recent transaction marks a major shift in habits for one of the crucial watched Bitcoin-holding entities within the company enviornment.

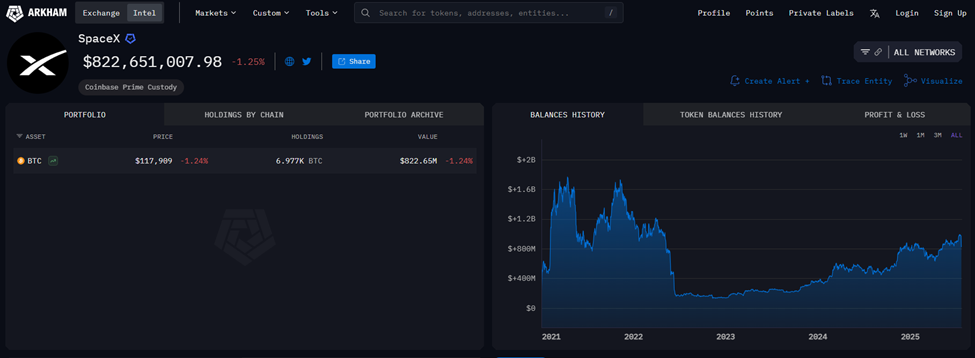

Based on Arkham Intelligence, SpaceX nonetheless holds 6,977 BTC, valued at roughly $822.65 million.

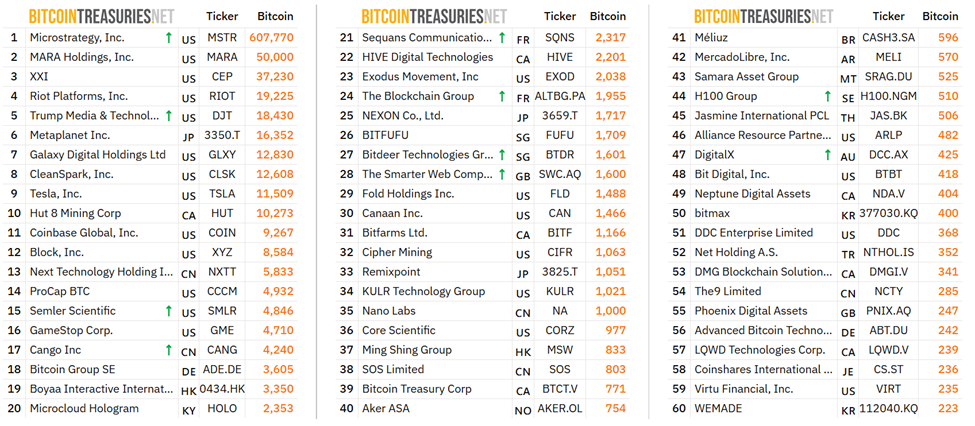

This makes it one of many largest company Bitcoin holders after Tesla, which holds 11,509 BTC price $1.36 billion. SpaceX and Tesla’s Bitcoin holdings are underneath Coinbase Prime custody.

In the meantime, this transaction reignited hypothesis round Musk’s crypto technique, particularly given the timing. It comes amid heightened investor anticipation for Tesla’s earnings report, scheduled for launch after the market shut on Wednesday, July 23.

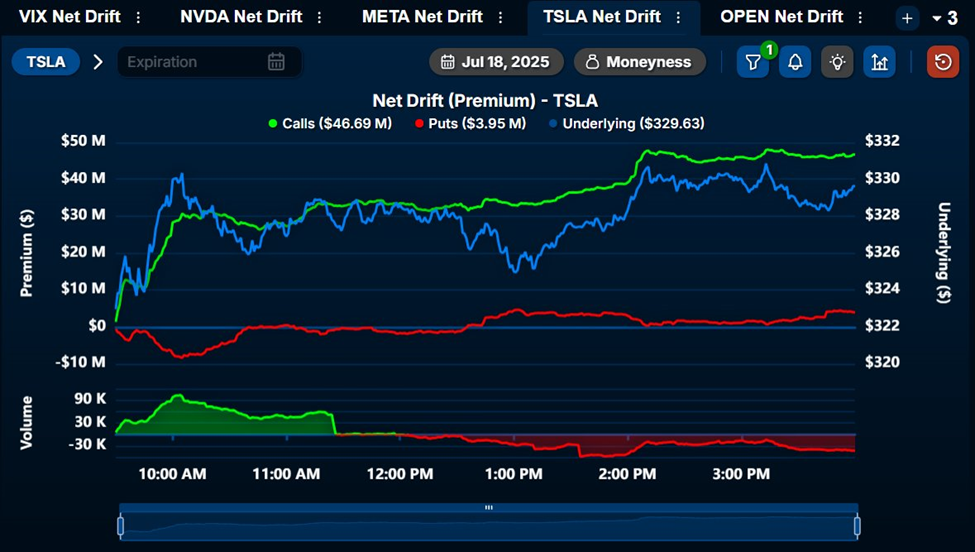

Choices merchants are already contributing, with over $47 million in web name (buy) choices positioned on TSLA on Friday, July 18, alone.

Traders Eye Income Shift As Tesla Earnings Loom

On Monday, dealer John Trades flagged a $1.5 million buy of TSLA 550 calls, signaling bullish sentiment regardless of Tesla’s turbulent 12 months.

Tesla’s earnings are anticipated to replicate the corporate’s shifting income composition. Based on tech investor Samsolid, auto income is projected to fall 19.6% year-over-year (YoY), whereas power income may bounce by 67%, and providers by 15.3%.

“If power continues to develop as a bigger share of complete income, we may see general income acceleration,” he defined on X.

This realignment of enterprise segments may have main implications for Tesla’s long-term valuation narrative. That is very true if it reduces reliance on automobile gross sales and will increase publicity to recurring or infrastructure-driven revenue streams.

Nevertheless, crypto market contributors are fascinated by whether or not Tesla made any adjustments to its Bitcoin stockpile in Q2.

“A number of Tesla earnings wildcards…Will Tesla change Bitcoin accounting for a third straight quarter? Will Tesla take a ZEV credit score rev hit in Q2 attributable to 2022- emission fines scrapped? Any Tesla Power margin hit in Q2 from Trump tariffs?” inventory market reporter Ed Carson posed.

The synchronized consideration on SpaceX’s BTC transfer and Tesla’s earnings raises the stakes for Bitcoin worth as Wednesday nears.

Is Elon Musk reactivating his crypto portfolio, or is the richest man on the earth repositioning for broader shifts in monetary markets?

With Tesla earnings on deck and SpaceX’s crypto footprint out of the blue reawakened, markets are bracing for a risky week pushed by Musk’s twin company empires.

Information on Bitcoin Treasuries exhibits Tesla is the ninth-largest public firm holding Bitcoin. SpaceX shouldn’t be on the record as it isn’t publicly traded.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.