Funding merchandise tied to crypto belongings have witnessed their strongest influx week up to now, based on the newest report from CoinShares.

The European-based digital asset funding agency disclosed that institutional buyers poured $4.39 billion into crypto-related funding autos final week, setting a brand new all-time report for weekly inflows. This determine surpasses the prior peak of $4.27 billion, recorded in December 2024, shortly after the U. election.

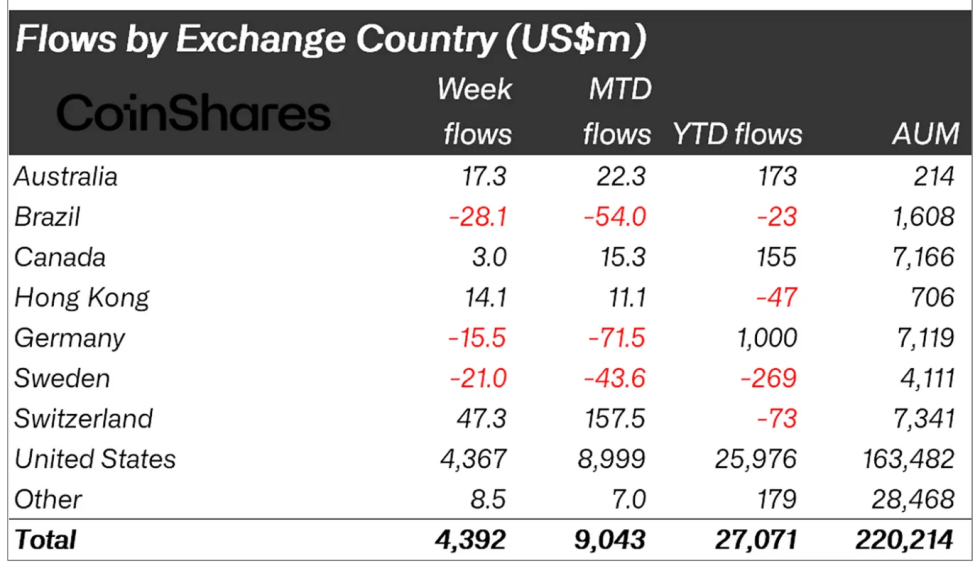

This inflow marks the 14th consecutive week of optimistic flows, bringing the overall year-to-date influx to $27 billion. CoinShares’ head of analysis, James Butterfill, famous that belongings beneath administration (AuM) have now reached a report excessive of $220 billion.

The surge in curiosity displays rising institutional engagement throughout numerous areas, supported by the sturdy efficiency of exchange-traded merchandise (ETPs), significantly within the US market.

Ethereum Surpasses Milestones Amid File Demand

Whereas Bitcoin remained dominant when it comes to total flows, Ethereum outpaced all digital belongings by registering a report $2.12 billion in weekly inflows. This quantity practically doubles its earlier excessive of $1.2 billion.

Over the previous 13 weeks, cumulative inflows into Ethereum merchandise have reached 23% of its complete AuM. Inflows for 2025 have already exceeded final 12 months’s full complete of $6.2 billion. This growth suggests a rising investor choice for Ethereum.

Bitcoin attracted $2.2 billion throughout the identical interval, a decline from the $2.7 billion seen the earlier week. Regardless of the lower, Bitcoin ETP volumes remained sturdy, accounting for 55% of the asset’s complete trade buying and selling quantity.

CoinShares highlighted that complete buying and selling turnover in crypto ETPs globally hit an all-time excessive of $39.2 billion final week, indicating heightened market exercise and liquidity throughout institutional venues.

US Dominates Regional Flows as Altcoins Appeal to New Capital

Regionally, the US remained the biggest contributor, accounting for $4.36 billion of the overall weekly inflows. Different markets together with Switzerland ($47.3 million), Hong Kong ($14.1 million), and Australia ($17.3 million) additionally reported optimistic contributions.

In the meantime, Brazil and Germany noticed minor outflows of $28.1 million and $15.5 million, respectively, suggesting a extra cautious investor sentiment in these areas.

Past Bitcoin and Ethereum, a number of altcoins additionally recorded notable inflows. Solana introduced in $39 million, XRP noticed $36 million, and Sui attracted $9.3 million.

These figures mirror rising curiosity in broader market segments past the 2 largest belongings. The continued progress of ETP merchandise for a spread of tokens suggests evolving investor methods, together with elevated diversification and thematic publicity throughout the crypto sector.

The sustained momentum in fund flows, mixed with new all-time highs in buying and selling volumes and AuM, signifies that digital belongings stay a robust focus amongst institutional buyers heading into the second half of 2025.

With Ethereum inflows now outpacing even Bitcoin on a relative foundation, buyers may doubtless carry on eye on how this shift influences broader crypto market dynamics.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.