Stablecoins are not only a crypto-native software—they’re reshaping monetary entry, funds, and even central banking dynamics.

Current insights shared by Messari spotlight how dollar-pegged stablecoins are seeing document adoption globally, pushed by inflation, cross-border demand, and advancing regulatory readability.

A lifeline in high-inflation economies

In additional than 22 nations, inflation exceeded 10% in 2024. Nations like Argentina, Venezuela, Turkey, and Nigeria, lengthy suffering from foreign money instability, noticed a few of the largest surges in stablecoin adoption. Based on Chainalysis, Turkey recorded the very best stablecoin buying quantity relative to GDP. Greenback-pegged digital property are more and more seen as steady financial savings instruments in areas the place native currencies quickly lose worth.

Actual-world spending and monetary infrastructure

DeFi protocols like Hyperbeat are bridging the hole between blockchain property and every day finance. Constructed on Hyperliquid, Hyperbeat permits customers to load USDC or USDT and spend straight through a Visa card powered by Rain. Unspent funds may even earn yield or cashback rewards in HYPE. This mix of on-chain property and real-world utility creates versatile, yield-generating spending traces backed by crypto.

Stablecoin market now rivals conventional monetary rails

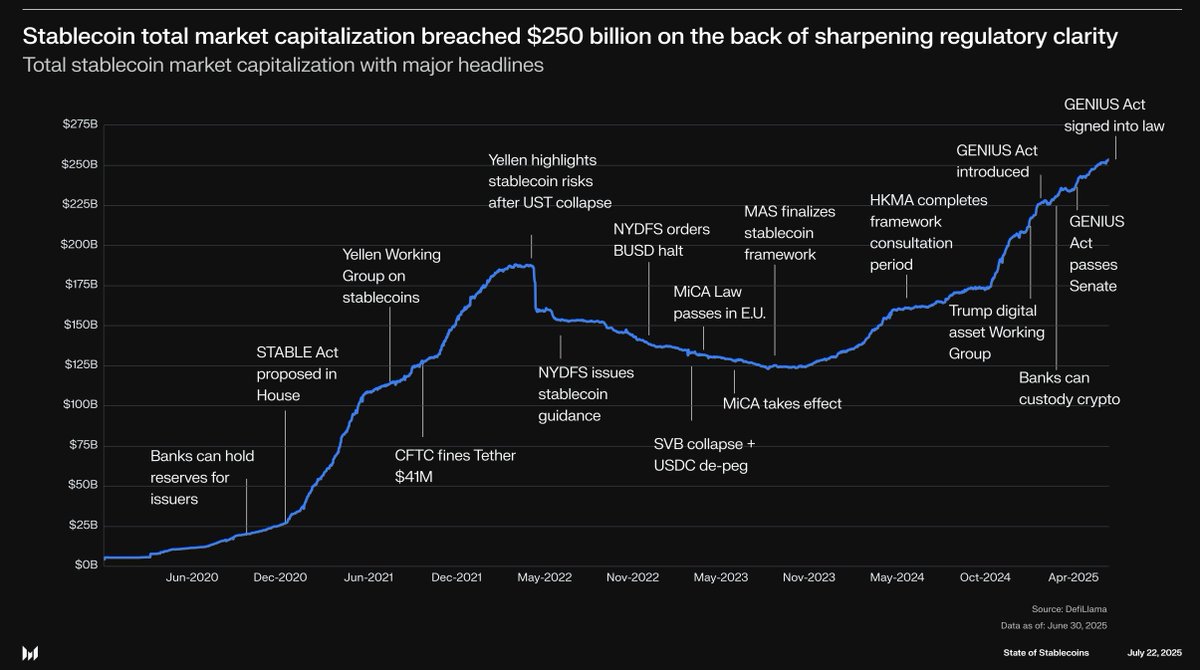

With a complete market capitalization exceeding $250 billion, stablecoins are closing in on legacy fee giants like Visa and PayPal. Regulatory developments, together with the GENIUS Act, have helped solidify their place. Cross-border fee quantity is projected to surpass $320 trillion by 2032, and stablecoins current a robust resolution to scale back friction and prices in that course of.

Menace to conventional banking?

The U.S. Treasury has warned that the rise of tokenized cash market funds and yield-bearing stablecoins may undermine conventional financial institution deposits. Funds held in financial savings, time deposits, and transactional accounts could movement into higher-yield, blockchain-based options.

Dominance and profitability

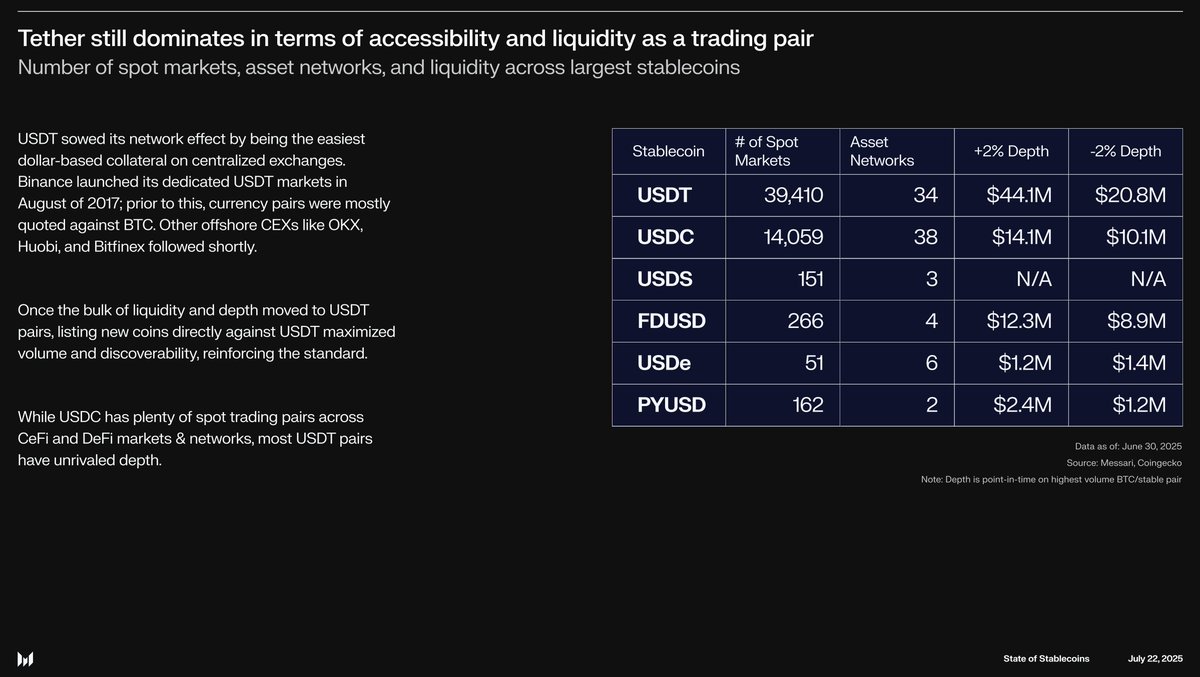

Tether (USDT) stays essentially the most broadly used stablecoin, with over 39,000 buying and selling pairs and unmatched depth throughout centralized exchanges. It now generates income on par with the biggest ETFs, solidifying its dominance in each crypto markets and rising monetary methods.