Wall Road is more and more betting on US rate of interest cuts earlier than the tip of 2025. On the identical time, political strain from Donald Trump has intensified, as he turns into extra vocally aggressive towards Powell for fee cuts.

With inflation cooling and markets adjusting expectations, crypto might stand to realize essentially the most from a looser financial coverage.

Trump Needs Fed to Convey Curiosity Charge Right down to 1%

Earlier at this time, Trump renewed his assault on Federal Reserve Chair Jerome Powell. He referred to as for a 3 proportion level fee lower and claimed it will save the US economic system $1 trillion yearly.

The US President additionally accused Powell of protecting charges excessive for “political causes.”

Whereas the Fed has held charges regular at 4.25%–4.50% since June, hypothesis is rising. Goldman Sachs now expects the primary lower to reach in September.

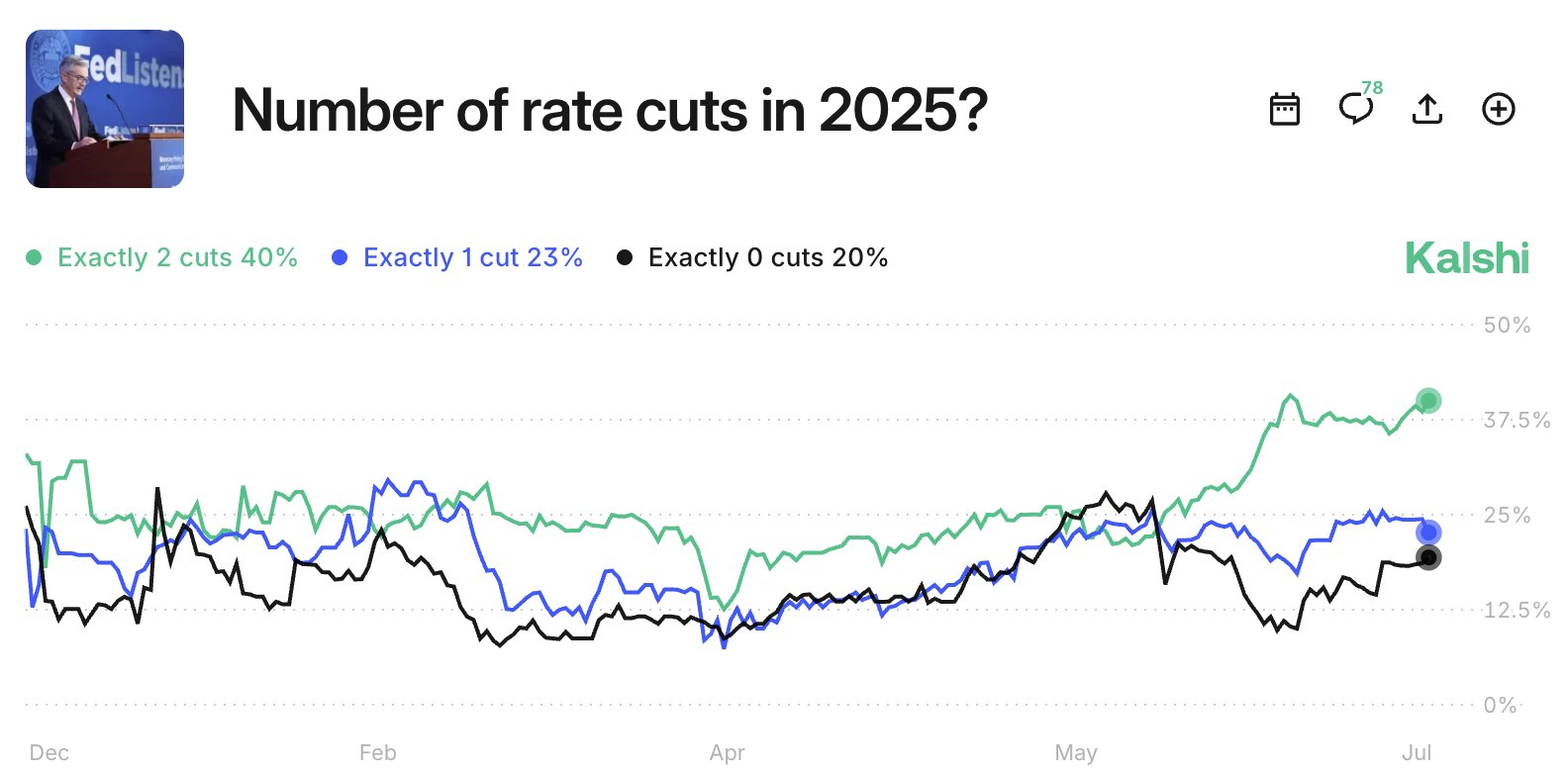

In the meantime, merchants on prediction market Kalshi see a 40% probability of two cuts earlier than year-end.

This shift follows a steep drop in US inflation expectations. One-year shopper expectations fell to 4.4% in July, the bottom since February. That marks a 2.2 proportion level drop over simply two months—one of many largest two-month declines in historical past.

Longer-term inflation expectations are additionally easing. 5-year outlooks dropped 0.8 proportion factors within the final quarter, now sitting at 3.6%.

General, these traits recommend the Fed has extra room to ease with out sparking fears of a value spiral.

The crypto market is paying shut consideration.

Bitcoin stays above $118,000, whereas Ethereum holds close to $3,700. Each property have traditionally rallied after Fed fee cuts, benefiting from elevated liquidity and investor danger urge for food.

Might a Main Crypto Bull Run Start?

Traditionally, fee cuts have kicked off robust crypto bull markets.

After the Fed slashed charges in March 2020 through the COVID-19 disaster, Bitcoin soared from below $10,000 to over $60,000 inside a yr. Ethereum adopted, supported by DeFi and NFT development.

If a brand new fee lower cycle begins in September, it might deliver related situations. Decrease yields push buyers towards risk-on property, together with crypto.

Capital might additionally rotate from bonds and money into Bitcoin, Ethereum, and high-conviction altcoins.

Moreover, falling inflation expectations and bettering regulatory readability—such because the GENIUS and CLARITY Acts—might reinforce investor confidence.

This convergence of macro and coverage alerts might lengthen the present cycle past earlier all-time highs.

Nevertheless, timing issues. Crypto is already close to file ranges, so momentum might rely upon how briskly and deep the cuts are. A delayed or shallow response from the Fed might restrict upside.

Key Dates to Watch

The following Federal Reserve coverage assembly will happen on July 29–30. Whereas markets count on no change, Fed commentary might be carefully parsed for alerts about September.

The following crucial date is September 16–17, when the FOMC reconvenes. That is extensively seen as the primary reasonable window for a fee lower, particularly if inflation continues to say no.

Different key indicators to watch:

- July CPI print: Due early August, this may form expectations for the September determination.

- Jackson Gap Symposium (Aug 22–24): Powell’s speech right here might shift sentiment considerably.

- US Jobs Studies (August & September): Labor softness might strengthen the case for cuts.

For crypto merchants, these dates provide cues for potential market inflection factors. A confirmed Fed pivot might set off renewed shopping for strain, notably in Bitcoin, Ethereum, and high-liquidity altcoins.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.