JPMorgan is reportedly contemplating loans backed immediately by shoppers’ Bitcoin and Ethereum holdings, a transfer that may pull TradFi additional into crypto.

JPMorgan May Launch Crypto-Backed Loans As Quickly As Subsequent 12 months

In response to a Monetary Instances report, JPMorgan Chase is exploring plans to supply its shoppers the choice to make use of their cryptocurrency holdings as collateral for loans. JPMorgan Chase is the most important financial institution within the US and ranks amongst the most important on this planet. It manages over $4 trillion in belongings and serves clients in additional than 100 markets across the globe.

The Monetary Stability Board (FSB) considers the financial institution to be a World Systematically Essential Financial institution (G-SIB), which signifies that it’s so related to financial stability on Earth that its collapse may probably imply widespread monetary misery.

Led by CEO Jamie Dimon, who has brazenly expressed his dislike for Bitcoin, the financial institution has traditionally been cautious round digital belongings, however its stance has been shifting.

JPMorgan Chase plans to permit shoppers to take loans towards holdings in cryptocurrency exchange-traded funds (ETFs), in response to reviews from final month. Simply final week, Dimon introduced that the financial institution is about to discover stablecoins.

Now, this concept of providing direct cryptocurrency collateral may take the financial institution a step additional into digital belongings. As per FT, JPMorgan may start Bitcoin and Ethereum-backed loans subsequent 12 months. That mentioned, the report cautions that the plans are topic to vary.

The financial institution’s earlier inflexible stance might have price it enterprise, as revealed by one supply cited by the newspaper.

In response to one individual conversant in the matter, Dimon’s early feedback about bitcoin — during which he additionally mentioned he would hearth any dealer who traded it — had alienated some potential shoppers who both had made their cash via crypto belongings or have been long-term believers of their potential.

Earlier this month, one other G-SIB, Normal Chartered, made headlines of its personal within the digital asset area. The financial institution introduced the launch of a spot buying and selling desk for Bitcoin and Ethereum, changing into the primary financial institution of its scale to supply the service.

Due to their significance, G-SIBs face heightened regulatory scrutiny. So for these establishments to be keen to dip into cryptocurrencies exhibits how far the sector has are available gaining acceptance inside conventional finance circles.

Bitcoin Has Taken To Sideways Motion Lately

Whereas cryptocurrency institutional adoption has been making strides, Bitcoin itself has gone chilly just lately as its worth has hit a part of consolidation. The asset is at present buying and selling round $119,000, which is kind of unchanged from final week.

The pattern within the BTC worth over the previous month | Supply: BTCUSDT on TradingView

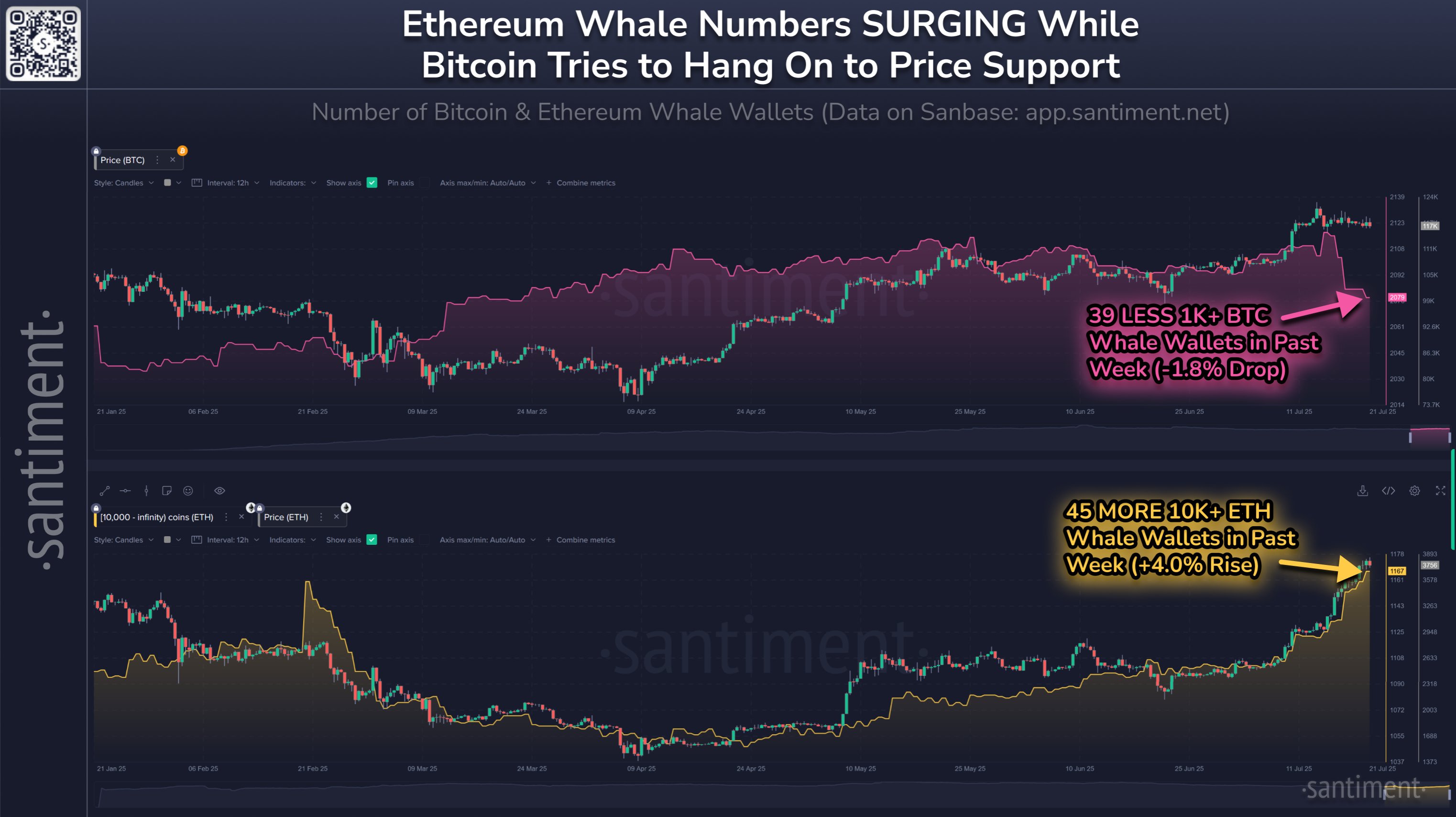

The identical isn’t true for the broader market, nevertheless, because the altcoins have been flying. Ethereum, specifically, has taken the highlight with its 25% surge. Knowledge from on-chain analytics agency Santiment exhibits this rally has come as whale-sized entities have been rising on the community, whereas Bitcoin has been witnessing an exodus.

The variety of whales in contrast between BTC and ETH | Supply: Santiment on X

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.