Key Takeaways

Coinbase’s CEO has dismissed perceived competitors from Charles Schwab’s deliberate crypto buying and selling enterprise.

Brian Armstrong, CEO and founding father of the U.S.-based crypto alternate Coinbase, has downplayed Charles Schwab’s deliberate entry into the sector.

On the time, some analysts seen Charles Schwab’s crypto buying and selling debut as a problem to Coinbase’s moat. Nonetheless, Armstrong dismissed the perceived competitors and bolstered Coinbase because the “Amazon of crypto.”

He added that the alternate is a ‘one-stop store’ for custody, funds, staking, stablecoins, borrowing, and so on.

Supply: X

Coinbase moat and COIN response

Coinbase is at the moment the custodian of 8 out of the 11 Spot Bitcoin [BTC] ETFs (alternate traded funds) issuers in america.

Aside from Constancy (which has its in-house custody), VanEck and Bitwise partially depend on it. Whereas the remaining absolutely use Coinbase as their main custodian.

As well as, the alternate is the primary distribution accomplice for Circle’s USDC stablecoin with 20% of all USDC held on the platform.

It additionally has a stake in Circle, additional underscoring its moat within the stablecoin section.

That being mentioned, the agency’s inventory, COIN, not too long ago hit an all-time excessive of $444.65, because of a broader market rally within the crypto sector. It has rallied by 214% since April’s lows of $142.58. At press time, it was barely right down to $405, as per Google Finance information.

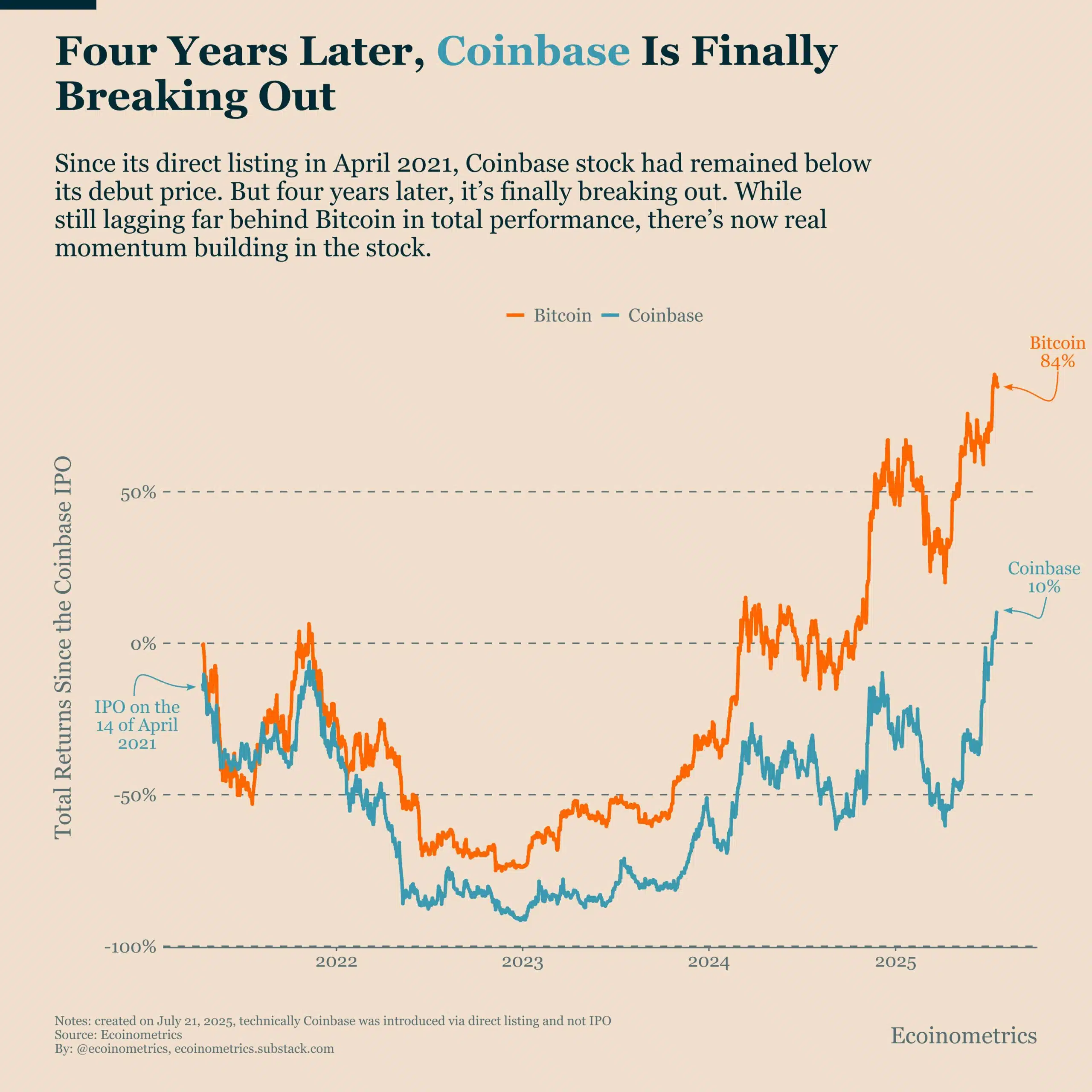

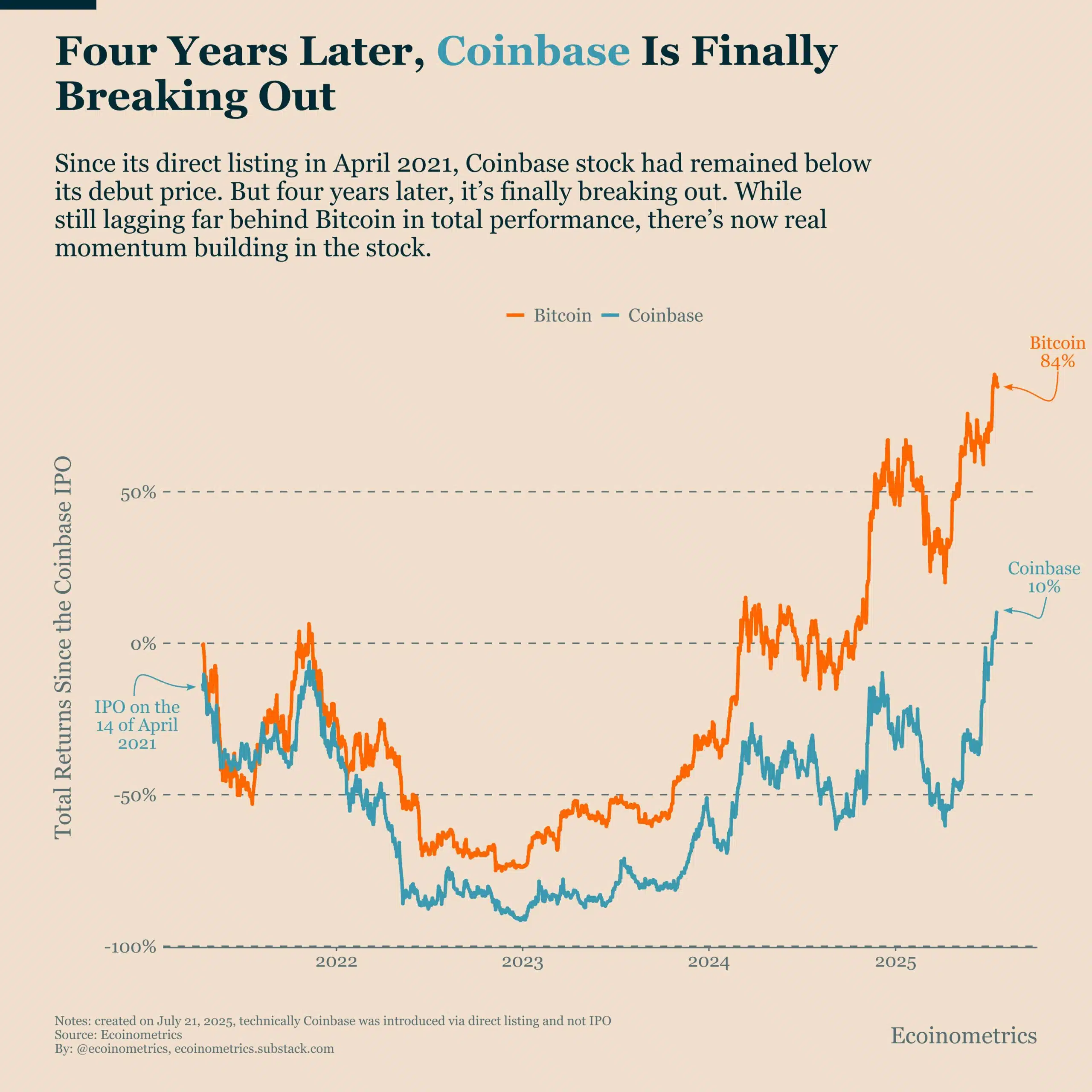

Ecoinmetrics linked COIN’s breakout to Bitcoin’s rising exercise and regulatory aid, particularly the GENIUS Act being signed into legislation. Actually, the agency added that momentum has been constructing for COIN, regardless of lagging behind BTC since its debut in April 2021.

Supply: Ecoinmetrics

Final month, Bernstein analysts positioned the next score on the inventory with a worth goal of $510, about 30% upside from its press time worth. The analysts introduced Coinbase because the “Amazon of crypto,” stating that it was extensively misunderstood by Wall Avenue.

In the meantime, the general analysts’ consensus for COIN is a “reasonable purchase” with a mean worth goal of $320, $510 as the best worth goal, and a lowest goal at $185.

Nonetheless, there was vital insider promoting these days, together with from the CEO, who offloaded almost 200k shares between 16-18 July.

Moreover, Cathie Wooden’s Ark Make investments has trimmed its COIN holdings and rotated into Ethereum [ETH] treasury agency BitMine Immersion Applied sciences (BMNR).