Ethereum value sits at $3,677, up about 16.5% this week. It retains stepping over $3,800, solely to get shoved again down.

With an enormous unstaking queue hanging within the background and momentum cooling a bit, the apparent query is whether or not this door lastly swings open or shuts once more. Two key metrics can assist perceive what occurs from right here.

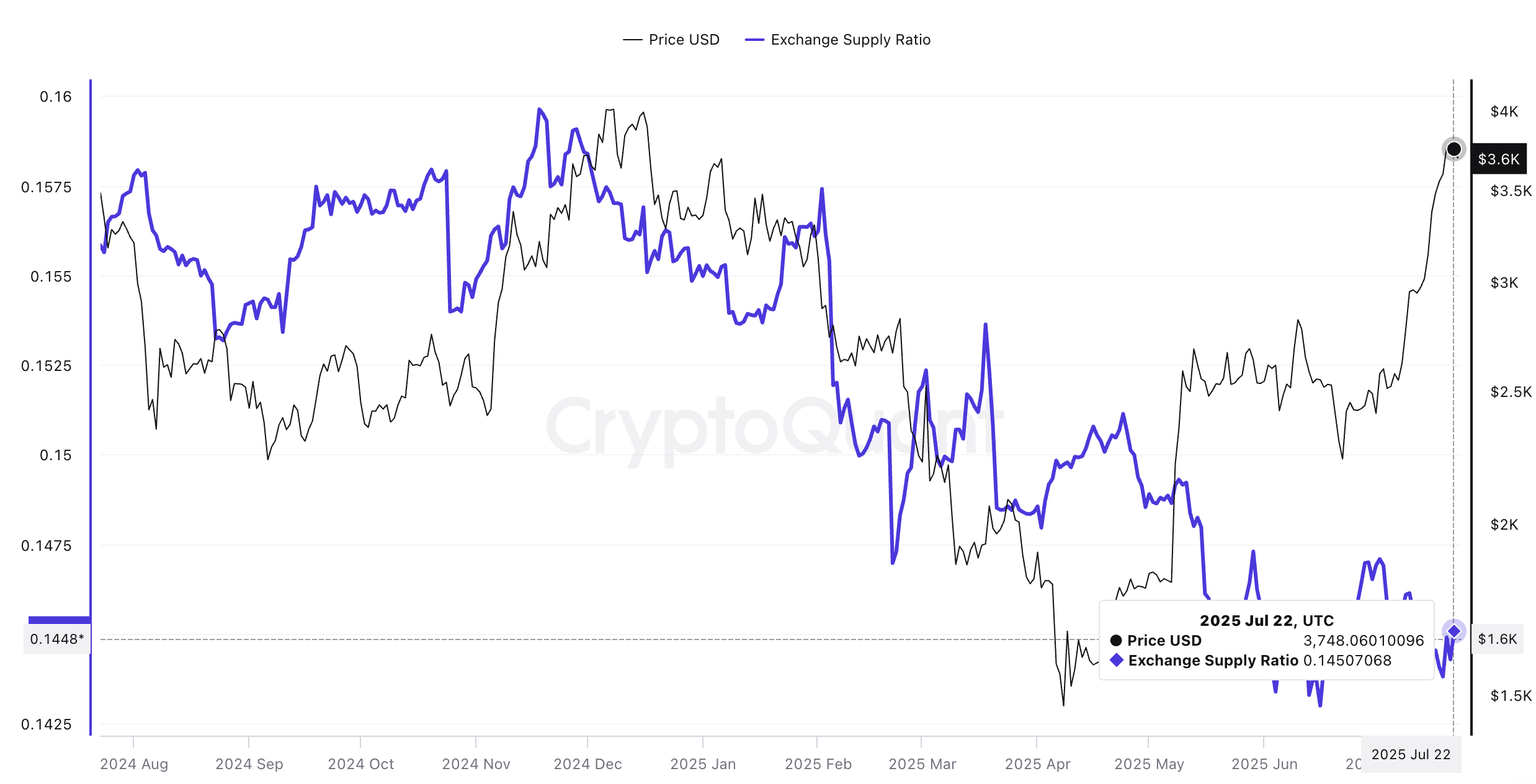

Alternate Provide Ratio Close to Lows

The Alternate Provide Ratio (ESR) is round 0.145, near this yr’s low of 0.142. A ratio is used as a substitute of uncooked alternate balances as a result of it measures alternate holdings towards whole circulating ETH, which adjustments with staking, burns, and unlocks.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

A low ESR means solely a small chunk of provide sits on exchanges and is able to promote. That’s the setup proper now.

In response to the chart, native ESR highs typically got here earlier than Ethereum value pullbacks. Due to this fact, low ESR ranges exude confidence.

If ESR goes up whereas value slips, it often means unstakers or giant holders are transferring cash to exchanges, and a dip can comply with.

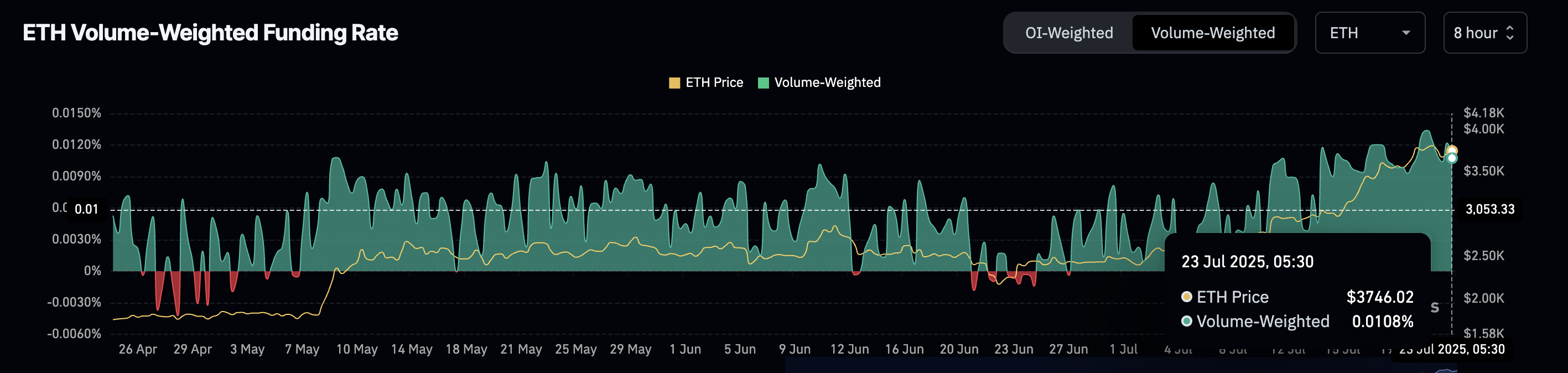

Funding and Open Curiosity

Open curiosity is about $55.9 billion, so lots of futures positions are open. The funding price is close to 0.01%, nonetheless optimistic however decrease than current spikes (something above 0.02% may be worrisome as that may imply excessive Lengthy leverage).

The present market construction signifies that merchants lean lengthy (count on costs to go greater), but they don’t seem to be paying a heavy premium to remain there. That claims leverage is current with out being excessive. This can be a wholesome state of affairs, and the ETH value rally seems to be spot-driven.

Funding is the charge that longs and shorts pay one another to maintain perpetual costs close to spot. Open curiosity is the full worth of all open contracts.

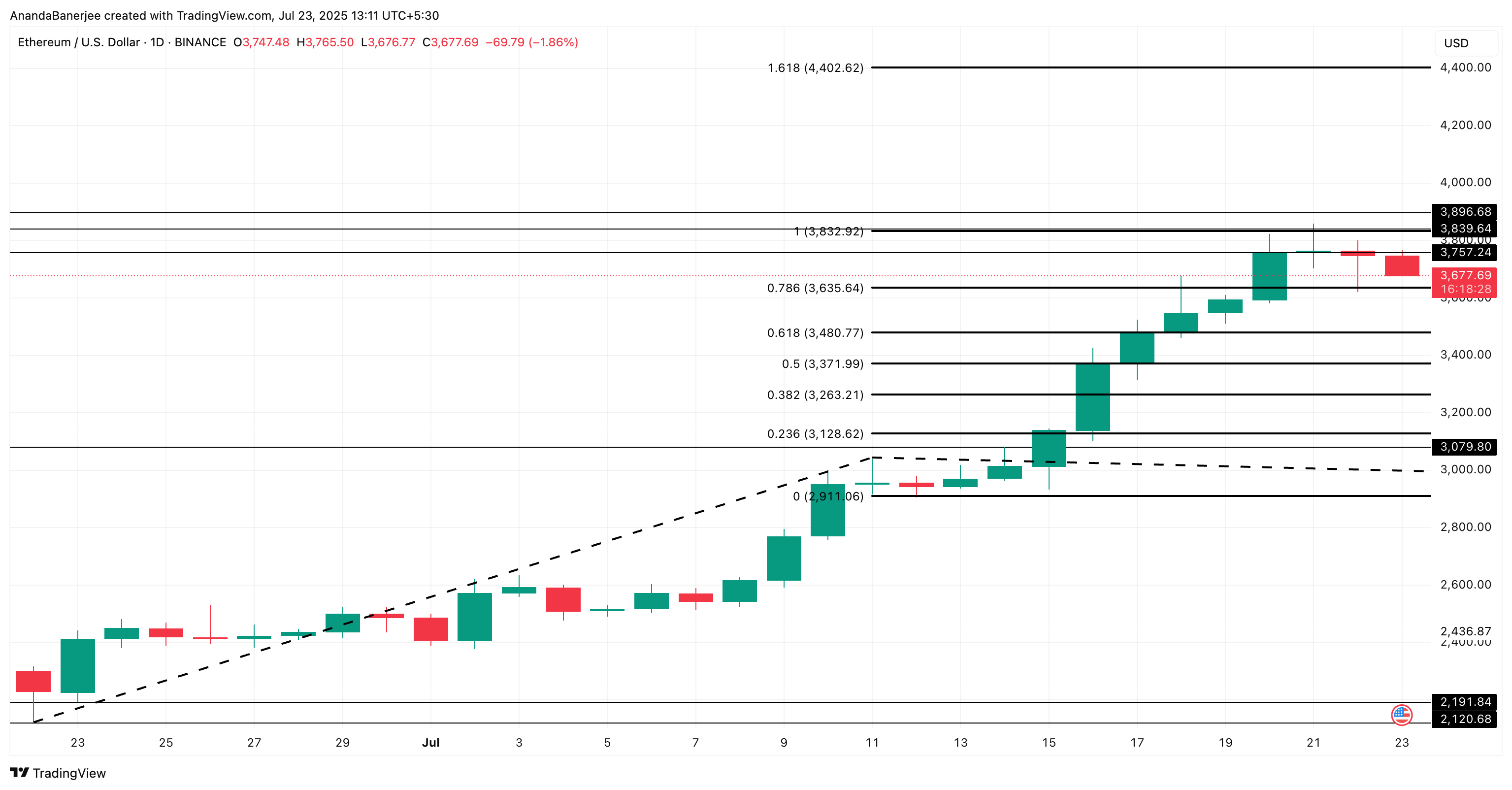

Ethereum (ETH) Worth Wants To Beat Key Ranges

ETH is buying and selling inside two key ranges of $3,832 and $3,635 (the 0.786 Fib stage). Because the higher stage (resistance) would recommend, the true block sits simply above the “$3,800 door.” But merely breaching the $3,832 resistance like earlier won’t assist.

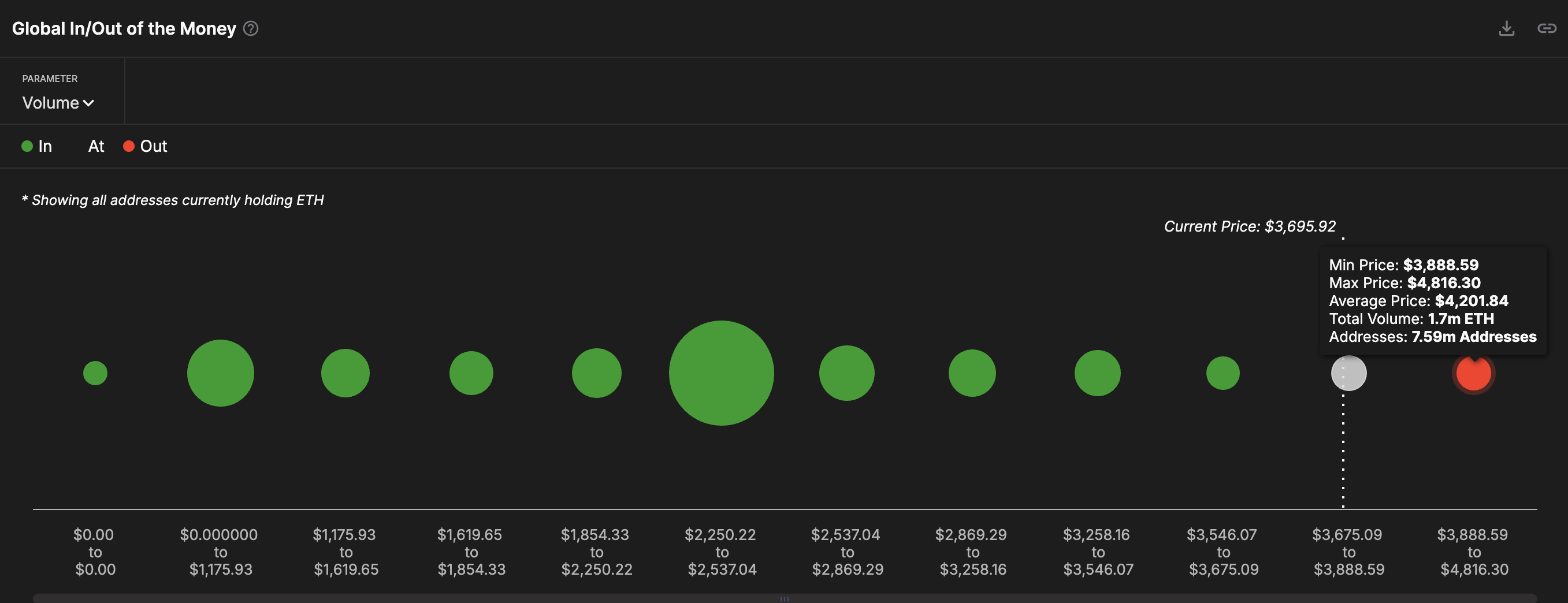

There’s a holder cluster above $3,888, which additionally must be breached. That cluster doubtless explains why fast strikes above $3,800 fade; many wallets are close to break‑even there and promote into energy.

A every day shut above $3,896 would open doorways to $4,402 (the 1.618 extension). If ETH corrects once more, $3,635 is first assist, then $3,480. A drop below these ranges, along with a rising ESR, would weaken the bullish setup quick.

Fibonacci ranges flag widespread response zones. The in-and-out-of-money map reveals the place many wallets purchased; these areas typically act as actual resistance or assist, validating the Fib ranges.

Nonetheless, the complete short-term bullish speculation may get invalidated if the ETH value dips below $3,128 or the 0.238 Fib extension stage.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.