Welcome to the US Crypto Information Morning Briefing—your important rundown of crucial developments in crypto for the day forward.

Seize a espresso to learn how company gamers are rewriting the Bitcoin (BTC) playbook in actual time. As conventional finance (TradFi) norms unravel, daring methods are rising to reshape company steadiness sheets and redefine what it means to go all in on digital property, no matter danger or reward.

Crypto Information of the Day: Technique Rips Up Rulebook on Path to 1 Million Bitcoin, Says Max Keiser

Technique, now MicroStrategy, not too long ago revealed a brand new providing referred to as STRC, or “Stretch.” Marketed as a perpetual most well-liked inventory with an preliminary 9% dividend, the product is explicitly designed to help the corporate’s objective of accumulating extra Bitcoin.

Michael Saylor, government chairman of Technique, introduced the IPO by way of X (Twitter), calling it a brand new lever for Bitcoin accumulation.

Technique’s submit echoed the identical language, reaffirming that web proceeds will go towards common company functions, together with buying Bitcoin.

That mission, nevertheless, was punctuated extra dramatically in an unique remark to BeInCrypto by Bitcoin evangelist Max Keiser.

“Technique is dedicated to 1 million Bitcoin by any means essential. They’re tearing up the company finance rule e-book and charging hell-bent for leather-based to the 1 million Bitcoin promised land,” Keiser advised BeInCrypto.

Morgan Stanley, Barclays, Moelis & Co., and TD Securities are joint bookrunners, signaling sturdy institutional coordination.

Nonetheless, Keiser’s remark cuts via the finance converse, articulating that MicroStrategy doesn’t need extra Bitcoin. Relatively, it desires all of the Bitcoin.

This aggressive tone is according to Technique’s decade-long shift from an enterprise software program agency to a Bitcoin holding firm.

In the meantime, even because the agency progressively pivots to BTC, analysts say the agency might set off a Bitcoin cascade worse than Mt. Gox or Three Arrows Capital.

MARA Raises $850 Million to Double Down on Bitcoin

MARA Holdings, the world’s largest public Bitcoin miner, is becoming a member of the Bitcoin accumulation wave. The agency revealed a $850 million non-public providing of convertible senior notes due in 2032.

The transfer alerts continued strategic conviction in Bitcoin as a treasury reserve and a core asset within the firm’s enterprise mannequin. The providing consists of 0.00% convertible senior notes, with an choice for preliminary purchasers to purchase an extra $150 million.

Redemption phrases kick in from January 2030, and the corporate has embedded a number of mechanisms to handle dilution.

MARA intends to make use of the majority of the proceeds to purchase further Bitcoin and fund common company functions. This increase highlights MARA’s function as a miner and digital asset treasury operator.

Like Technique, MARA is positioning itself to amass extra Bitcoin whereas fortifying its steadiness sheet towards future market disruptions.

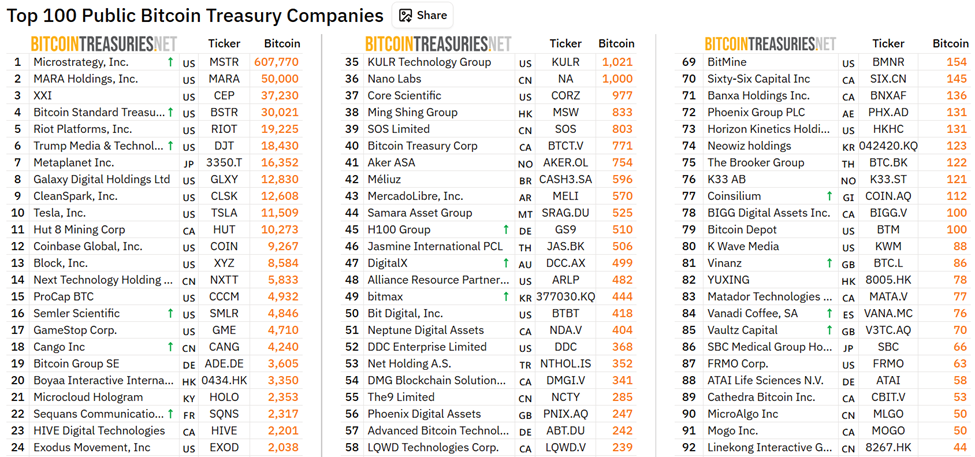

Information on Bitcoin Treasuries reveals MARA is a distant second amongst public company holders of BTC, holding 50,000 tokens.

In the meantime, as of this writing, MicroStrategy is the biggest holder, with a 607,770 portfolio valued at $71.80 billion.

Chart of the Day

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to observe right now:

Crypto Equities Pre-Market Overview

| Firm | On the Shut of July 22 | Pre-Market Overview |

| Technique (MSTR) | $426.40 | $425.74 (-0.15%) |

| Coinbase World (COIN) | $404.44 | $405.50 (+0.26%) |

| Galaxy Digital Holdings (GLXY) | $29.11 | $29.90 (+2.71%) |

| MARA Holdings (MARA) | $19.88 | $18.86 (-5.33%) |

| Riot Platforms (RIOT) | $14.27 | $14.13 (-0.98%) |

| Core Scientific (CORZ) | $13.48 | $13.60 (+0.89%) |

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.