- Solana broke $200 for the primary time in 5 months, locking in $538M in realized good points and hitting $105B market cap.

- ETF momentum and staking exercise have pushed institutional inflows, with funds like REX-Osprey SOL + Staking drawing consideration.

- Derivatives markets present surging hypothesis, and pockets creation is booming—suggesting each contemporary demand and a possible transfer towards $250+.

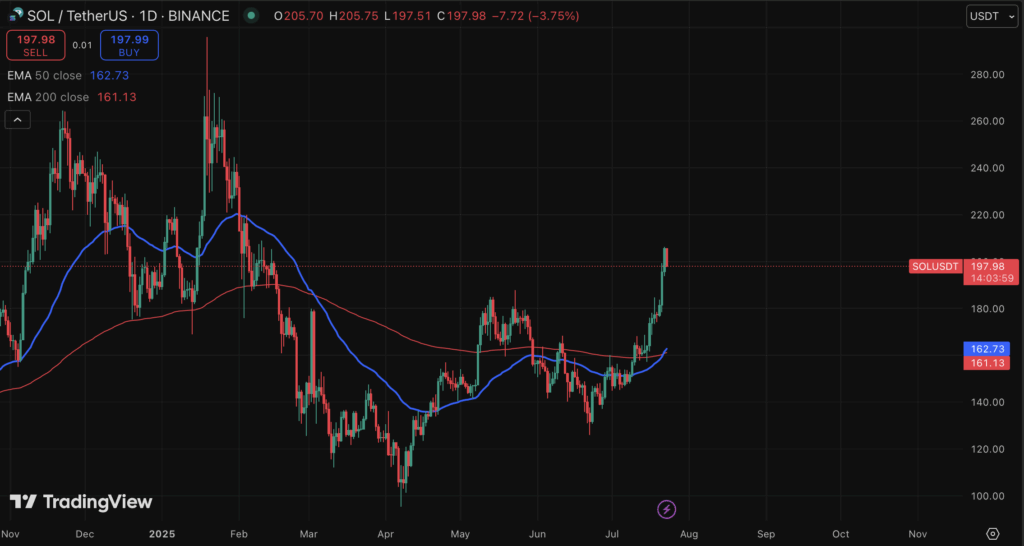

Solana simply did one thing it hasn’t carried out shortly—blast previous $200. Yep, first time in 5 months. It pushed as excessive as $200 flat earlier than settling down round $197, which, all issues thought-about, continues to be fairly wild. The day by day shut on July 21? A strong $195. Greatest closing value since… early 2025.

That day alone, SOL locked in a 7.88% acquire. And extra importantly? About $538 million in realized good points. That’s the largest two-month haul shortly—so, yeah, it appears to be like like long-dormant baggage are lastly waking up.

Even the day after was no slouch. Solana moved 4.6% intraday, exhibiting there’s nonetheless gasoline within the tank. Market cap? It’s now again above $105 billion. That places it forward of corporations like Intel, which is type of nuts when you consider it.

Staking Up, TVL Climbing, and the Chain’s Nonetheless Cooking

Solana’s community has been buzzing. Whole Worth Locked (TVL) surged—virtually $800 million in inflows hit the community just lately. TVL now sits simply shy of $10 billion. It hasn’t been at that degree in virtually six months.

That TVL soar? It’s not simply hype—it comes with staking spikes and contemporary capital rotating in quick. SOL’s been on a heater, up 23% over the previous week alone.

ETF Buzz Sends Establishments Scrambling

Right here’s the place issues get even spicier. Merchants on prediction markets are actually pricing in a 99% likelihood of a spot Solana ETF touchdown someday in 2025. With some SEC inexperienced lights and keen asset managers, that doesn’t really feel far off.

In truth, the REX-Osprey SOL and SOL Staking ETFs already received the automated thumbs-up. They’re stay. And the SOL + Staking fund is pulling in capital quick—virtually $100 million already. The staking mannequin, particularly, is catching massive buyers’ eyes.

In the meantime, Nasdaq-listed Upexi scooped up 100K SOL. DeFi Growth Corp? They purchased practically one million and are validating on-chain now. Establishments clearly need in.

Technicals Flash Inexperienced, Eyes on $250 Subsequent?

There’s a powerful technical case right here too. Solana broke out of an inverse head-and-shoulders sample above $159. That’s bullish metropolis. The primary goal was $185–$210. It’s already touching that zone.

If momentum retains up, $220–$250 is on the desk. A stretch goal? $300 isn’t loopy if the rally retains tempo.

That breakout additionally cleared a significant provide wall at $185. A lot of the underwater crowd from earlier cycles is now in revenue. The $538 million in good points thus far would possibly simply be the beginning.

New Wallets, Large Derivatives Motion, and Rising Volatility

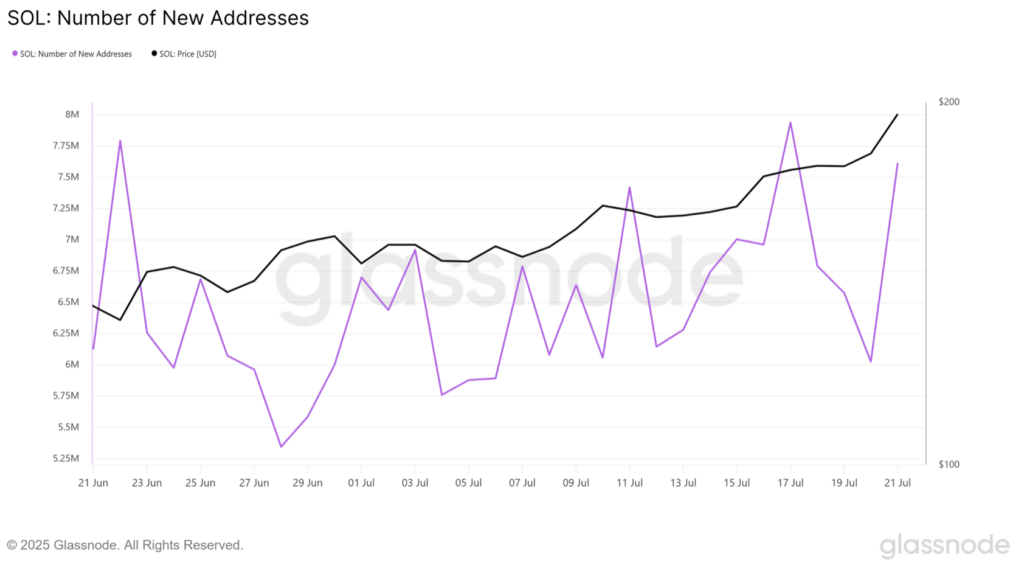

Glassnode knowledge reveals that as SOL approached $195, pockets creation spiked 26%. Round 1.5 million new addresses popped up—individuals need in. This isn’t simply merchants recycling positions. New cash is getting into.

In the meantime, derivatives merchants are piling on. Open curiosity in Solana futures jumped by $1.5 billion in simply three days. On the CME, over $4 billion price of SOL contracts traded just lately. That’s large.

And right here’s the kicker—implied volatility spiked from 4% to 14%, that means merchants are bracing for some massive swings forward.