Key Takeaways

Bitcoin hovered close to $118K as miner inactivity and whale accumulation help bullish momentum. Bearish sentiment and shorting might set off a squeeze, with $124K–$130K doable if help holds.

Since mid-2024, Bitcoin [BTC] has rallied from round $60K to almost $119K, but miners have remained noticeably inactive all through the uptrend.

At press time, BTC traded round $118K whereas complete miner reserves had been at 1.809M BTC—among the many lowest ranges recorded since early 2022.

Sometimes, aggressive miner offloading alerts market tops, however their reluctance to promote suggests ongoing provide self-discipline. Due to this fact, this lack of distribution might permit institutional flows and ETF demand to steer momentum.

The muted miner conduct continues to bolster Bitcoin’s bullish construction within the medium time period, supplied these reserve ranges keep suppressed.

Can Bitcoin break away from its $120K resistance ceiling?

Bitcoin not too long ago tapped the $120K mark however shortly pulled again to ~$117.9K, signaling short-term exhaustion at resistance.

On the time of writing, the Parabolic SAR flipped above BTC’sprice, suggesting slowing momentum, whereas the RSI cooled to 61 from beforehand overbought ranges.

Costs remained inside an ascending channel, however the decrease boundary at $116K now acts as vital help.

Nonetheless, until BTC breaks above the $120K–$122K resistance zone with quantity affirmation, upside continuation stays in danger.

Due to this fact, the $116K–$118K zone should maintain to protect the present pattern construction amid indecisive worth motion.

Supply: TradingView

Will fear-driven sentiment interrupt Bitcoin’s bullish pattern?

Weighted sentiment has turned damaging, falling beneath -1.03, at press time, reflecting a wave of concern or skepticism amongst contributors.

In the meantime, Social Dominance has declined to round 27%, suggesting decreased crowd consideration in comparison with earlier native highs.

This mixture of weakening sentiment and fading dominance signifies a cooling retail narrative round BTC. Traditionally, such circumstances have usually preceded consolidation or short-term pullbacks.

Nonetheless, in contrarian setups, fading optimism generally marks accumulation zones. Due to this fact, until sentiment and visibility get well quickly, Bitcoin’s rally may lose steam within the brief time period.

Supply: Santiment

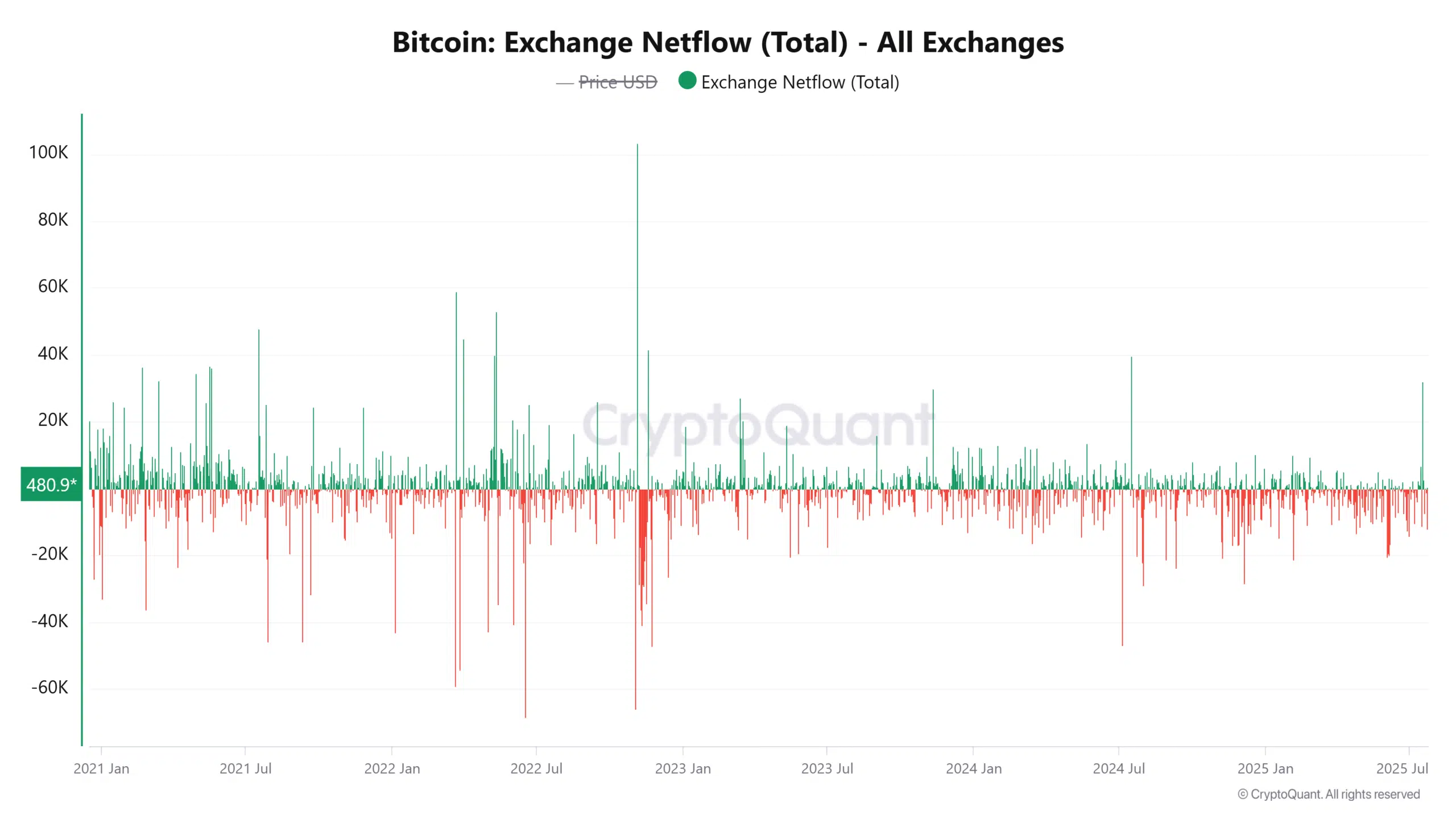

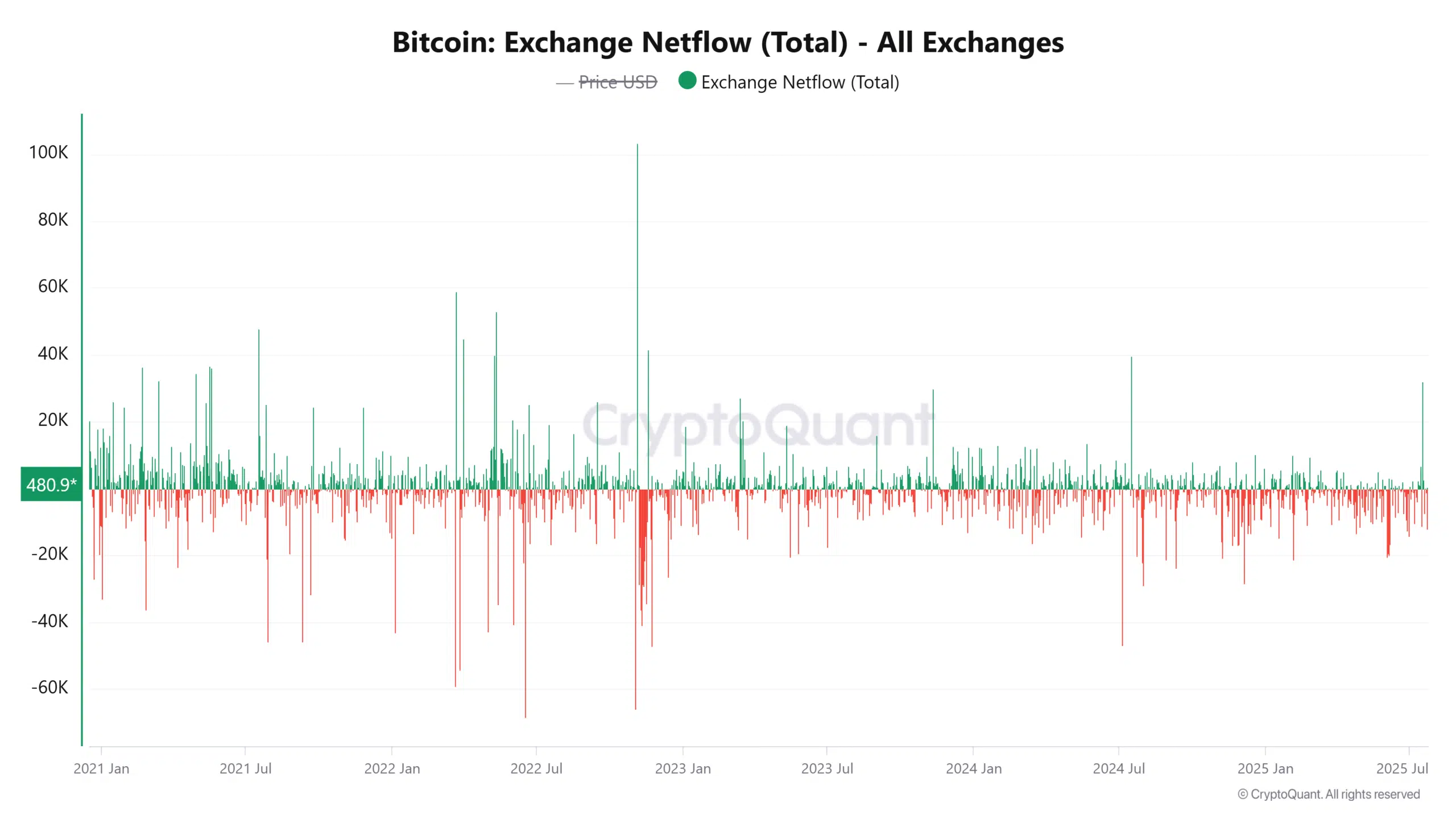

Are trade outflows signaling whale accumulation?

Trade netflows remained firmly damaging, with a current -11.7K BTC outflow marking a 129.75% drop in trade balances.

This constant pattern of BTC transferring off exchanges displays sturdy accumulation conduct from whales or long-term holders.

Sometimes, such outflows cut back sell-side liquidity and assist create a provide crunch over time. Due to this fact, the continuing drainage from exchanges aligns with a bullish outlook, supplied no main influx spikes seem to disrupt the steadiness.

Thus far, the absence of inflows suggests holders aren’t making ready to promote, retaining upside potential intact.

Supply: CryptoQuant

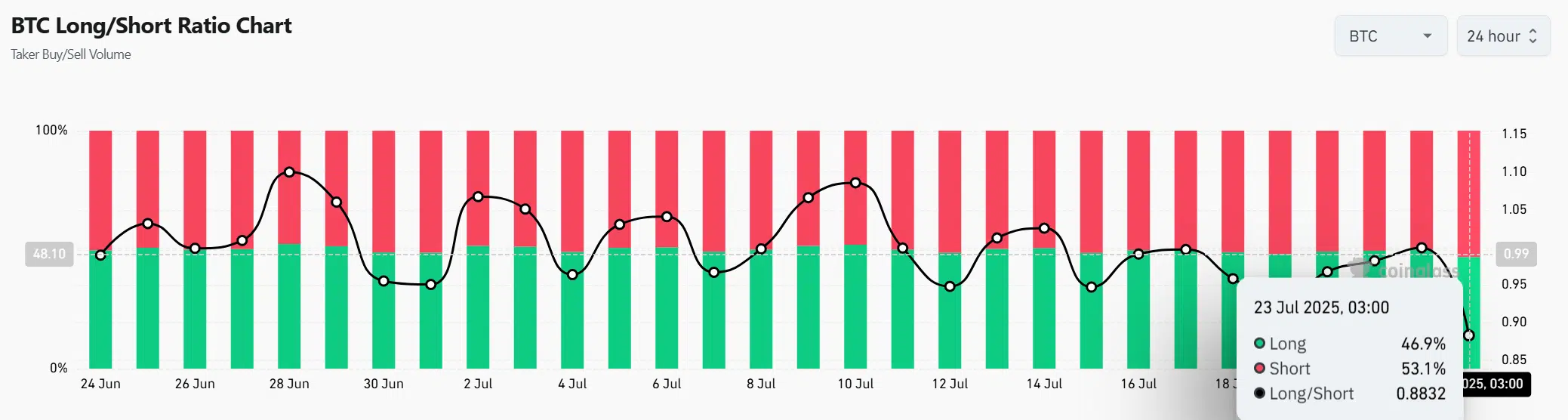

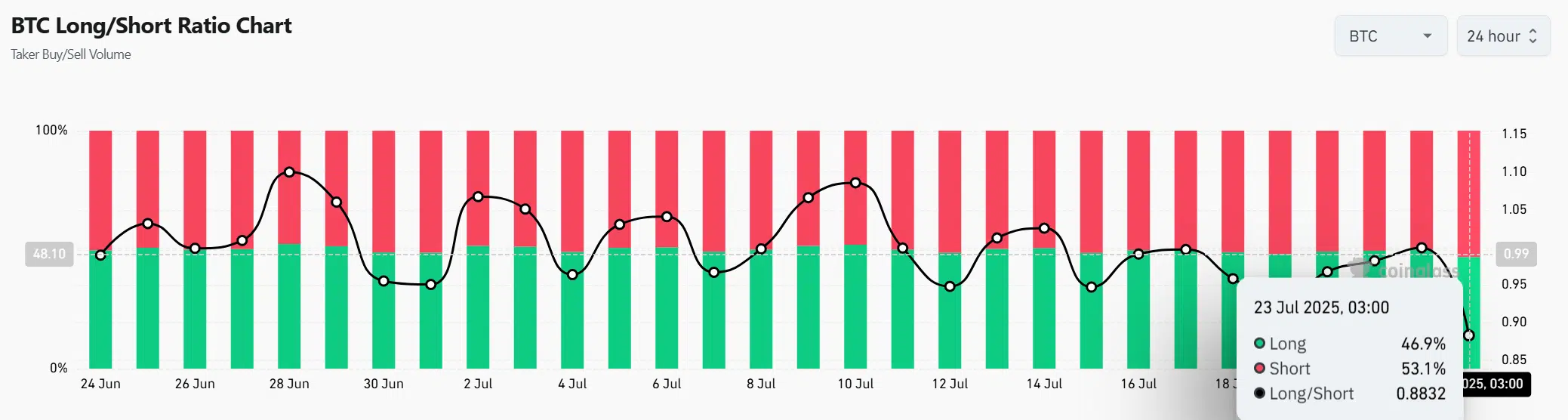

Will aggressive shorting backfire on Bitcoin bears?

The derivatives market has flipped in favor of bears, as of writing, with the Lengthy/Quick ratio at 0.88 and brief positions dominating at 53.1%.

This tilt towards brief publicity usually units the stage for a possible brief squeeze—particularly when mixed with sturdy spot accumulation.

In the meantime, taker promote quantity continues to outpace buys, additional confirming the bearish stance amongst leveraged merchants.

Nonetheless, if Bitcoin defends the $116K–$118K help zone, closely shorted positions may unwind quickly. Such liquidations would probably set off a pointy transfer larger, catching brief sellers off-guard.

Supply: Coinglass

Can Bitcoin reclaim momentum and rally previous $120K?

Regardless of rising bearish sentiment and aggressive brief positioning, Bitcoin nonetheless advantages from miner inactivity and powerful trade outflows.

So long as BTC holds the $116K–$118K help zone, any squeeze on shorts may reignite bullish momentum and push costs towards $124K–$130K.

The present standoff presents a possibility for volatility, with sentiment and positioning more likely to decide the subsequent breakout route.