Key Takeaways

SUI flipped Solana in month-to-month stablecoin transfers. Moreover, its weekly quantity and customers have been rising these days. Whereas Solana continues to be main by lively customers, will SUI finally catch up?

Sui Community (SUI) is constant to race towards Solana (SOL), with many deeming it because the ‘Solana killer’ whereas a number of have additionally mocked it. In truth, on the time of writing, its worth was buying and selling at $3.89 whereas that of SOL was at $203, all having damaged their bearish buildings.

With the competitors now already set, SUI flipped SOL on the month-to-month stablecoin transfers entrance, in accordance with Torero Romero on X (previously Twitter).

At press time, it had $128.9 billion in transfers forward of SOL, Polygon (POL) and The Open Community (TON) which had $121.3 billion, $31.8 billion and $1.46 billion respectively.

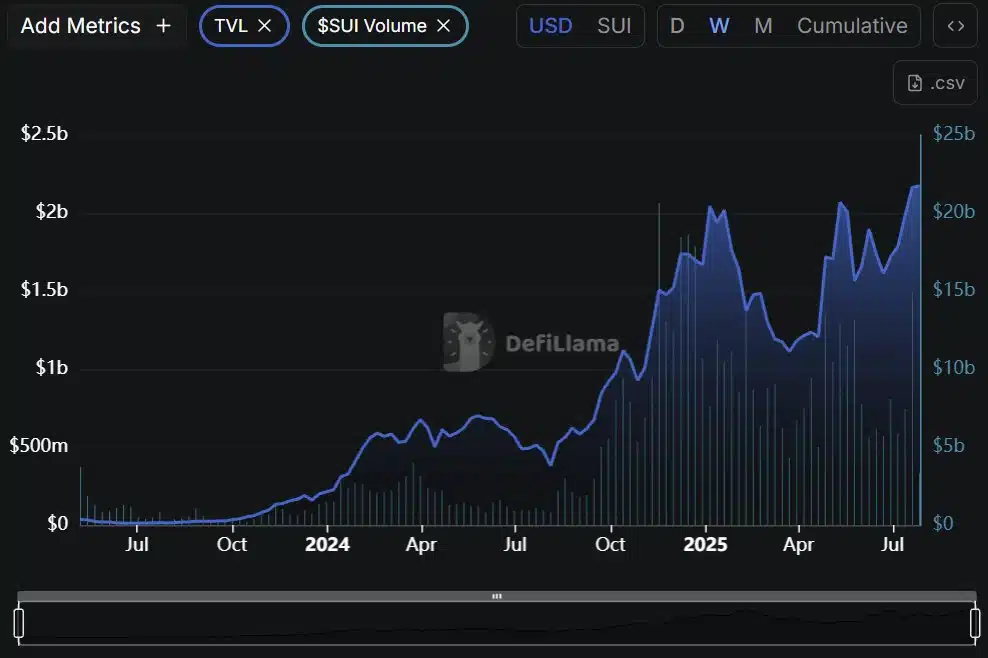

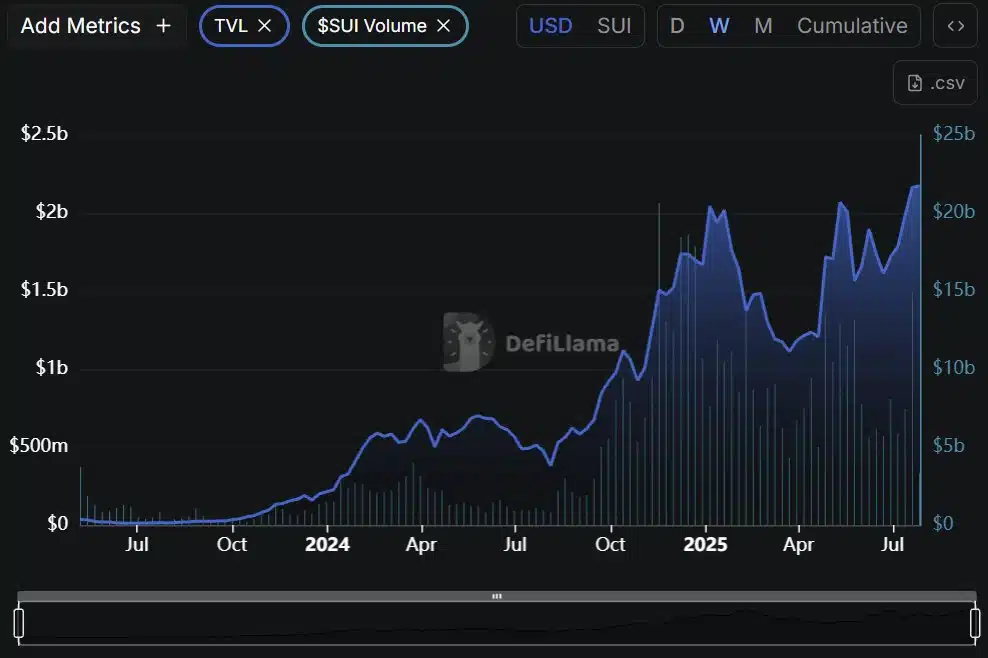

Uptick in TVL and quantity

Taking a look at extra metrics, SUI appeared to have flipped the swap as its token quantity rose by 100%, evaluating to its earlier week. This resulted in $3.7 billion in per week.

Additionally, its Whole Worth Locked (TVL) rose from about $17 billion to $22 billion. Nonetheless, SOL led on this entrance with $27 billion – An indication that SUI has been in spirited competitors towards Solana.

Supply: DefiLlama

In the meantime, its app income surged to an ATH of $50.37 million.

This affirmed the utilization of the blockchain, particularly from memecoins. That is the place Solana blockchain thrives. In truth, SUI’s greatest memecoins surged by about 26% in a day, as per CoinGecko.

Similarity in worth actions

Furthermore, their worth motion charts have been trying equivalent. Particularly at a time when the broader crypto market is rising.

SUI swept liquidity above the press time worth of $4 and instantly, one other cluster began to type. The dynamic liquidation leverage was at $18 billion, on the time of writing.

Supply: CoinGlass

Equally, SOL gave the impression to be forming a cluster above after selecting liquidity above $200, as per CoinGlass. On Solana’s aspect, very minimal resistance was forward as per the price foundation distribution map on Glassnode.

This might additional gasoline the competitors which could assist drive the worth of the low capped altcoin.

Verdict on SOL vs. SUI race?

Nonetheless, the potential of it flipping SOL on all fronts could also be an uphill job. This may be confirmed by the disparity of their each day lively customers (DAU), with SOL’s figures being 4x that of SUI, regardless of a drop.

The DAUs for SUI have been at 1.1M, in comparison with Solana’s 4M after a drop from 5.2M. This put Solana within the lead, however additional corroborated that SUI is perhaps catching up.

Supply: Token Terminal

That being stated, for SUI to overhaul Solana, it should take a while. A few of SUI’s strengths stem from its theoretical throughput which has outpaced that of Solana this yr.