Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

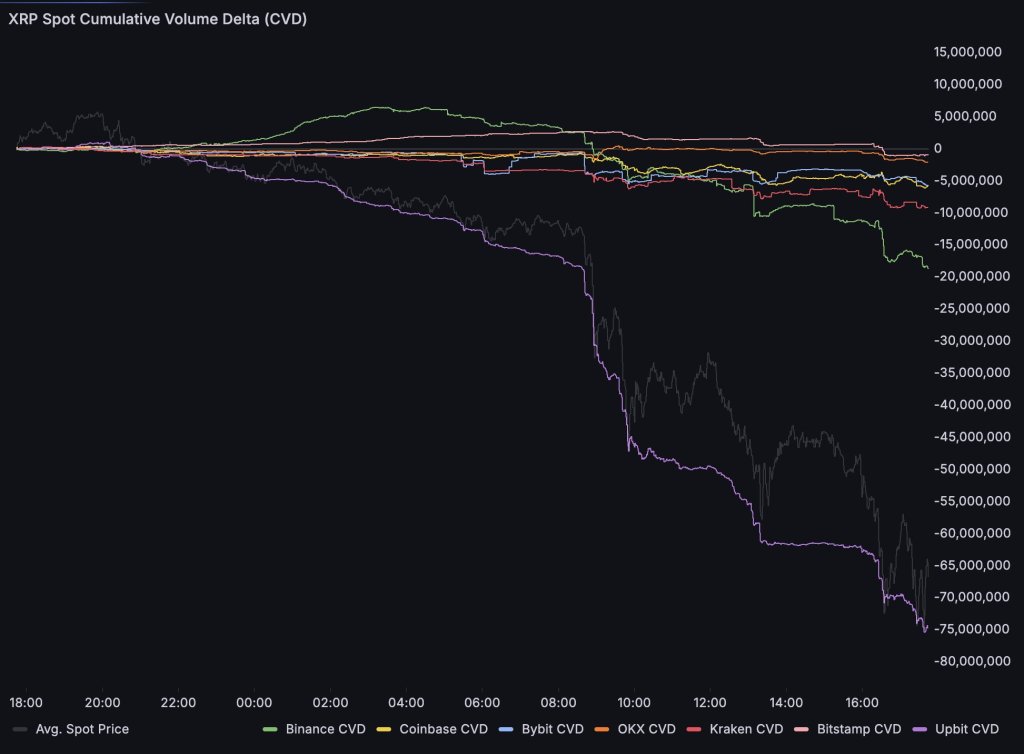

An abrupt XRP promote‑off by greater than -15% on 23 July was pushed overwhelmingly by aggressive market promoting on South Korean alternate Upbit, in accordance with unbiased analyst Dom (@traderview2), who printed multi‑venue order e book heatmaps and cumulative quantity delta (CVD) knowledge to X. “Korean market Upbit selected violence right now on XRP,” he wrote, quantifying “Over 75 million XRP bought at market during the last 24 hours.”

Why Did XRP Crash Yesterday?

The spot CVD chart shared by Dom isolates internet market shopping for and promoting throughout main venues. Whereas Binance, Coinbase, Bybit, OKX, Kraken and Bitstamp CVD strains remained comparatively flat to modestly destructive, the Upbit CVD (purple line) plunged in a close to‑one‑approach trajectory to roughly –75 million XRP in the course of the interval, mirroring the intraday decline within the common spot value plotted alongside it. The analyst said: “The pump AND dump was delivered to you by Upbit… The orderbooks have been fairly empty, thus the fast transfer down right now.”

Concurrent order e book heatmaps for Binance, Coinbase, Binance USDⓈ‑M perpetuals and Kraken present a pointy breakdown from current highs above $3.5 towards the mid‑$3.1 space in the course of the session. Seen liquidity pockets have been skinny above value, with bids clustering just under, per Dom’s statement that depleted depth amplified the influence of the concentrated Upbit move.

Associated Studying

He added that “We’ve got reached some bids round $3, which I’m monitoring now,” emphasizing that “I feel we would like that space maintain to maintain shorter time period bull construction in tact.”

The identical supply underscored that the Korean venue had additionally dominated the previous upside part. On 11 July, Dom attributed the sooner surge to localized demand: “XRP pump delivered to you primarily by the Koreans on Upbit. Binance market tailing behind. All different venues principally flat (Coinbase barely collaborating). Almost 30M $XRP market purchased on high exchanges during the last hour.” That earlier burst of concentrated shopping for was later offset by the most recent wave of concentrated promoting, producing what he characterised as a “pump AND dump” sequence centered on Upbit’s order move.

Associated Studying

Taken collectively, the info depict a two‑stage transfer by which preliminary Korean spot accumulation drove value growth, adopted days later by heavy Korean liquidation right into a structurally skinny world order e book, accelerating XRP’s descent. Dom’s monitoring focus now rests on whether or not the recognized bid curiosity round $3 can stabilize value and protect the shorter‑time period bullish construction he references. As of the charts printed, that assist zone remained the important close to‑time period degree.

Notably, spinoff positioning intensified the transfer: CoinGlass knowledge reveals that XRP futures lengthy positions suffered roughly $82.8 million in liquidations yesterday, second solely to Ether and forward of Bitcoin, with complete market lengthy liquidations exceeding $630 million. This compelled deleveraging probably compounded the spot stress as cascading margin calls translated into further market promote orders, reinforcing the fast draw back extension initiated on Upbit.

At press time, XRP traded at $3.09.

Featured picture created with DALL.E, chart from TradingView.com