A non-public sale investor’s try and front-run a Binance itemizing highlights prevalent dangers within the crypto market.

Itemizing and delisting bulletins, significantly on well-liked exchanges, are inclined to affect value, with forward-looking merchants and traders leveraging the buy-the-rumor and sell-the-event state of affairs.

Binance Itemizing Fumble Prices PUMP Investor $6 Million as Token Crashes Publish-Hype

In line with blockchain analyst Lookonchain, the investor, recognized as “PUMP Prime Fund 2,” transferred 2 billion PUMP tokens price $12.79 million to the Binance change on the time.

Like every other investor, this one anticipated a profitable exit following a possible spot itemizing. The expectation got here as itemizing bulletins on well-liked exchanges like Binance and Coinbase fueled value surges for concerned cash.

Nevertheless, within the rapid aftermath of the itemizing occasion, the worth drops as early traders money in for fast income.

For instance, Bithumb itemizing bulletins propelled LISTA and MERL. Nevertheless, a big value drop adopted instantly after.

Nevertheless, the tides turned for PUMP Prime Fund 2, as Binance by no means listed the token. By the point the investor rerouted the funds to the Bybit change, the worth had plunged by practically half.

The blunder value the investor an estimated $5.86 million in unrealized good points. After receiving the two billion PUMP tokens again from Binance, the investor instantly moved the belongings to Bybit, the place PUMP’s value had already dropped to $0.0035 from $0.0064 simply eight days earlier.

“This error value him a major promoting alternative, and promoting PUMP as we speak could have prompted him to lose ~$6M,” wrote Lookonchain.

This incident highlights how meme coin hype cycles are accelerating and imploding sooner than ever. It additionally displays the intricacies of Binance’s itemizing processes. Lately, the itemizing of the lesser-known NEIRO meme coin prompted a notable value decline for the extra established NEIROETH.

Hype-Pushed Oversubscription and a Fragile Launch

Earlier this 12 months, Binance Pockets’s TGE for PUMP noticed a staggering 247x oversubscription, which signaled large speculative demand. Nevertheless, BeInCrypto famous on the time that curiosity could have been pushed extra by meme coin hype and the platform’s branding than any actual basic utility.

PUMP features because the governance token for PumpBTC, however critics argue its tokenomics and use case haven’t demonstrated sufficient long-term worth to justify sustained demand.

The steep 60% drop in PUMP’s value inside 24 hours of launch is without doubt one of the sharpest crashes amongst Binance-associated TGEs this 12 months.

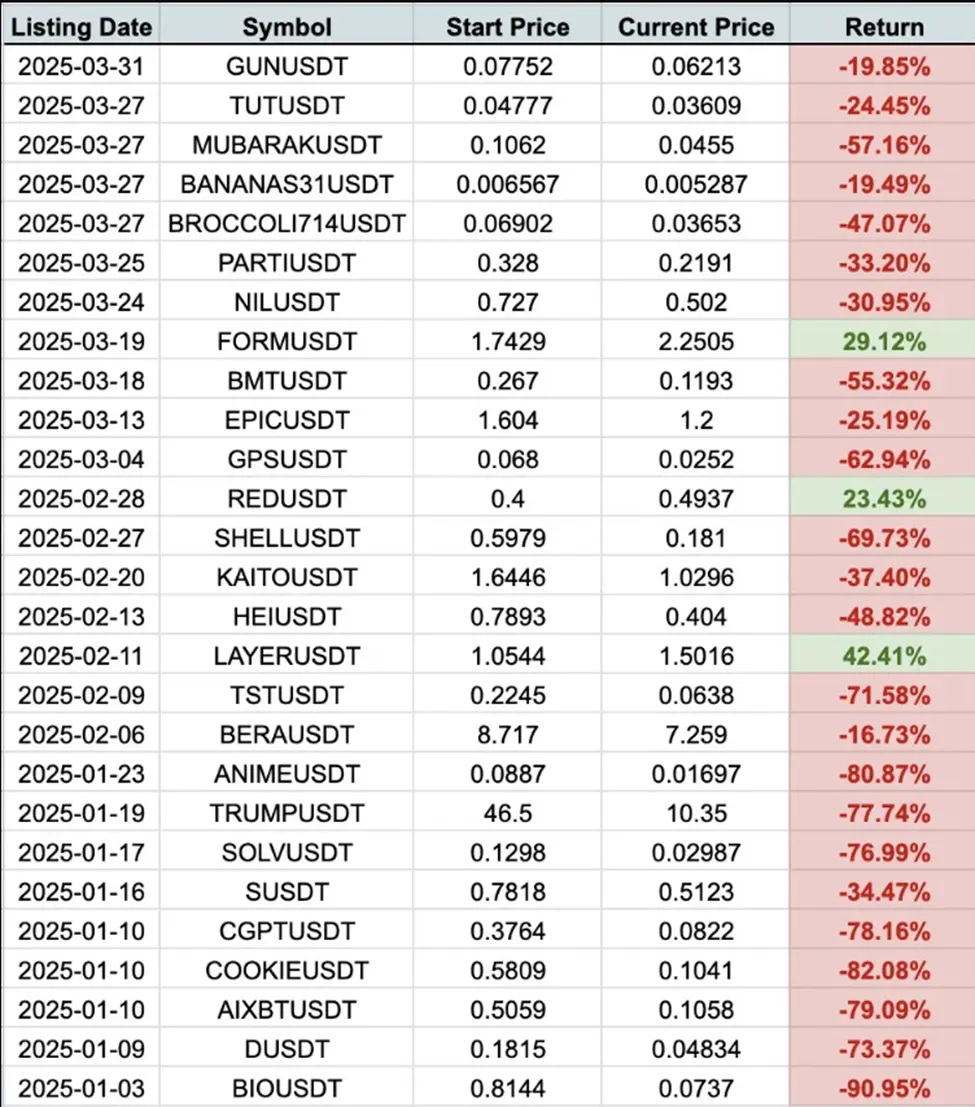

In the meantime, whereas Binance listings have traditionally been market-moving occasions, usually triggering large short-term value surges, latest knowledge paints a unique image. A rising variety of tokens listed on Binance have seen steep post-listing declines.

This implies that generally even a giant change’s endorsement could not assure value efficiency or investor confidence.

In PUMP’s case, the expectation of a Binance itemizing drove personal sale traders to place early, however when that itemizing didn’t materialize, the fallout was swift.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.