Bitcoin (BTC) possesses extra upside potential even because it sits slightly below the document excessive reached mid this month, based on crypto analytics platform Swissblock.

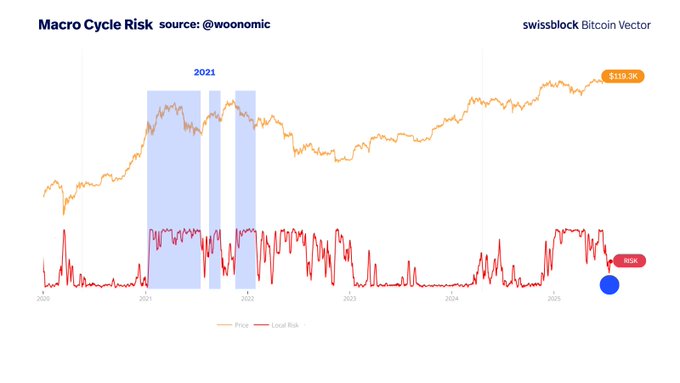

The analytics platform says that whereas Bitcoin is hovering near the all-time excessive, the chance posed to the crypto king by the broader financial developments and world monetary situations stays low.

Swissblock says the low macro danger is a “uncommon and traditionally bullish” sign for the flagship crypto asset.

In response to Swissblock, the rationale Bitcoin has loved solely a slight uptick over the past couple of days is because of the truth that “bulls usually are not bidding aggressively.”

“They’re ready for volatility.”

Bitcoin is buying and selling at $117,589 at time of writing.

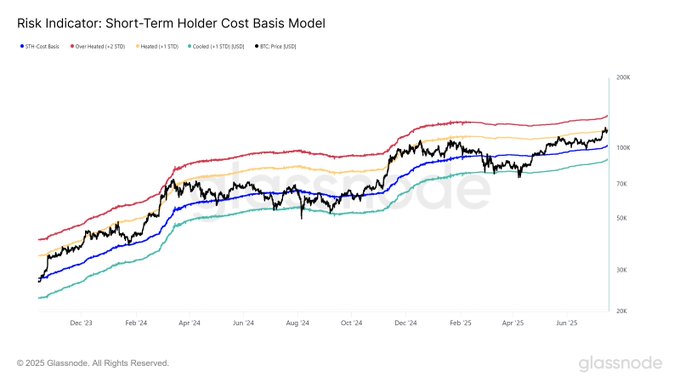

The analytics platform says that Bitcoin might respect by round 17% from the present stage earlier than the short-term holders of the crypto king discover themselves underwater based mostly on the Quick-Time period Holder Value Foundation Mannequin.

“Quick-Time period Holders are energetic however not overheated.

Revenue-taking is current, however the Quick-Time period Holder danger zone (roughly $138,000) hasn’t been reached.

This means there’s nonetheless room for enlargement earlier than we see any panic promoting or euphoria.”

In response to Swissblock, the bullish cycle for Bitcoin has not ended regardless of altcoins outperforming over the quick time period.

“BTC is performing because the structural anchor, not the explosive chief.

The bid is rotating into Ethereum, Solana, and high-impulse altcoins.

BTC holds. Altcoins transfer.

The cycle isn’t ending. It’s evolving.”

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney