As Bitcoin (BTC) continues to commerce close to its all-time excessive (ATH) of $123,218, considerations over rising alternate deposits are mounting. Nonetheless, recent on-chain knowledge reveals a big distinction between the present rally and former ones – most notably, a decline in BTC deposits to exchanges.

Bitcoin Circulate Pulse Reveals Low Trade Exercise

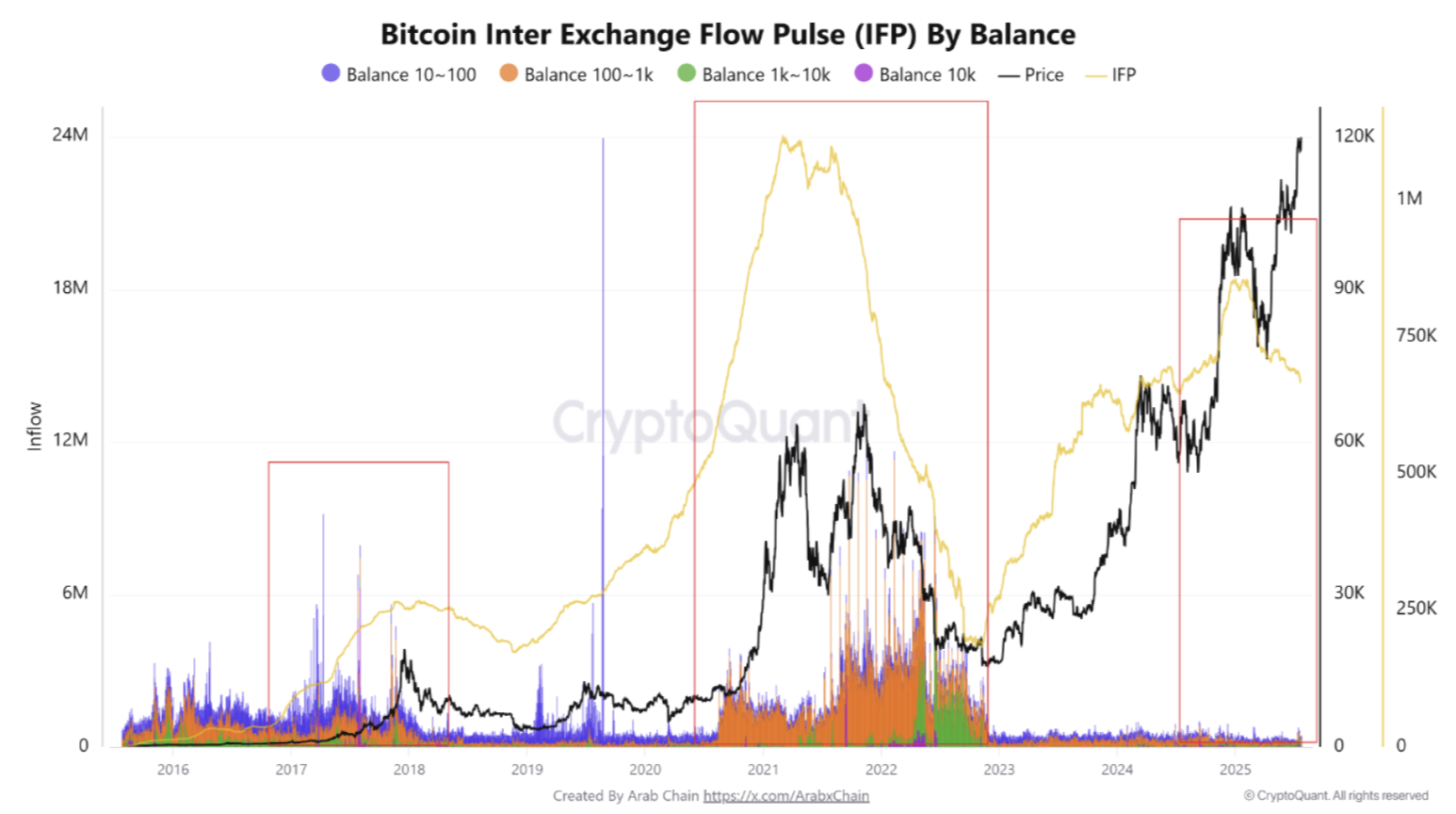

In accordance with a CryptoQuant Quicktake put up by contributor Arab Chain, the Bitcoin Inter-Trade Circulate Pulse (IFP) indicator is exhibiting “attention-grabbing habits” in mid-2025. Notably, massive buyers don’t seem like promoting their holdings, regardless of BTC buying and selling at document highs.

Associated Studying

Usually, subtle buyers start profit-taking as an asset approaches ATH territory. Nonetheless, that habits seems to be largely absent this time.

The dearth of promoting exercise stands in distinction to the market peaks of 2017 and 2021. Throughout each these situations, there have been massive BTC inflows to exchanges, which have been intently adopted by vital worth corrections.

Arab Chain shared the next chart highlighting the connection between a rising IFP and Bitcoin’s worth trajectory. The chart illustrates how worth corrections adopted rising IFP ranges on the finish of 2017 and once more in 2021. In 2025, regardless of an IFP surge earlier within the 12 months, the BTC market has since consolidated moderately than corrected.

For context, the IFP indicator tracks the amount of Bitcoin transferred between centralized exchanges, offering insights into investor sentiment and market circumstances. A rising IFP usually suggests rising intent to promote or arbitrage, whereas a declining IFP signifies diminished alternate exercise and stronger holder conviction.

This 12 months’s dynamic between IFP and BTC worth suggests buyers are selecting to carry Bitcoin, at the same time as costs hover close to document highs. Arab Chain famous that such habits reinforces the bullish case. They mentioned:

This habits signifies excessive confidence within the uptrend to date and partly explains why the worth has continued to rise with none clear promoting strain. Alternatively, if the Bitcoin IFP indicator begins to rise, it signifies an intention to promote and an anticipated vital provide strain. Due to this fact, a sudden rise within the indicator is a powerful warning signal for speculators.

BTC Miners Partaking In Revenue-Taking

Whereas massive buyers stay largely inactive on the promoting entrance, Bitcoin miners seem like cashing in on the present rally. Miner outflows surged to 16,000 BTC on July 15 – the very best single-day stage since April 7.

Associated Studying

As promoting strain builds, current evaluation by CryptoQuant contributor Chairman Lee highlights a key assist stage that BTC should defend to stay on observe for the $180,000 year-end goal. At press time, BTC trades at $117,529, down 1.4% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com