Key Takeaways

Ethereum eyes $4K breakout as Funding Charges rise, lengthy positions dominate, and U.S. institutional demand grows. Technical assist and bullish sentiment counsel sturdy momentum for continued upward motion.

Ethereum [ETH] could also be gearing up for a breakout, and this time, the indicators are onerous to disregard. With a cluster of technical and behavioral indicators converging, the trail towards the $4K milestone worth degree seems more and more viable.

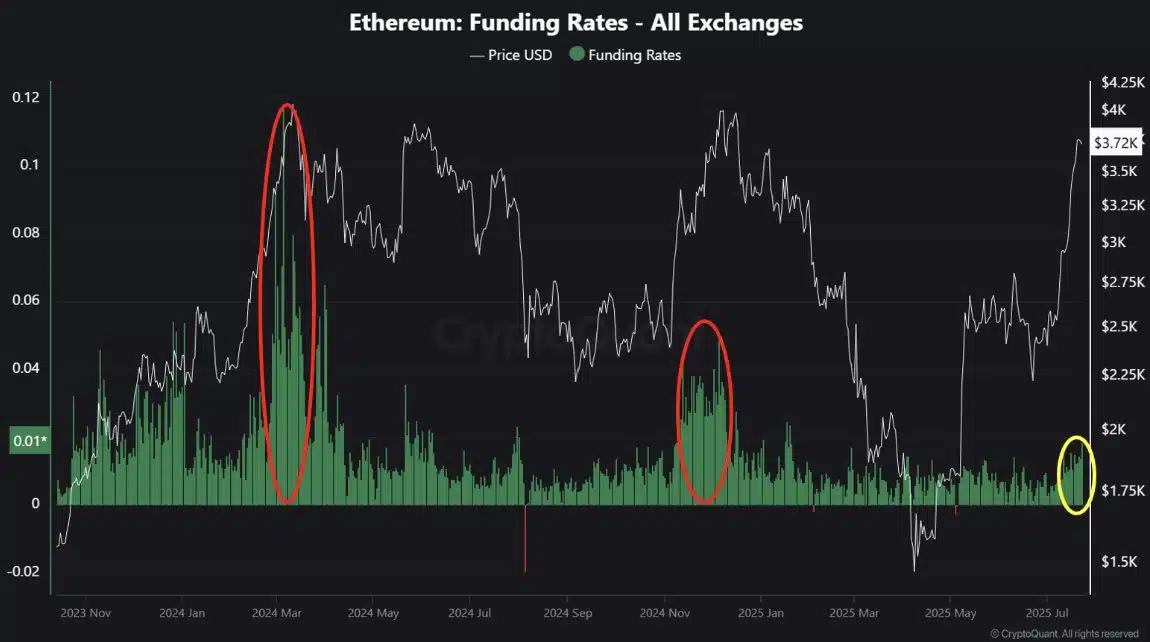

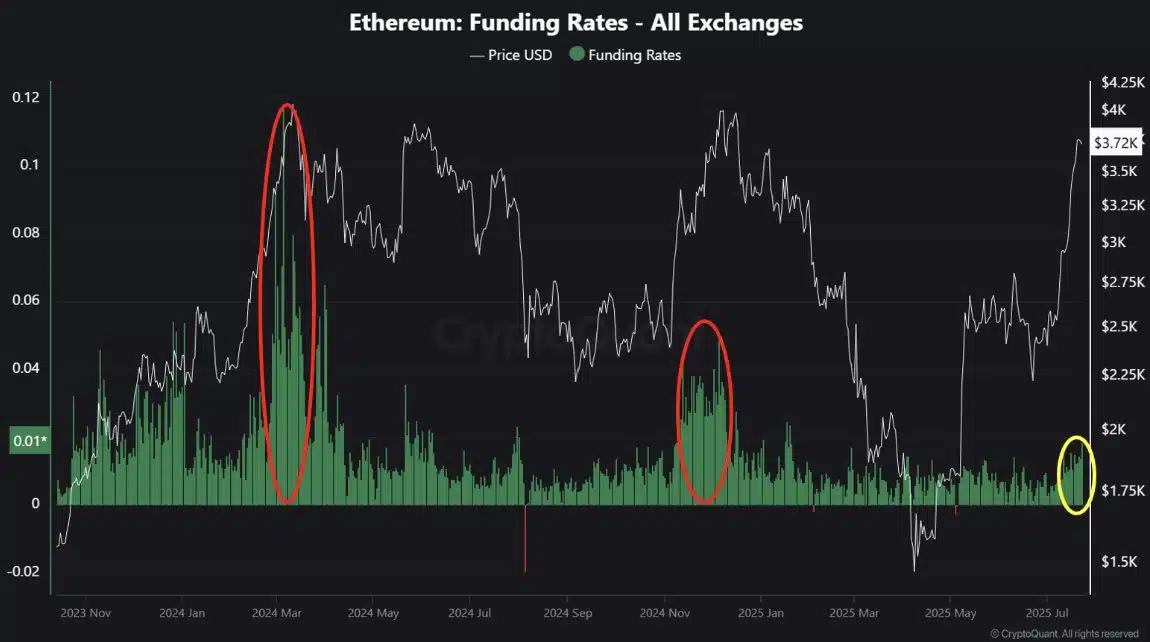

Funding Charges trace at one other rally

AMBCrypto’s latest evaluation highlights Ethereum’s steadily rising Funding Price as a key bullish indicator.

This metric—representing the associated fee to carry lengthy futures positions—is following a well-recognized sample seen earlier than ETH’s final two main rallies.

As a substitute of leaping sharply, the Funding Price is climbing step by step, exhibiting rising confidence amongst lengthy merchants with out indicators of dangerous over-leveraging.

Traditionally, this sort of constant improve tends to be a extra reliable sign for an upcoming breakout.

Supply: CryptoQuant

Ethereum bulls are in management

Supporting the Funding Price sign is a shift in dealer positioning.

Hyblock knowledge reveals 61% of worldwide buying and selling accounts held lengthy positions, at press time, barely above the weekly common.

Though excessive lengthy ratios can generally alarm traders throughout overheated rallies, the present distribution seems extra like deliberate, strategic accumulation than speculative extra.

Supply: Hyblock

Coinbase premium hole additionally aligns with the rally

A rising premium on Coinbase is reinforcing Ethereum’s upward momentum.

Although the value hole could appear small, it’s vital—Coinbase is commonly seen as a barometer for U.S. institutional curiosity.

Traditionally, this type of premium has aligned with sturdy shopping for exercise from American traders, signaling that bigger gamers are getting into the market.

It additionally tends to look alongside main catalysts, reminiscent of ETF hypothesis or broader macroeconomic developments.

Traditionally, such divergence has coincided with durations of sturdy shopping for strain from American traders, typically signaling that greater gamers are stepping in.

This sort of premium largely coincides with main elementary catalysts, reminiscent of ETF hypothesis or macroeconomic shifts.

Supply: CryptoQuant

Zooming right down to technicals, Ethereum is retesting a key resistance zone that just lately turned a key assist degree.

If present assist zones proceed to carry, provoke a clear breakout in direction of $4K milestone worth degree—particularly with rising volumes and U.S. investor demand.

With all indicators pointing to bullish sentiments, the rally to 4K seems greater than seemingly.