With the crypto market in a bull run, each good cash buyers and retailers are looking for avenues to maximise their returns. Unsurprisingly, crypto futures buying and selling is gaining monumental traction.

Futures buying and selling provides unmatched leverage and adaptability, permitting merchants to amplify good points with out holding the underlying asset. Establishments worth it for hedging and precision, whereas retailers are drawn to its revenue potential, even throughout short-term worth swings.

Nevertheless, selecting the best platform is essential. Retail merchants who wish to compete with whales and establishments on an equal footing want the identical degree of pace, leverage choices, and strategic instruments.

Constructed for pace, simplicity and seamless consumer expertise, CoinFutures is quietly changing into a high decide amongst consultants for the perfect crypto futures buying and selling platform.

With on the spot onboarding, as much as 1000x leverage, and automatic stop-loss and take-profit instruments, it’s the supreme platform for everybody from good cash whales to on a regular basis retailers with little time on their palms.

Crucially, there’s no KYC, no order ebook, and no funding fee; the platform is designed for simplicity, giving merchants a clear, hassle-free expertise from the beginning.

As buyers await the subsequent leg of the continuing bull run, CoinFutures customers can place themselves to seize outsized returns, even by betting on massive caps like Bitcoin and Ethereum.

Crypto Futures Buying and selling Is Surging, Sideliners Are Lacking Out

Crypto futures have grow to be one of many fastest-growing segments of the digital asset market. Based on a July 2025 report by CoinLaw, common day by day buying and selling quantity in crypto derivatives now exceeds $24.6 billion, up 16% year-over-year.

Futures contracts tied to Bitcoin and Ethereum noticed even stronger development, with volumes rising 26% over the identical interval.

“The crypto derivatives market hit a brand new file in 2025 with $8.94 trillion in month-to-month buying and selling quantity, surpassing spot buying and selling as soon as once more.”, the CoinLaw report learn.

Equally, the CME Group, a benchmark for regulated derivatives, reported a 145% improve in day by day crypto futures buying and selling in Might.

In conventional finance, derivatives like futures and choices dominate quantity. A examine by Greenwich Associates discovered that 81% of establishments use single-stock choices, 75% use index choices, and 65% depend on index futures.

With establishments getting into, crypto futures are anticipated to observe go well with.

Because of CoinFutures, on a regular basis retailers can guarantee they don’t lag behind. They’ll entry high-leverage buying and selling with out KYC, funding charges, or the standard complexity that slows most platforms down.

Specialists Tip CoinFutures As The Finest Crypto Buying and selling Platform

As extra merchants look to capitalize on the continuing crypto bull market, CoinFutures has emerged as one of the really helpful futures buying and selling platforms within the house.

Its pace, accessibility, and ease of use are being seen as main benefits, particularly for retailers who need the benefits of futures buying and selling with out the complexity most platforms are constructed round.

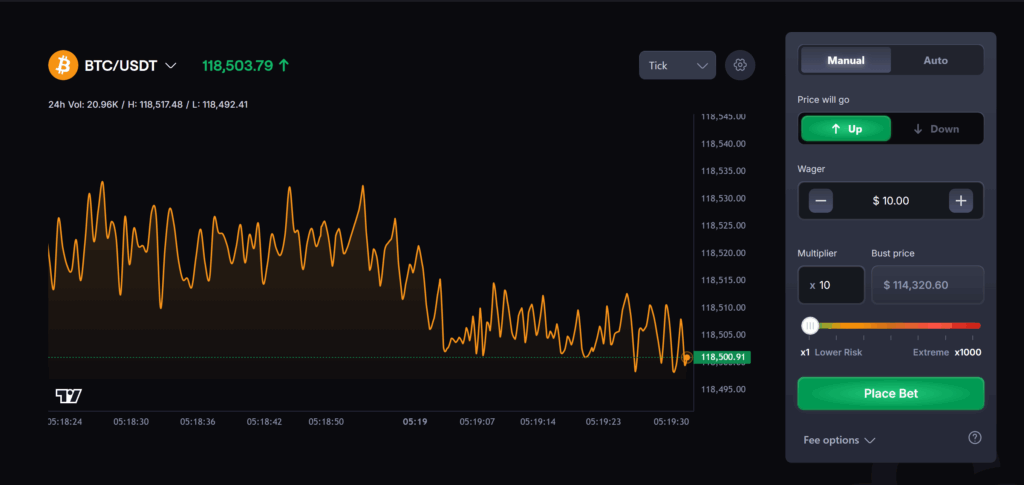

Not like conventional derivatives exchanges, CoinFutures doesn’t depend on order books, liquidity swimming pools, or market makers. As an alternative, the platform makes use of a proprietary algorithm that tracks the real-time volatility and worth motion of main cryptocurrencies like Bitcoin and Ethereum.

This technique simulates worth motion with precision, giving customers a buying and selling expertise that carefully mirrors the actual market.

The result’s a buying and selling setting that feels intuitive and quick.

Customers merely choose the path of the commerce, up or down, select their multiplier, and set the quantity they wish to guess with. Superior choices like stop-loss and take-profit settings could be added instantly by means of the Auto Mode function, which lets trades handle themselves based mostly on customized exit standards.

There are not any funding charges, no hidden liquidation set off. A dealer can log in and place a guess in seconds.

CoinFutures provides as much as 1000x leverage on choose pairs. Which means that retailers don’t have to hunt for 1000x meme cash. They’ll merely guess on high-conviction setups in Bitcoin and Ethereum and seize outsized returns. That is additionally the proper function for small-scale retailers.

Even a small $10 guess may end up in engaging good points, particularly in a bull market.

Customers may have loads of options to make knowledgeable selections. A built-in bust worth calculator will permit merchants to grasp the precise degree at which their guess will probably be invalidated. It additionally means even small deposits can be utilized for high-risk, high-reward methods, with out being uncovered to unclear liquidation mechanics.

The platform additionally encompasses a public leaderboard that ranks customers based mostly on ROI and complete revenue, which provides a aggressive edge and helps critical merchants monitor their efficiency towards others in actual time.

Nevertheless, what really units CoinFutures aside is its is its no-KYC coverage. By eradicating id checks, the platform permits anybody to begin buying and selling immediately, with out the delays, rejections, or surveillance that always include centralized exchanges.

That is particularly necessary for customers in areas going through authorities crackdowns or unsure crypto rules. Merchants can take part freely with out worrying about frozen accounts or jurisdictional blocks. It ranges the taking part in area, giving everybody equal entry to the identical instruments and alternatives

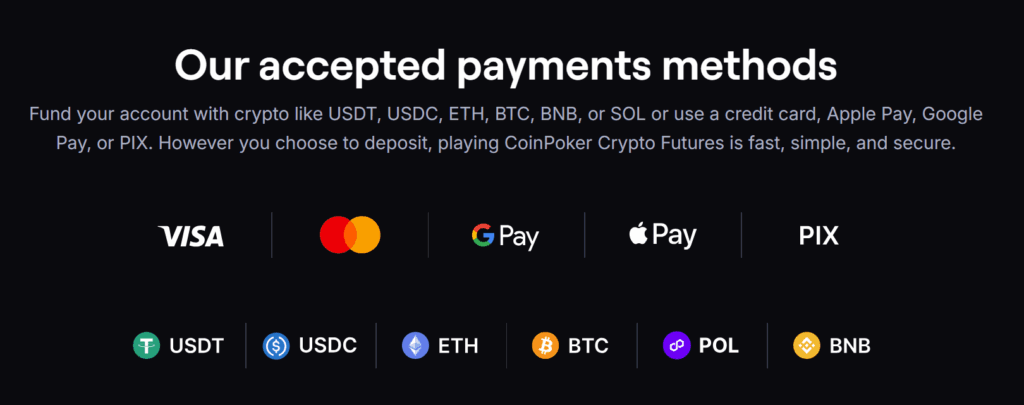

CoinFutures additionally permits a broad vary of deposit strategies, permitting for ease of entry.

For retail merchants who need pace, leverage, and ease, with out compromising on management, CoinFutures delivers a streamlined strategy to commerce crypto futures. It lowers the barrier to entry and offers on a regular basis customers the instruments to commerce like the professionals, which explains why it’s being more and more seen as the perfect crypto futures buying and selling platform.

All that is obtainable at minimal buying and selling prices, with both a low entry charge or a small lower on income. There are additionally no deposit or withdrawal expenses, making it supreme for energetic merchants who transfer out and in of positions incessantly.

The best way to Commerce Crypto Futures on CoinFutures

Comply with this easy course of to begin buying and selling futures on CoinFutures:

Step 1: Register and Obtain

CoinFutures runs by means of the CoinPoker app, developed by the identical workforce, and is out there on Home windows and Android. iOS assist is presently in improvement. Obtain it right here.

Step 2: Fund Your Account

Deposit utilizing crypto (USDT, USDC, BTC, ETH, BNB, SOL, MATIC, and so forth.) or fiat strategies reminiscent of credit score/debit card, Apple Pay, Google Pay, or PIX. No exterior pockets connection is required.

Step 3: Open the Crypto Futures Tab

Launch the app or browser interface and entry the “Crypto Futures” part from the primary menu.

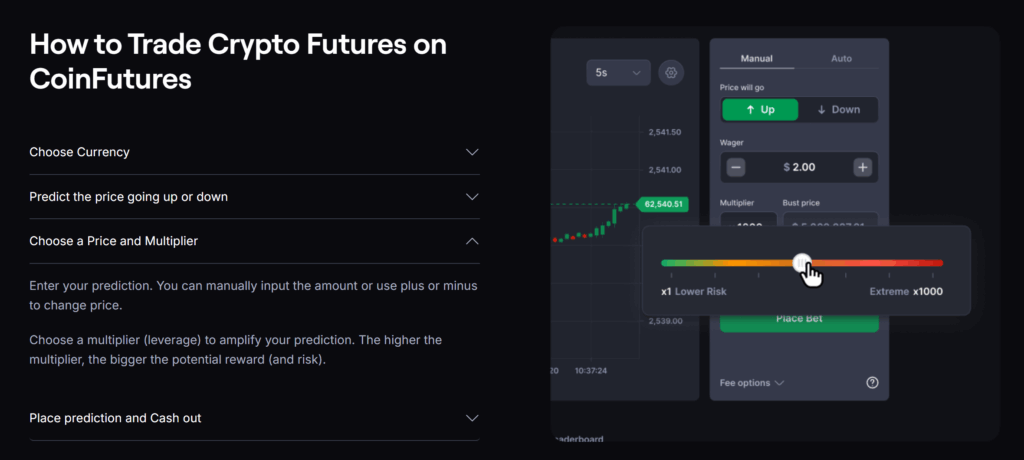

Step 4: Select Your Market and Prediction

Choose a cryptocurrency like BTC, ETH, or meme cash. Resolve whether or not you suppose the worth will go up (lengthy) or down (quick).

Step 5: Set Stake and Multiplier

Enter the quantity you wish to danger and select a leverage multiplier, as much as 1000x. The upper the multiplier, the higher the potential reward and danger.

Step 6: (Elective) Use Auto Mode for Threat Management

Allow Auto Mode to set stop-loss and take-profit ranges. Your commerce will routinely shut if both threshold is hit, even for those who’re offline.

Step 7: Place the Commerce and Monitor

Verify your commerce. You may monitor your place in actual time and money out manually anytime earlier than reaching the bust worth.

Step 8: Verify Outcomes and Leaderboards

As soon as the commerce is full, assessment your efficiency in your commerce historical past. You may also examine the general public leaderboard to see how your ROI stacks up towards different merchants.

Closing Ideas

As demand for leveraged buying and selling continues to develop, crypto futures are shortly changing into a core a part of the market.

Establishments are getting into, day by day volumes are rising, and merchants the world over are searching for methods to amplify returns with out the constraints of spot buying and selling.

CoinFutures stands out by providing a streamlined platform with as much as 1000x leverage, on the spot onboarding, no KYC, and built-in danger controls like Auto Mode.

With no funding charges, no order books, and a proprietary market monitoring algorithm, customers get the pace and readability wanted to make high-impact trades.

CoinFutures customers can place themselves for outsized returns, even by betting on massive caps. Specialists consider Bitcoin is headed to $200,000, Ethereum to $10,000 and XRP to $10. With simply 2x to 5x leverage, even spot merchants can considerably enhance their good points with out taking over extreme danger or overexposing their capital.

Go to CoinFutures

This text has been supplied by one among our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please remember our industrial companions might use affiliate packages to generate revenues by means of the hyperlinks on this text.