Tokenized Pokémon card market features momentum on Solana

The tokenization of bodily collectibles is quietly gaining momentum, with Pokémon playing cards primarily based on the globally well-liked Japanese gaming and anime franchise rising as a standout use case. On Solana, a brand new wave of platforms is popping real-world property (RWAs) like Pokémon playing cards into non-fungible tokens (NFTs).

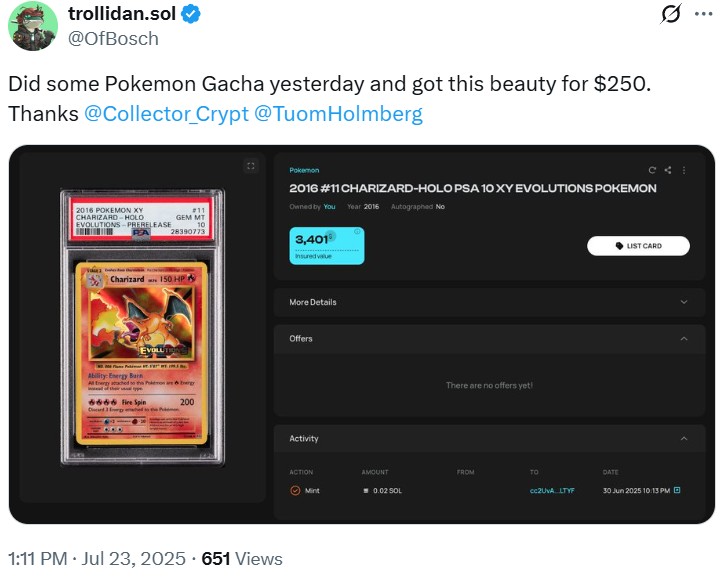

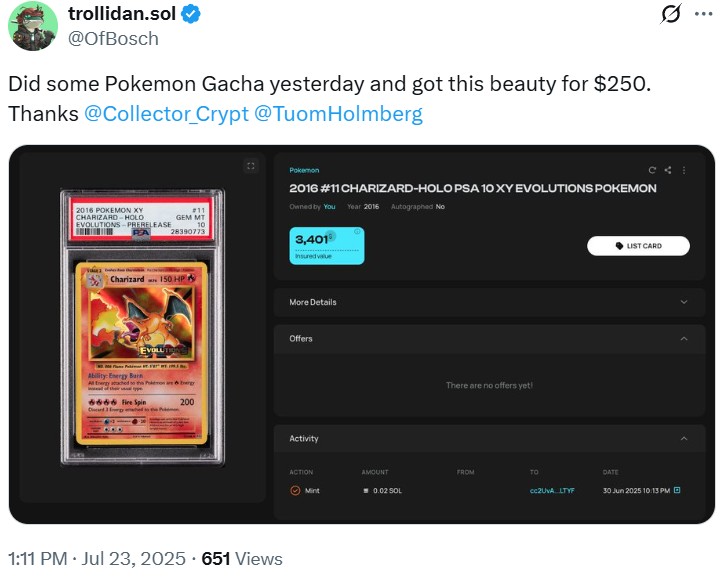

One of many main platforms on this area of interest is Collector Crypt, which has processed practically $95 million in whole quantity in below a 12 months, based on a Dune Analytics dashboard by X consumer zKayAPE. The platform focuses on tokenizing Pokémon playing cards into NFTs, every of which is claimed to be redeemable for its bodily counterpart. A lot of the exercise is pushed by its digital gacha characteristic, impressed by Japan’s capsule-toy merchandising machines, the place customers take a look at their luck by buying and selling a set sum of money for randomized gadgets.

These platforms operate like onchain variations of Japan’s oripa retailers (quick for “unique pack”), which mix blind-box card playing with prompt resale alternatives. The blockchain variations improve this mannequin by providing automated buybacks at 80–85% of card worth, permitting collectors to pursue uncommon playing cards with near-instant liquidity.

“The secondary market exercise is rising too and whereas it’s nonetheless smaller than gacha, it has recorded market volumes totalling as much as $440k as a sector,” zKayAPE mentioned on X.

“Emporium recorded a $11.3K prime gross sales for Mario Pikachu card and a prime gross sales of $9.3K was additionally recorded on Collector Crypt for a Poncho Pikachu card not too long ago.”

FTX collectors in China can head to Backpack to get their a reimbursement

Backpack Alternate has launched a declare sale channel for FTX collectors in China, providing another path to accessing funds amid delays in formal payouts.

Backpack’s channel operates independently of the FTX property’s chapter proceedings. As an alternative of processing redemptions, Backpack permits collectors — significantly these in jurisdictions going through restrictions — to promote their claims to an “unbiased institutional purchaser.”

On July 2, the FTX Restoration Belief filed a movement to freeze payouts to collectors in an inventory of 49 “restricted” jurisdictions together with China.

Outspoken FTX creditor Sunil Kavuri mentioned that about $470 million price of claims belong to those restricted jurisdictions, with Chinese language buyers accounting for almost all of the pie with $380 million. Round 70 objections have been filed towards the property’s try and withhold payouts, largely from Chinese language collectors.

Since Backpack’s July 18 announcement launching its claims gross sales portal, customers have shared screenshots displaying profitable withdrawals of funds which have been inaccessible because the FTX collapse. One consumer mentioned their restoration arrived at a ten% low cost.

Backpack has used comparable methods to draw former FTX prospects. In Could, the change opened claims for FTX EU customers, permitting them to redeem euro balances after finishing Know-Your-Buyer (KYC) verifications. Backpack acquired FTX EU in January 2025.

The subsequent spherical of official FTX creditor distributions is scheduled to start on Sept. 30.

Learn additionally

Options

‘Deflation’ is a dumb solution to method tokenomics… and different sacred cows

Options

Banking The Unbanked? How I Taught A Whole Stranger In Kenya About Bitcoin

Tokenize to exit Singapore after licence denial

One other cryptocurrency change is exiting Singapore’s more and more selective regulatory regime. The Straits Occasions reported on July 20 that Tokenize Xchange is shutting down operations by September 30, after the Financial Authority of Singapore (MAS) refused to grant it a crypto license.

Tokenize raised $11.5 million in 2024, meaning to increase its headcount. Nevertheless, its complete 15-person Singapore group will now be let go.

Tokenize is becoming a member of a rising listing of companies exiting the Lion Metropolis, relocating employees and sources to Malaysia. The corporate additionally reportedly claimed it should search regulatory approval from Abu Dhabi World Market of the United Arab Emirates (UAE).

The central financial institution set a June 30 deadline for all crypto companies to get licensed, even when they solely served abroad customers and denied service to native customers.

The native outlet estimates that round 500 crypto professionals will relocate from Singapore to extra permissive jurisdictions like Hong Kong or the UAE.

Hong Kong’s stablecoin euphoria must settle down

Only some issuers shall be licensed below Hong Kong’s new stablecoin regime, the town’s de facto central financial institution mentioned, warning buyers to not fall for extreme hype, imprecise proposals or fraud.

With the Stablecoins Ordinance set to take impact on Aug. 1, Hong Kong’s prime monetary regulator is sounding the alarm over mounting market euphoria and misinformation surrounding the town’s incoming stablecoin licensing regime.

In a July 23 weblog submit, Eddie Yue, chief government of the Hong Kong Financial Authority (HKMA), mentioned many stablecoin proposals acquired to date stay “overly idealistic” and lack concrete use circumstances, technical competency, or viable implementation plans. Whereas dozens of establishments have contacted the HKMA to specific curiosity in changing into licensed issuers, Yue mentioned that solely a choose few will make the reduce.

Learn additionally

Options

Cleansing up crypto: How a lot enforcement is an excessive amount of?

Options

Crypto whales like Humpy are gaming DAO votes — however there are answers

“Earlier on we’ve got clearly acknowledged that, within the preliminary stage, we’ll at most grant a handful of stablecoin issuer licences. In different phrases, a lot of candidates shall be disillusioned,” Yue wrote.

The warning comes amid a rising pattern of listed firms utilizing imprecise stablecoin bulletins to spice up share costs and buying and selling quantity. Yue mentioned some companies have seen surges in inventory exercise just by declaring plans to discover stablecoin enterprise, even with out clear roadmaps.

He urged buyers to “stay calm and train unbiased judgment” in evaluating such market information, warning that speculative conduct might backfire. “How a lot stablecoin issuance enterprise can contribute to the corporate’s short-term profitability is considerably unsure,” he mentioned.

Yue added that the HKMA has noticed fraudulent schemes disguised as stablecoin promotions, which have already led to public losses. Underneath the Stablecoins Ordinance, providing an unlicensed fiat-referenced stablecoin (FRS) to retail buyers or advertising it to the Hong Kong public will turn out to be unlawful from August 1.

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist protecting blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.