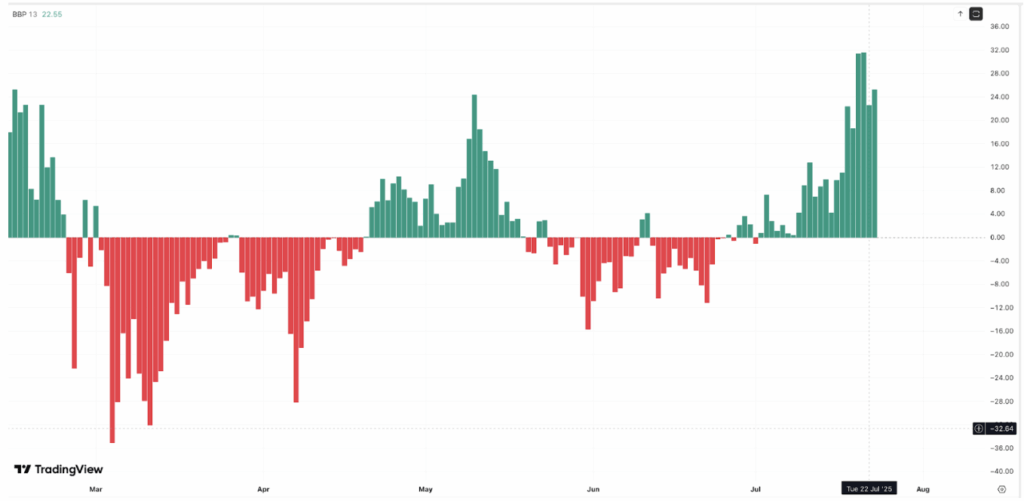

- Litecoin surged 20% in every week, breaking key resistance and signaling bullish momentum with BBP climbing above 22.5.

- Over $33M in lengthy liquidations sit under $116, making the rally fragile if value dips—although $19M in shorts above might gas extra upside.

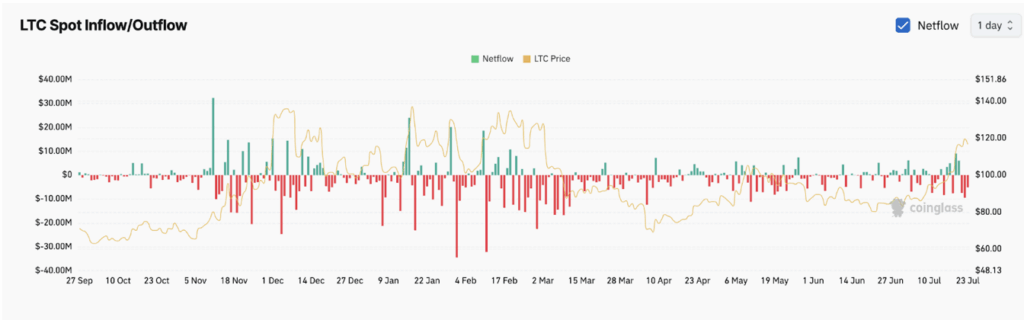

- Change outflows recommend holders are locking up LTC, lowering promote strain and protecting the trail open towards the $147 goal zone.

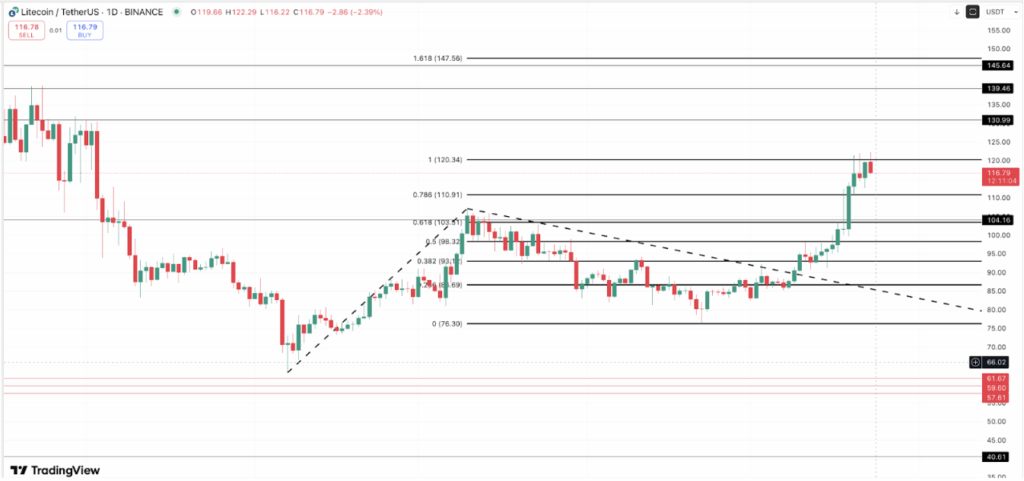

Litecoin kinda got here outta nowhere this week. After hovering beneath $100 for some time, it instantly shot up greater than 20%, cruising previous key resistance and touchdown close to $116. Merchants are watching it once more—and for good purpose. Yeah, it’s nonetheless manner off from its all-time excessive (over 70% under it), however momentum? It’s constructing. And if the rally holds, we might be staring down a push towards $147. Not a nasty transfer.

Bulls Are Taking Cost—And The Charts Again It Up

One of many largest indicators that this isn’t only a fluke got here from the Bull-Bear Energy (BBP) indicator. It mainly tells us who’s within the driver’s seat—patrons or sellers. When it’s crimson, sellers are calling the pictures. However as soon as it flips inexperienced? That’s bulls exhibiting muscle.

Earlier this month, BBP flipped inexperienced and has been climbing steadily ever since. It simply handed 22.5—a reasonably strong stage—which suggests patrons have taken over, they usually’re not letting up.

BBP rising with value motion? That’s what you wanna see in case you’re hoping for follow-through. It means this isn’t simply short-term noise. The power is actual.

$33 Million in Liquidation Threat—Watch Your Step

Right here’s the place it will get kinda sketchy. The liquidation map is flashing some warning lights. LTC’s received about $33 million in lengthy positions hanging proper under the present value. If Litecoin dips even a bit, over-leveraged merchants—particularly these sitting on 25x or 50x bets—might get wiped.

That triggers a sequence response. Extra liquidations, extra compelled promoting… and growth, an extended squeeze kicks in.

Nonetheless, it’s not all doom. There’s additionally about $19 million in shorts ready above the present vary. If LTC climbs towards $120 or $125, it might set off quick liquidations—aka a mini rally gas pump.

Backside line: market’s bullish, but it surely’s additionally kinda heavy with leverage. Clean climb? Nice. Sharp transfer the flawed manner? Might get messy.

Outflows Are Choosing Up—And That’s a Good Factor

Examine this—over the previous few classes, Litecoin noticed about $5.12 million circulation out of exchanges. That’s not folks promoting, it’s the other. When cash go away exchanges, they’re often headed to chilly storage or perhaps DeFi apps. It’s an indication that holders aren’t seeking to dump anytime quickly.

Much less LTC sitting on exchanges = much less promote strain. And that’s good for value motion. So yeah, netflows turning unfavourable may look bearish on paper—however in actuality, it’s a sneaky bullish signal.

Can Litecoin Hit $147 Subsequent?

As of now, LTC’s flirting with the $120 zone. That’s a strong resistance stage. But when it breaks via and sticks the touchdown, the following large goal sits up on the $147.56 mark—that’s the 1.618 Fib extension, and it’d be a 27% transfer from right here.

Worth already smashed via $110 and cleared the $103 space, which was the Fib 0.786 line. Subsequent ranges? $130, $139, after which the $147-$148 area. If momentum stays scorching, there’s not a number of provide overhead to sluggish it down.

Nonetheless, it’s not all clear skies. If LTC drops beneath $110 once more, that’s your first crimson flag. Under $104? That’s when bulls may begin sweating. A dip previous that may most likely put us proper again into correction mode.