Solana worth lately surged previous the $200 mark however has since corrected. It now trades round $185, down over 6% day-on-day. Very like Solana-based meme cash, Solana’s core token additionally seems to be in a short-term cooldown part.

However is that this only a wholesome dip earlier than a bounce? Or are deeper losses brewing? On-chain exercise and key technical zones inform a narrative of a powerful help cluster slightly below, hinting {that a} reversal may not be far off.

New Wallets Are Nonetheless Exhibiting Up

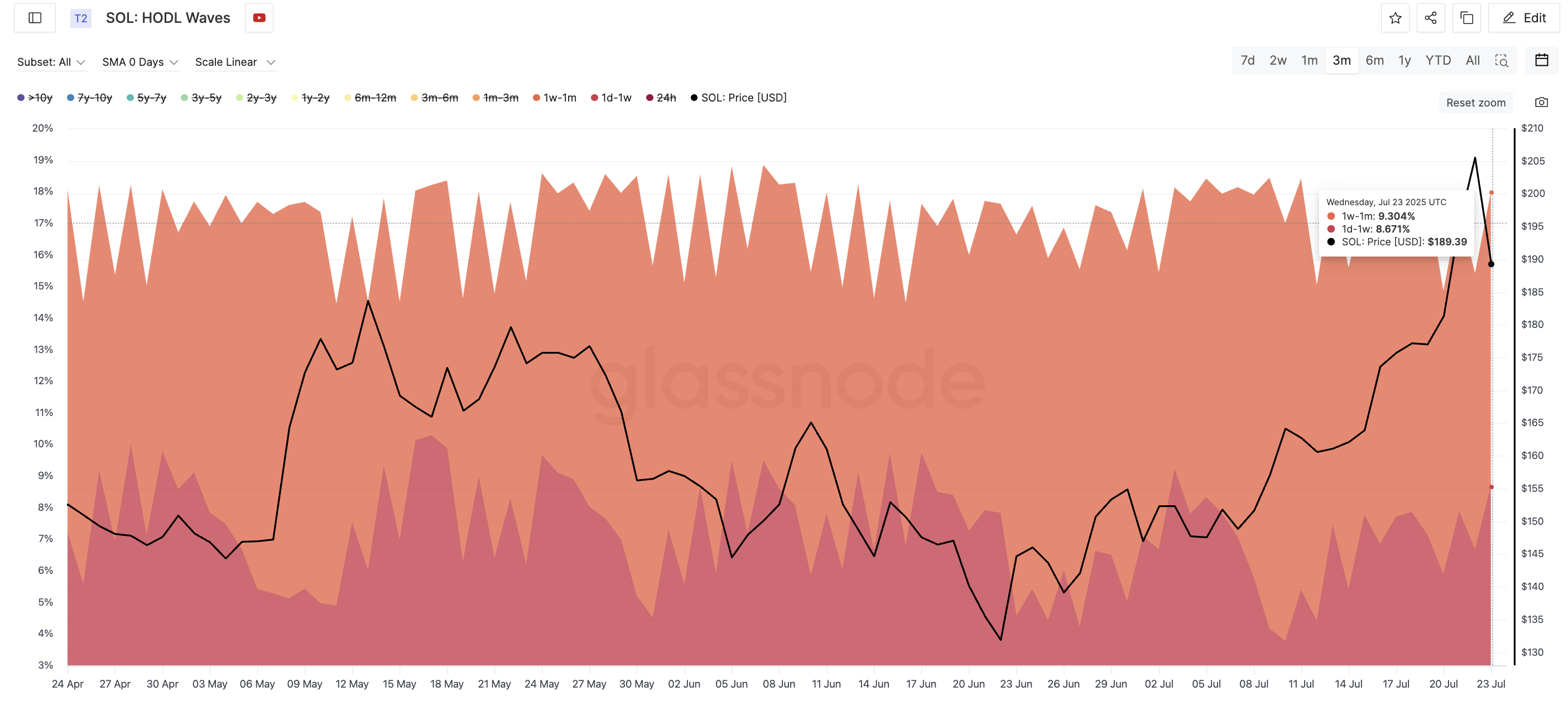

Regardless of the dip, short-term holders usually are not bailing; they’re coming into. The three-month HODL Waves chart exhibits a spike within the “1 day to 1 week” pockets band, suggesting that new consumers are accumulating Solana.

Each key short-term HODL bands have elevated in the course of the current dip:

- 1-day to 1-week wallets jumped from 6.67% to eight.67%, a 30% improve

- 1-week to 1-month wallets rose from 8.73% to 9.3%, a couple of 6.5% improve

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

This spike is necessary as a result of it mirrors a earlier pattern from Could, when Solana noticed a worth dip adopted by a rise on this identical short-term pockets band. Again then, the dip finally reversed. An identical rise now hints at rising purchaser conviction, whilst worth cools.

In brief, wallets holding Solana for lower than per week are rising, not exiting. That’s usually a bullish signal throughout corrections.

HODL Waves measure the distribution of cash by age of holding. An increase in youthful bands means new consumers are coming into the market.

Assist Cluster: $175 to $180 Zone Stays Intact

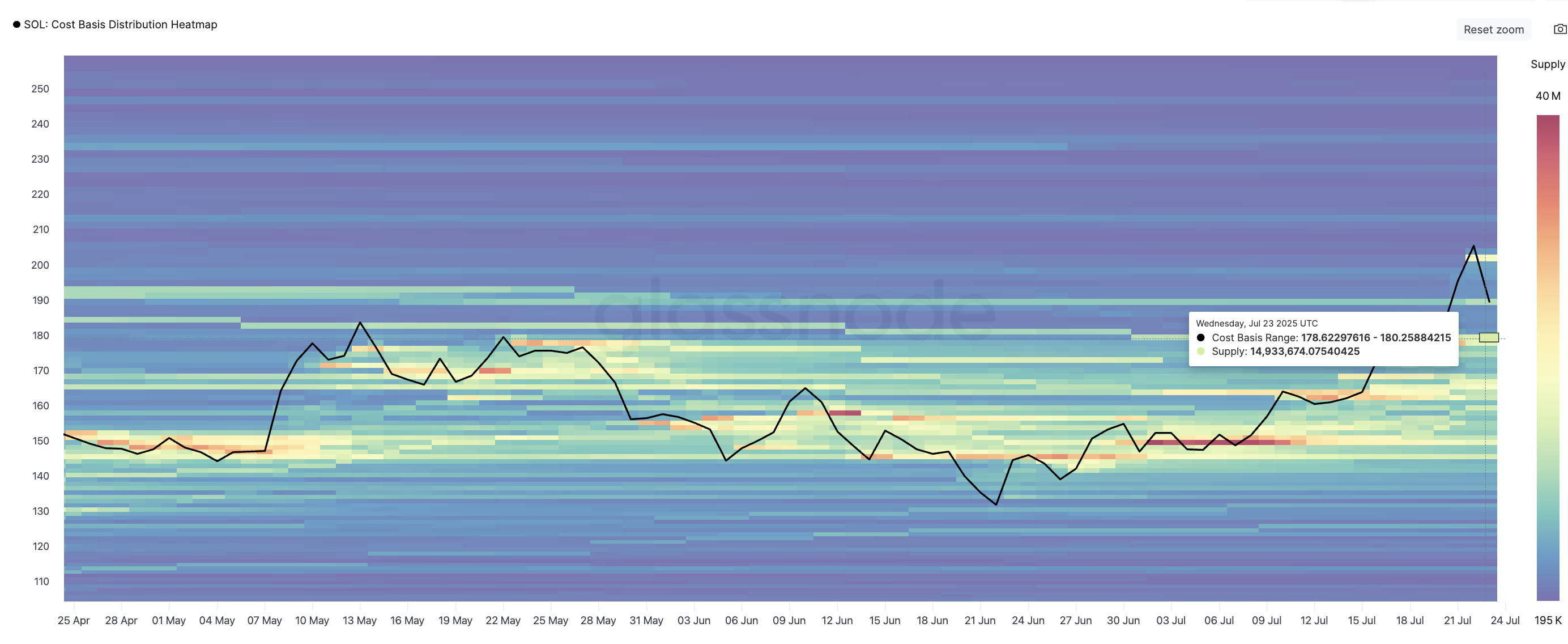

The following factor to look at is whether or not Solana holds its present help ranges. The Value Foundation Heatmap exhibits a dense cluster of pockets accumulation between $175 and $180, one of many strongest zones since April. That is the place many merchants purchased in and are more likely to defend their positions. The entire provide inside this zone provides as much as 38,964,258 SOL.

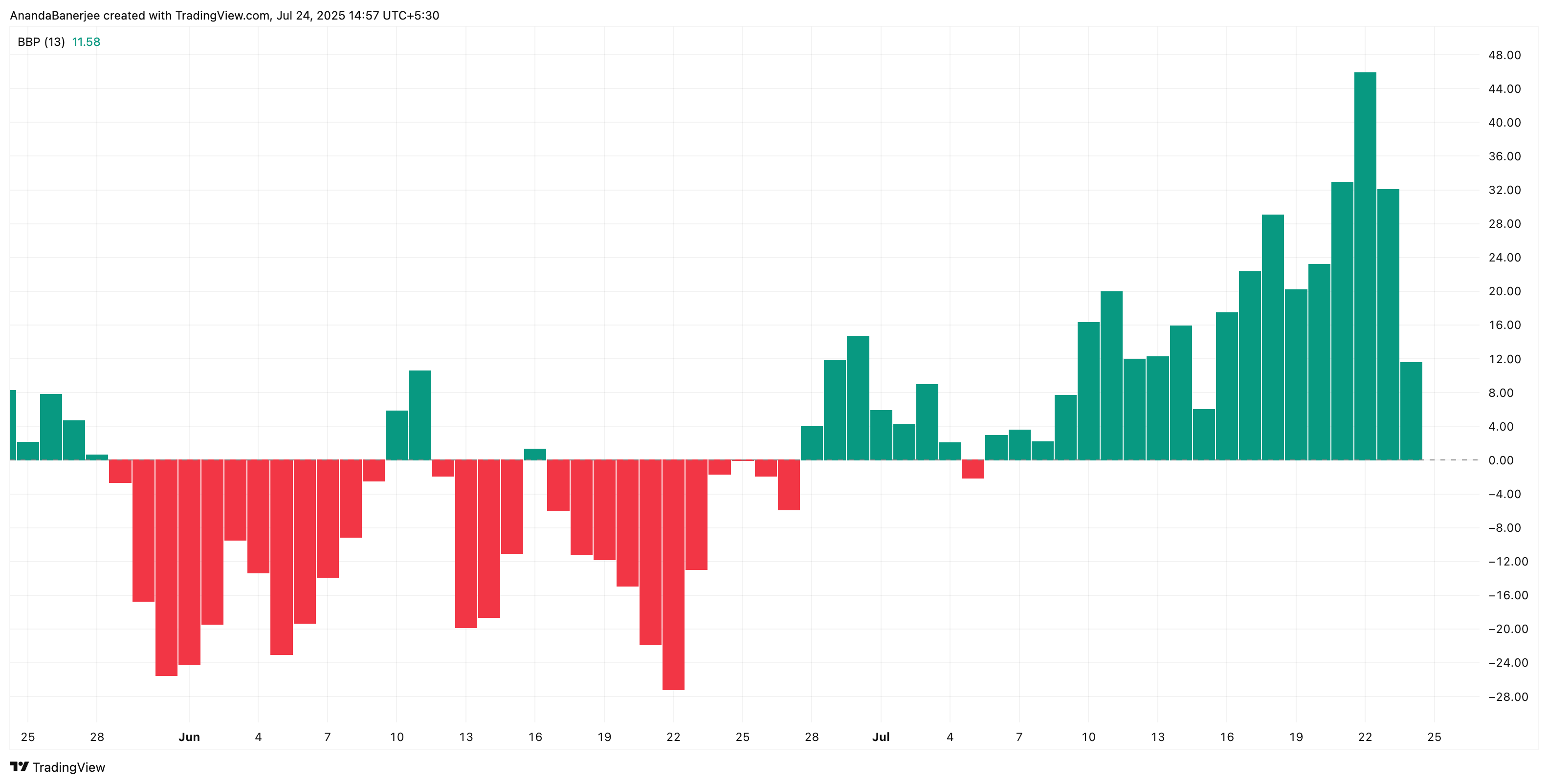

On the identical time, the Bull Bear Energy Index nonetheless favors the bulls. Whereas the indicator has cooled barely, consumers are nonetheless outpacing sellers. That’s a key clue that the dip hasn’t flipped sentiment but. And that the bulls may simply be capable of help the value vary on the heatmap.

This mix: sturdy help in the associated fee foundation zone and bulls sustaining management, factors to a possible bounce round $175, even when the value dips that low. A drop to that stage would solely be a 5.4% transfer from present costs. Except this vary breaks down laborious, a fast reversal may very well be on the playing cards.

The Value Foundation Heatmap visualizes the place nearly all of tokens have been acquired. Bull-Bear Energy gauges who has extra management within the present pattern: consumers or sellers. And the Bull Bear Energy Index measures the energy distinction between consumers (bulls) and sellers (bears) to point out who’s at present in charge of worth momentum.

Solana Worth Breaks Assist However Doesn’t Look Weak, But!

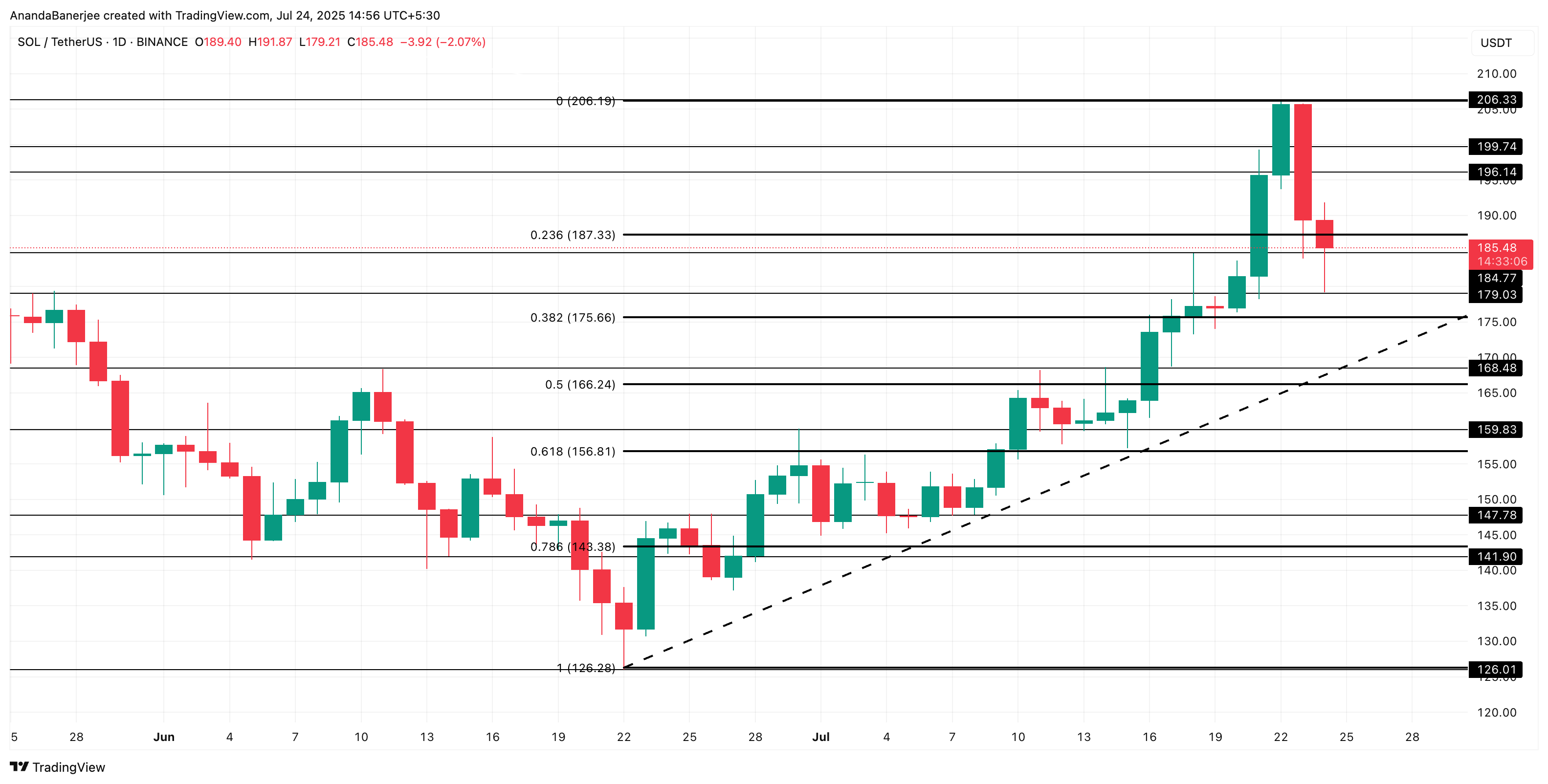

From a technical perspective, the Solana worth is at present testing the 0.236 Fibonacci retracement stage at $187, based mostly on its June low of $126 and July excessive of $206. Whereas the extent was breached on the time of writing, the SOL worth appears to be making an attempt laborious to reclaim the identical.

The following technical help lies at $184. If it fails to carry right here, the subsequent sturdy help sits at $175, which aligns with the start line of the associated fee foundation cluster.

This creates a confluence zone between $175 and $180, making it the important thing stage to look at. A bounce right here might hold the bullish construction alive. However a breakdown under $175 may set off sharper losses towards $166 and under.

Disclaimer

In step with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.