Key Takeaways

SHIB sees whale accumulation and declining change reserves, signaling long-term confidence. Rising transaction exercise and reset Open Curiosity recommend a possible breakout if help holds and bullish momentum returns.

A whopping 5 trillion Shiba Inu [SHIB], price practically $70 million, was not too long ago transferred from Coinbase Institutional to an unknown pockets.

This large transaction has stirred hypothesis about whale exercise and long-term investor positioning.

On the time of writing, SHIB was buying and selling at $0.00001311 after plummeting 12.87% within the final 24 hours. Massive-scale institutional outflows like this usually indicate strategic accumulation, not short-term dumping.

Subsequently, this motion might mirror rising confidence in SHIB’s future upside. Nonetheless, market members await affirmation from broader on-chain and technical indicators earlier than betting on sustained bullish momentum.

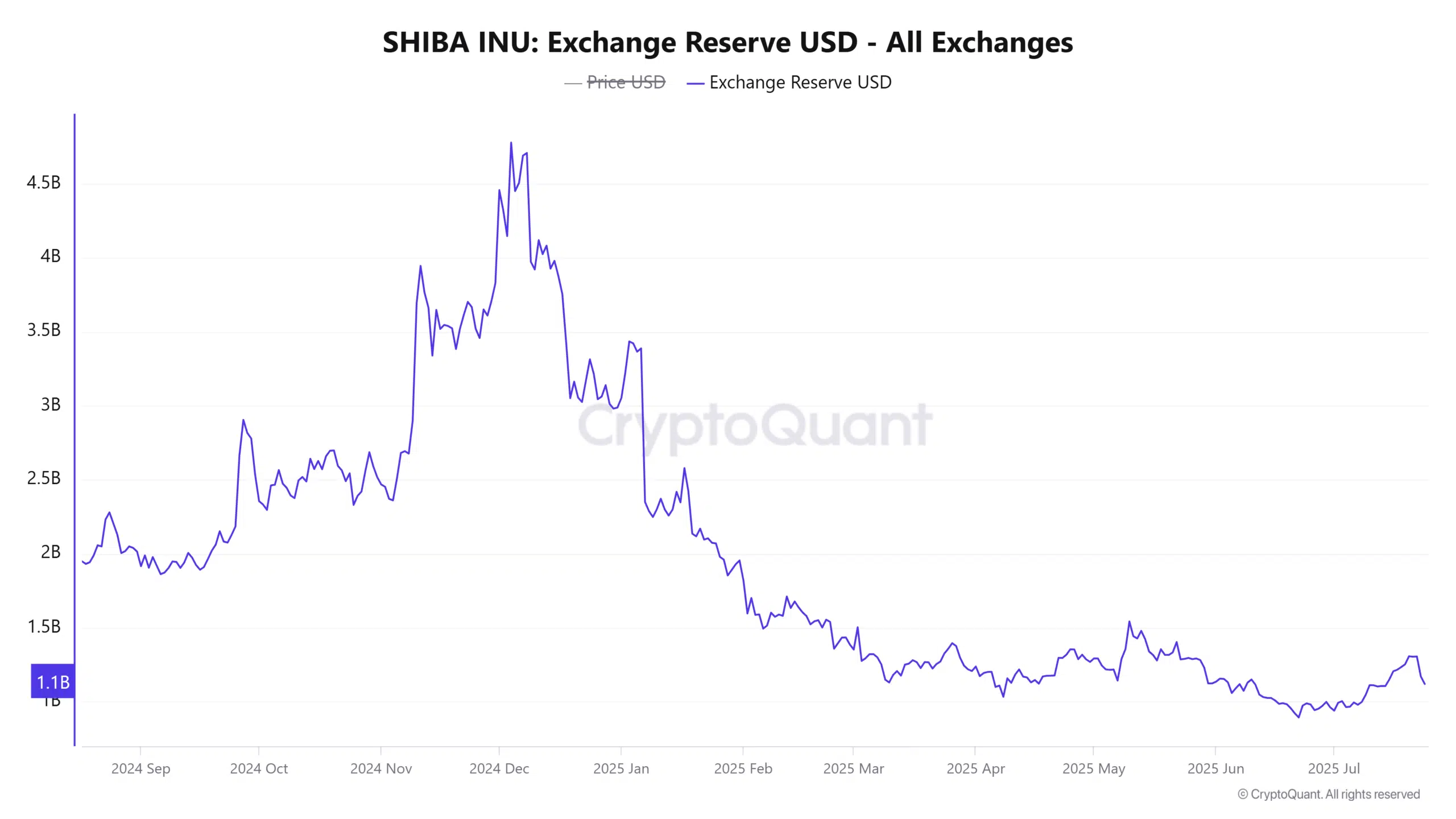

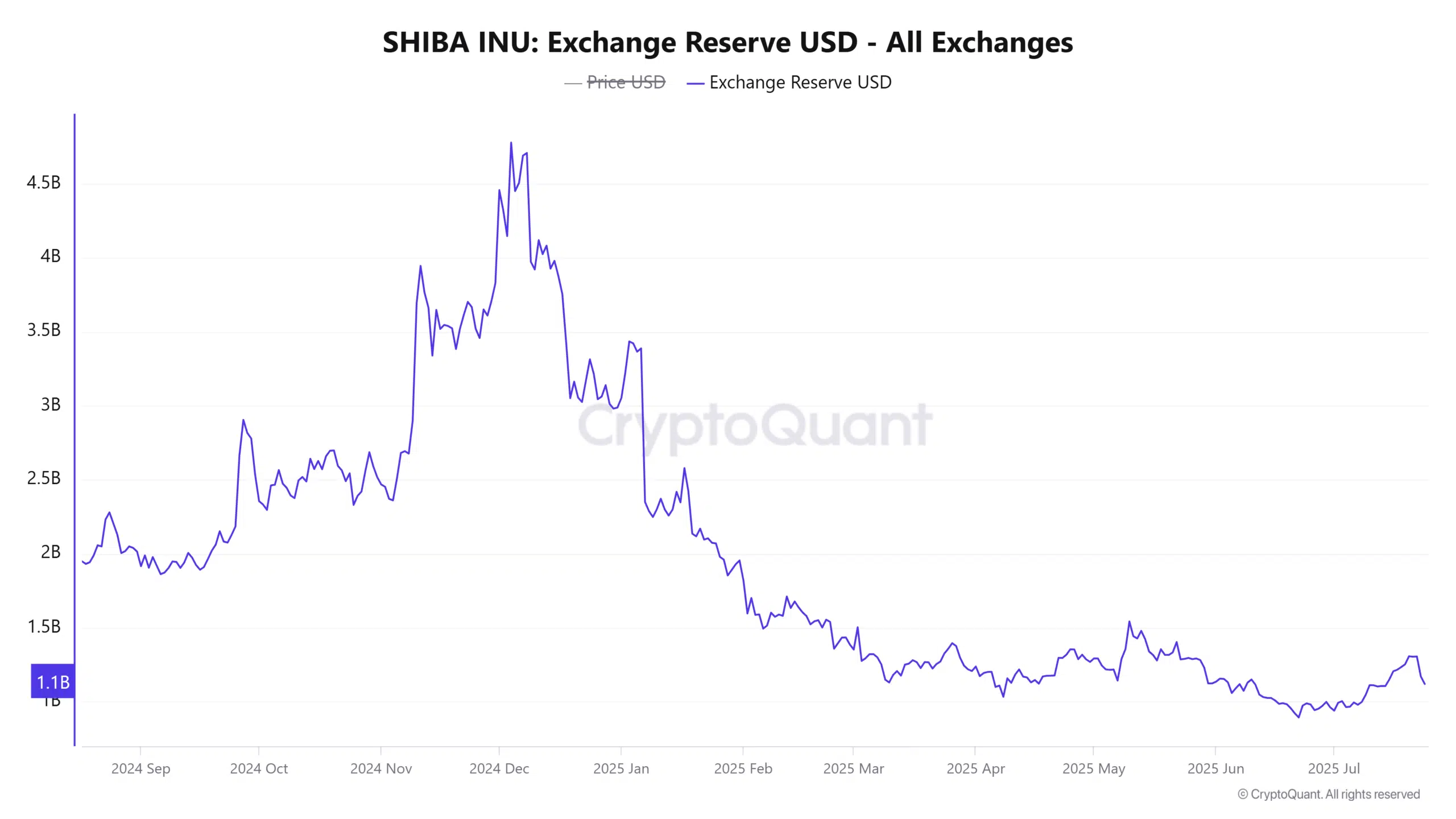

Why are SHIB reserves on exchanges declining regardless of value uncertainty?

The overall worth of SHIB held on exchanges has dropped by 10.74%, now sitting at $1.15 billion. This decline in Alternate Reserves usually alerts lowered sell-side stress and elevated holding conviction amongst traders.

As extra tokens transfer to self-custody, the obtainable provide for rapid buying and selling shrinks, doubtlessly laying the groundwork for value appreciation.

Furthermore, this development aligns with the latest whale withdrawal from Coinbase.

Whereas the worth stays beneath key resistance ranges, the continued drop in reserves means that many holders are making ready for longer-term good points somewhat than short-term exits.

Supply: CryptoQuant

Can SHIB’s rising transaction exercise validate renewed investor curiosity?

Transaction exercise throughout all worth bands has surged considerably over the long run. Small retail transactions between $1 and $100 grew over 57%, whereas high-value transactions within the $1M–$10M vary rose by a staggering 750%, at press time.

This constant improve throughout segments highlights increasing engagement from each retail and whales. Though present value motion seems muted, these on-chain metrics sign sturdy foundational progress.

Subsequently, SHIB’s community is witnessing more healthy distribution and broader utilization, which might help a value breakout if macro and technical circumstances align favorably within the close to time period.

Supply: IntoTheBlock

Does plunging Open Curiosity mirror fading dealer conviction?

Open Curiosity in SHIB’s Futures market has declined by 26.22%, falling to $228.45 million.

This steep drop means that many merchants are pulling again from speculative positions, seemingly on account of latest volatility or uncertainty about SHIB’s near-term path.

Whereas this discount might initially appear bearish, it additionally implies a reset in extreme leverage and will pave the way in which for extra steady market circumstances.

If recent momentum returns, this cleaner slate might allow extra sustainable value actions with out the burden of over-leveraged longs or shorts.

Supply: CoinGlass

Will SHIB maintain key help or revisit decrease ranges?

SHIB’s latest pullback has introduced it to a decent buying and selling vary, between the $0.00001600 resistance and the $0.00001313 help zone.

After rejecting the higher vary, the worth has retraced and now assessments the decrease certain. The RSI stood at 48.54, at press time, indicating impartial momentum with no rapid indicators of both bullish or bearish dominance.

Nevertheless, if patrons defend this help degree and push towards $0.00001600 once more, a breakout towards $0.00001772 turns into believable.

Conversely, failure to carry might expose SHIB to deeper losses close to earlier demand zones.

Supply: TradingView

Is SHIB making ready for a significant breakout?

Given the continued whale accumulation, falling change reserves, and rising on-chain engagement, SHIB’s outlook seems cautiously optimistic.

The sharp decline in Open Curiosity has reset the speculative panorama, doubtlessly decreasing volatility and enabling clearer directional strikes.

If bulls defend present help and regain momentum, a breakout above $0.00001600 might validate bullish continuation. Subsequently, SHIB may be positioning for a decisive transfer—traders ought to monitor upcoming reactions intently.