Key Takeaways

- Solana was not the one large-cap crypto asset witnessing a large worth drop. Nevertheless, Solana might be good for purchasing proper now. Do you have to await a bullish worth response, or bid SOL instantly?

Solana [SOL] reached a five-month excessive on Tuesday, the twenty second of July.

It climbed to a excessive of $206.3 however has since retraced 11.2% to commerce at $183.3 on the time of writing. This pullback was not restricted to Solana however unfold throughout the altcoin market.

The altcoin market cap, of which Ethereum [ETH] was a large portion, has shed 7.93% since Tuesday’s excessive. In the meantime, Bitcoin [BTC] has been comparatively regular, with a 2.1% decline.

Can Solana start to recuperate quickly, or will the pullback ship costs reeling additional down?

The Solana worth prediction for the approaching days and weeks

Supply: SOL/USDT on TradingView

The value motion on the 1-day chart was strongly bullish. The value had damaged out previous the excessive at $187.7 from Might. The bearish order block set in Might appeared to have been flipped to a bullish one.

Marked in cyan, this demand zone from $174 to $183 is anticipated to behave as assist.

Moreover, the truthful worth hole left behind on the twenty first of July, has additionally been stuffed. These two had some overlap on the value chart, reinforcing the significance of this space.

The technical indicators additionally leaned bullish. The Supertrend indicator signaled “purchase”, and the CMF was properly above +0.05.

Its studying of +0.28 conveyed intense shopping for stress in latest days. The RSI had dropped from 82.6 to 59.4 in a few days, however the momentum remained bullish.

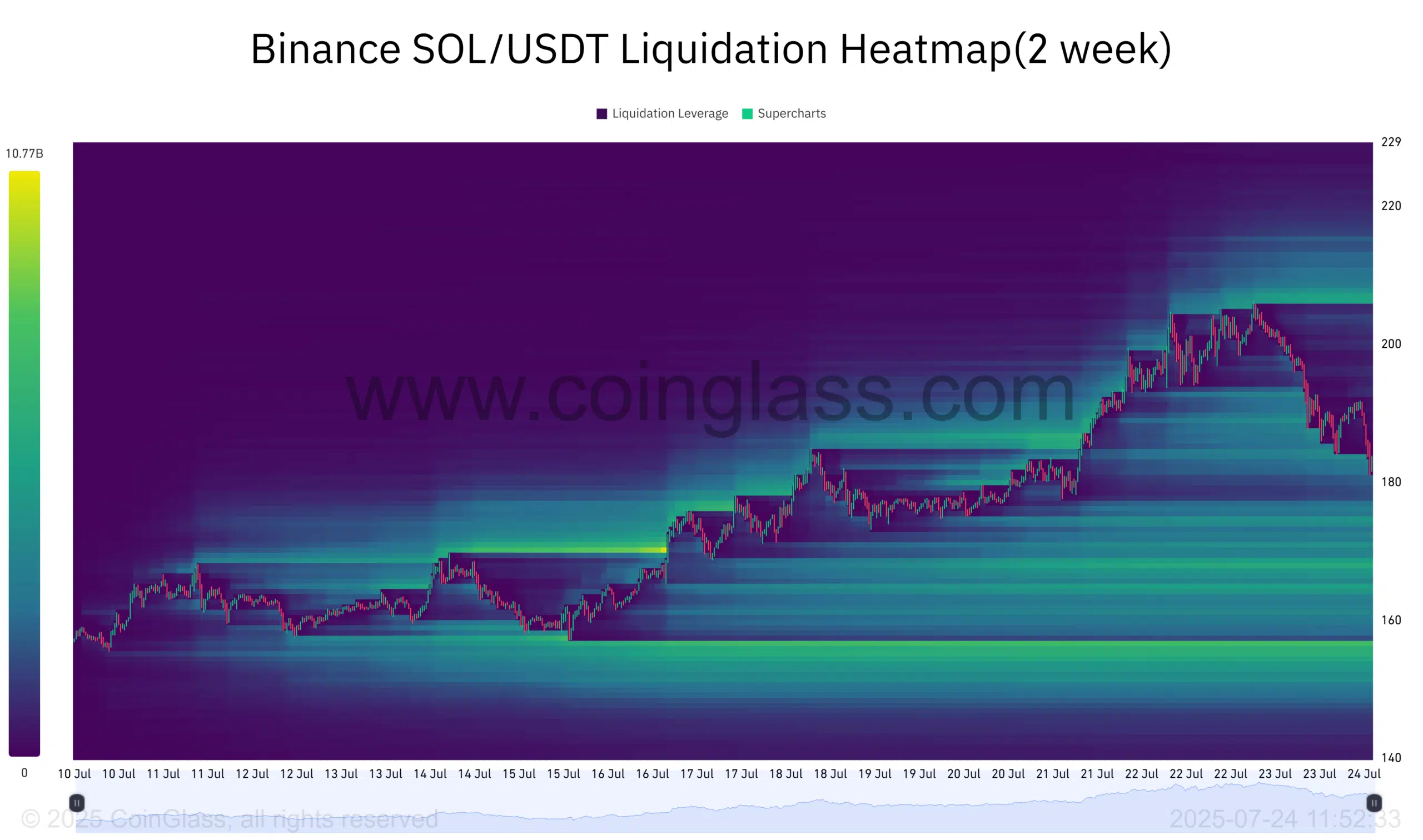

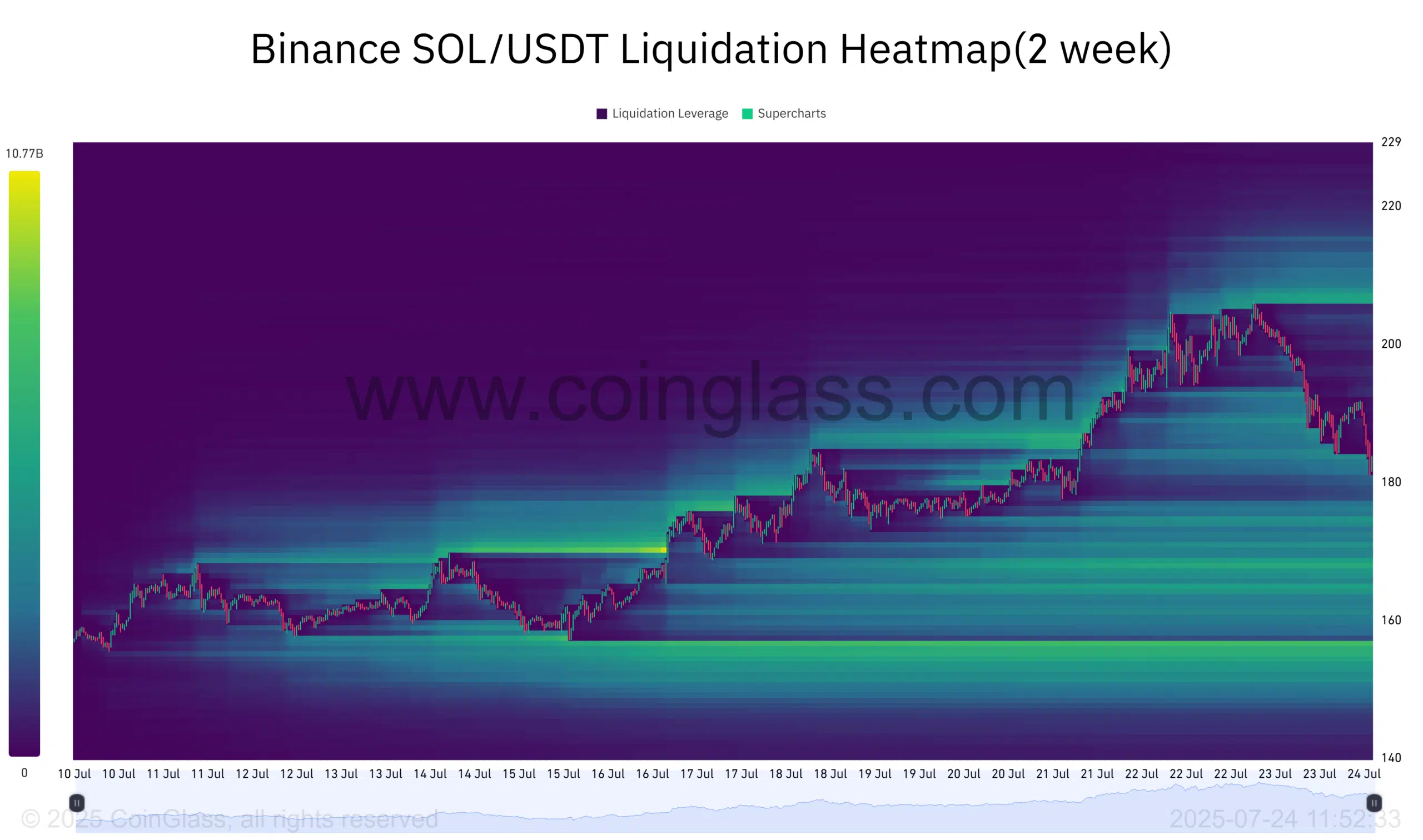

Supply: CoinGlass

The two-week liquidation heatmap confirmed that the $183 space was a key liquidity cluster. The value motion in latest hours noticed this space swept, which was an early signal that Solana may be prepared for a development reversal.

Nevertheless, there was one other pocket of liquidity within the $168 to $173 space. A transfer beneath $181.5 would sign a deeper short-term dip to $168 was seemingly over the subsequent few days.

Within the subsequent few weeks, the Solana worth prediction is strongly bullish. The $220 and $260 resistance ranges are the subsequent targets. Rising demand and bullish conviction on social media may gasoline the subsequent rally.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion