Welcome to the Asia Pacific Morning Temporary—your important digest of in a single day crypto developments shaping regional markets and world sentiment. Seize a inexperienced tea and watch this area:

GENIUS Act drives $4 billion stablecoin inflows. Christie’s launches crypto actual property division whereas Korean asset managers retreat from Bitcoin ETF plans amid regulatory issues. In the meantime, Injective tokenizes fairness stakes, signaling institutional blockchain adoption acceleration.

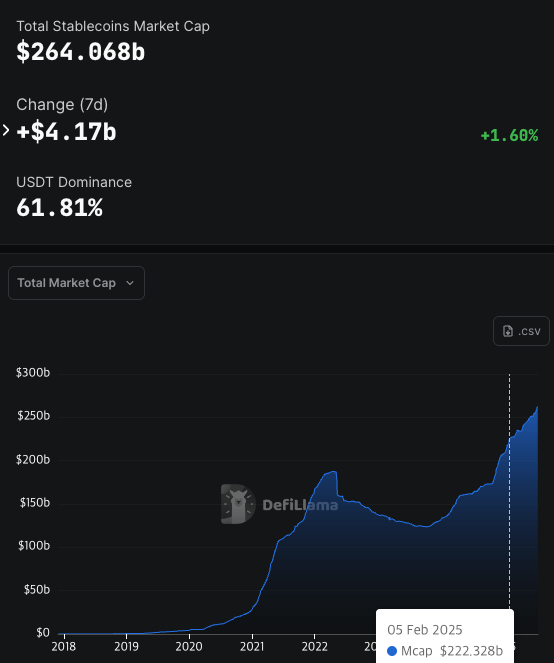

$4 Billion Flows Into Stablecoins Following GENIUS Act Passage

Stablecoin markets captured $4 billion in capital inflows inside one week of the GENIUS Act’s closing passage, in keeping with DeFiLlama information. Whole stablecoin market capitalization surpassed $264 billion, representing 26.9% development since January.

Company stablecoin curiosity accelerated post-legislation. Anchorage Digital partnered with Ethena Labs, launching USDtb underneath federal compliance requirements. WisdomTree launched the USDW stablecoin concentrating on institutional adoption.

Main banking establishments sign strategic entry plans. Financial institution of America CEO Brian Moynihan confirmed dollar-pegged stablecoin growth following regulatory readability. JPMorgan and Citigroup initiated preliminary stablecoin preparation frameworks this month.

Christie’s Worldwide Actual Property Launches Devoted Crypto Division

Christie’s Worldwide Actual Property has established the primary main brokerage crypto division, in keeping with The New York Occasions. The luxurious agency created specialised groups of attorneys, analysts, and crypto specialists. CEO Aaron Kirman launched the division after closing a number of high-value cryptocurrency transactions.

The transfer follows a $65 million Beverly Hills property sale utilizing digital foreign money. Kirman’s portfolio now consists of over $1 billion value of crypto-accepting properties. Notable listings embrace La Fin mansion at $118 million and Invisible Home at $17.95 million.

Current regulatory developments assist crypto actual property adoption. President Trump signed the GENIUS Act, establishing stablecoin federal guidelines. The Home handed the Readability Act, offering trade regulatory safety.

Cryptocurrency provides enhanced purchaser anonymity in comparison with conventional LLC buildings. Fannie Mae and Freddie Mac now think about crypto investments in mortgage functions. Kirman tasks cryptocurrency will comprise one-third of residential transactions inside 5 years.

Korean Asset Managers Withdraw Bitcoin ETF Plans Amid Regulatory Pushback

Main South Korean asset administration corporations deserted Bitcoin funding fund plans by way of regulatory sandboxes, in keeping with an area media report. Samsung Asset Administration, Mirae Asset International Investments, and KB Asset Administration explored Bitcoin-focused allocation funds utilizing innovation finance exemptions.

The corporations sought non permanent regulatory reduction to incorporate digital property as underlying investments. Present capital market legal guidelines prohibit cryptocurrency as a fund base asset. Monetary authorities offered unfavorable suggestions throughout preliminary consultations, prompting voluntary withdrawals.

Trade sources counsel the try geared toward establishing precedent for future crypto ETF introductions. All three corporations confirmed no formal functions have been submitted.

The pushback displays issues about coverage disruption amid pending Digital Asset Innovation Act laws. Authorities emphasised sustaining procedural integrity whereas a complete crypto framework growth proceeds.

This strategic retreat highlights institutional warning in navigating evolving regulatory landscapes. Officers count on systematic digital asset product launches following legislative completion, probably by the second quarter of 2025, signaling Korea’s measured strategy to crypto market integration.

Injective Protocol Tokenizes SharkLink Gaming Fairness Stakes

Layer-1 blockchain Injective launched its Digital Asset Treasury (DAT) platform, tokenizing shares of Ethereum funding agency SharkLink Gaming as its inaugural providing. The tokenized fairness trades underneath the image ‘$SBET’ on Injective’s on-chain infrastructure with real-time capabilities.

SharkLink Gaming ranks because the world’s second-largest company Ethereum holder in keeping with Strategic Ethereum Reserve information. The tokenization represents Injective’s technique to bridge conventional monetary markets with decentralized ecosystems.

Not like standard asset wrapping mechanisms, DAT-based tokenization incorporates governance rights and multi-chain liquidity integration alongside buying and selling performance. The platform permits 24-hour steady buying and selling, establishing new liquidity requirements for equity-backed digital property.

This growth indicators increasing institutional adoption of blockchain-native monetary devices, demonstrating sensible functions for conventional asset digitization inside DeFi frameworks.

Shigeki Mori contributed.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.