HBAR’s worth rally may be shedding steam. Regardless of a powerful month-to-month acquire of 58.77%, HBAR has erased all its weekly income and is down over 8% up to now 24 hours.

Whereas this may appear to be a typical cooldown, a better take a look at previous worth habits, short-term chart indicators, and key assist zones suggests deeper ache might be in retailer.

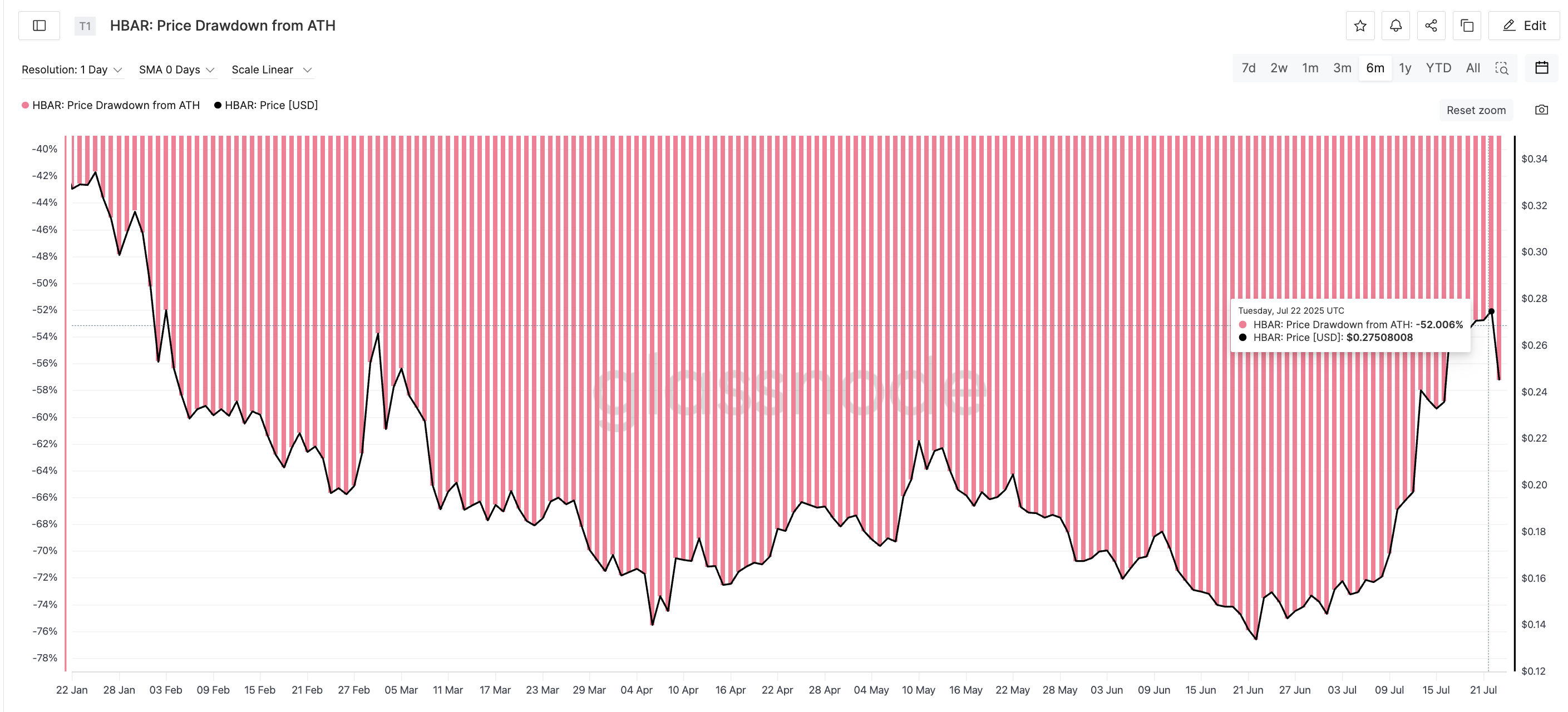

Historic Drawdowns Trace at a Acquainted Revenue-Taking Zone

Why take a look at drawdowns now? As a result of Hedera has entered a zone the place profit-booking traditionally begins. In March 2025, when HBAR had rallied to $0.26, the drawdown from its all-time excessive was round 53.74%. That’s precisely when a 47% crash adopted, dragging the token right down to $0.14 in only a month.

Quick ahead to July 22, and the drawdown stood at 52%, with HBAR buying and selling close to $0.27. Since then, the correction has already begun; an indication that merchants could once more be taking income on this 50–60% drawdown zone.

Even when this performs out like March however with a lighter contact (courtesy of the altcoin season narrative), a 40% drop from $0.27 places the HBAR worth round $0.16. Curiously, this traces up with a key assist degree. Extra on this later within the evaluation!

In brief, historic drawdown zones are the place merchants have sometimes hit the brakes. And that sample appears to be repeating.

ATH drawdown measures how far a token’s worth has fallen from its all-time excessive. It helps establish frequent zones the place merchants lock in income.

Loss of life Cross on the 4-Hour Chart Could Speed up the HBAR Worth Drop

Zooming into the 4-hour chart reveals one other bearish warning. The 20-period EMA (exponential shifting common) or the pink line is closing in on the 50-period EMA (orange line), a traditional bearish crossover often called a “dying cross.” Whereas it hasn’t triggered but, the setup is sort of full.

We use the 4-hour chart right here as a result of it typically picks up pattern shifts earlier than the each day timeframe does. This early sign means that momentum is shifting in favor of the bears.

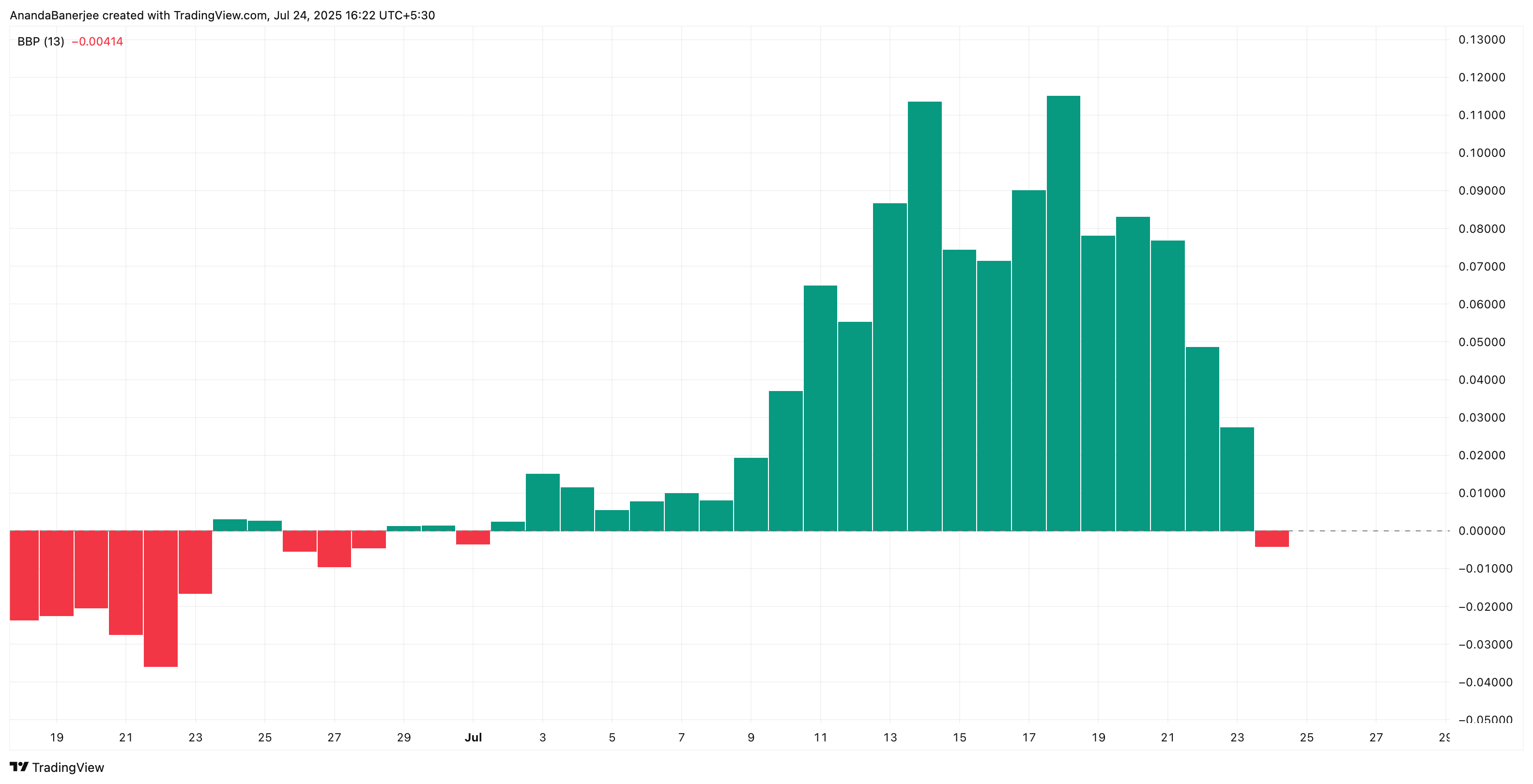

Supporting this view is the Bull Bear Energy Index, which simply flipped adverse. Sellers are gaining floor; a sign that the drop may speed up if bulls fail to step in. If the crossover confirms, led by bears taking management, count on momentum-driven promoting to push costs decrease, particularly with historical past already setting the stage.

Bull Bear Energy measures the energy of consumers vs. sellers. When it turns adverse (pink), it means bears have taken management.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Essential HBAR Worth Help Lies At $0.21

The HBAR worth is at the moment buying and selling round $0.23, teetering simply above the 0.382 Fibonacci retracement degree additionally at $0.23. This line was drawn from the current low of $0.12 to the excessive of $0.29.

If $0.23 breaks, which appears more and more doubtless, the subsequent assist lies at $0.212 (Fib 0.5 degree). Past that, $0.19 and $0.16 develop into crucial ranges to look at; the latter being a 40% drop from the current peak.

Nevertheless, if HBAR manages to reclaim the $0.25 assist (now turned resistance) and the dying crossover doesn’t occur, the bearish speculation may get invalidated.

Disclaimer

In step with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.