Key Takeaways

Chainlink exhibits bullish indicators as whales accumulate, handle exercise rises, and key assist holds. Regardless of cautious derivatives’ knowledge, momentum could drive LINK towards $22–$26 if present traits persist.

Whales have added over 1.60 million Chainlink [LINK] tokens within the final two weeks, signaling rising confidence from giant holders.

This accumulation surge comes as LINK approaches a essential technical juncture, the place worth motion has stalled close to a major assist zone.

This accumulation development mirrors historic setups that preceded rallies, suggesting that institutional conviction could also be constructing forward of a possible breakout.

The mix of strategic whale exercise and key worth ranges makes LINK’s subsequent transfer extremely consequential.

Is Chainlink making ready for a significant rebound after testing key assist?

Following its latest rejection close to the $20.16 mark, LINK has retraced to retest the $17.39–$15.90 assist area.

This zone has traditionally acted as a launchpad for robust recoveries, and present worth motion hints at potential consolidation.

Subsequently, if bulls defend this zone, a bounce towards $22 or increased could unfold. Nevertheless, a breakdown under $15.90 would threaten bullish momentum.

The present retest aligns with the latest accumulation spike, implying sensible cash is betting on a rebound. Merchants ought to look ahead to quantity affirmation and better lows to validate any restoration setup.

Supply: TradingView

Can handle development sign a rising wave of retail curiosity in LINK?

Chainlink’s handle exercise has picked up noticeably, reinforcing bullish undercurrents. Over the previous week, New Addresses jumped by 19.96%, whereas Lively Addresses grew by 8.20%, at press time, suggesting a renewed inflow of customers.

Zero-balance addresses additionally spiked 20.02%, which can mirror pockets creation and onboarding. These traits counsel rising grassroots adoption and mirror a broader curiosity in LINK regardless of the value correction.

When mixed with robust whale exercise, rising handle metrics add a supportive layer to the narrative of accumulation and potential worth restoration.

Supply: IntoTheBlock

Giant transaction knowledge revealed a 7.78% enhance, aligning with the narrative of rising institutional exercise.

These transactions typically sign strategic strikes by entities managing vital capital. The buildup sample, paired with this surge, implies that LINK is gaining traction amongst high-value gamers.

Whereas the value stays under latest highs, the underlying community exercise suggests a buildup section somewhat than distribution. Subsequently, rising whale footprints and large-scale transfers add weight to the bullish thesis.

Do derivatives metrics trace at hidden warning behind bullish sentiment?

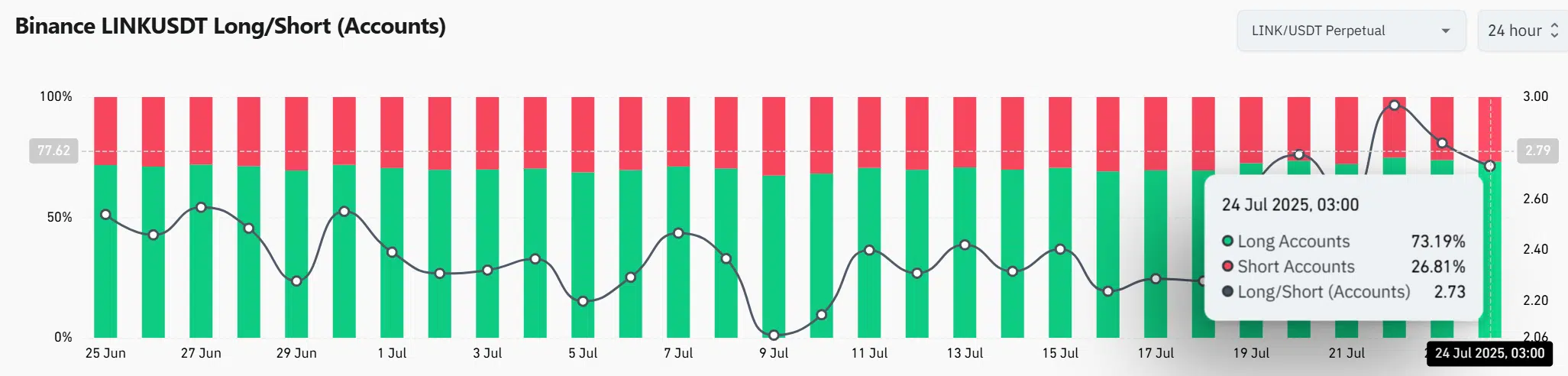

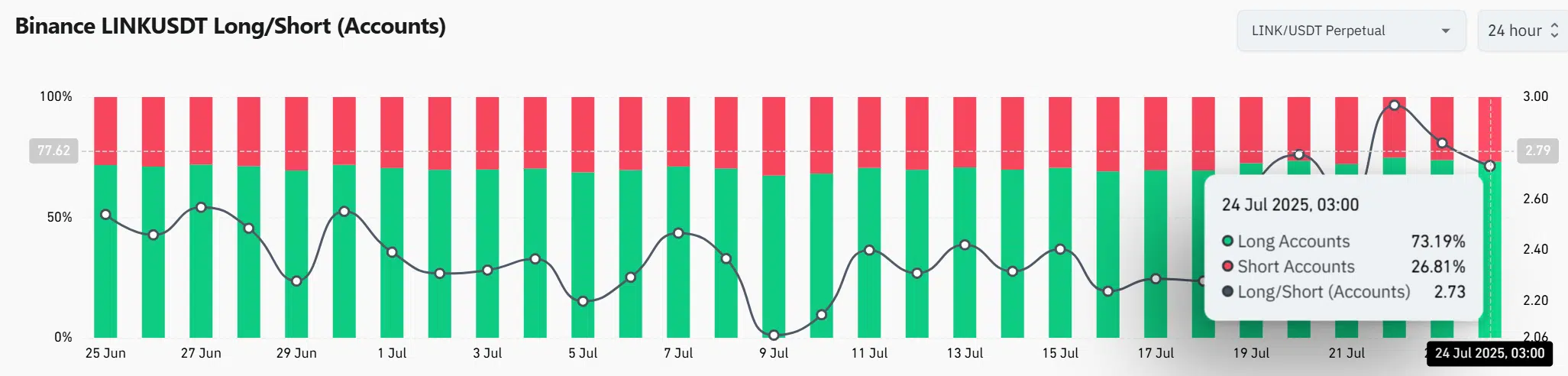

Regardless of the bullish Lengthy/Quick Ratio on Binance—the place lengthy accounts dominate at 73.19%—Open Curiosity (OI) has dropped by 15.11%, falling to $885.49 million, on the time of writing.

This divergence hints at leveraged merchants closing positions, doubtlessly as a consequence of short-term volatility or profit-taking.

Whereas the lengthy bias suggests optimism, falling Open Curiosity raises warning about market conviction. Subsequently, merchants ought to stay watchful, particularly if this sample persists.

If OI rebounds whereas lengthy bias holds, it might sign renewed confidence to assist a breakout.

Supply: CoinGlass

Will accumulation and assist maintain gasoline LINK’s subsequent breakout?

The present metrics counsel that accumulation and assist might gasoline LINK’s subsequent breakout.

Whale exercise and enormous transactions affirm institutional confidence, whereas rising pockets development exhibits retail engagement. If the $15.90–$17.39 assist zone holds, momentum is prone to shift again towards bulls.

Though derivatives knowledge exhibits blended sentiment, the broader alerts favor an upside transfer. A profitable protection of assist might ignite a rally towards $22 and doubtlessly $26.