Key Insights:

- Ethereum might outperform Bitcoin within the subsequent 3–6 months, based on Galaxy CEO Mike Novogratz.

- Large ETH purchases by listed corporations like BitMine and SharpLink present rising company adoption.

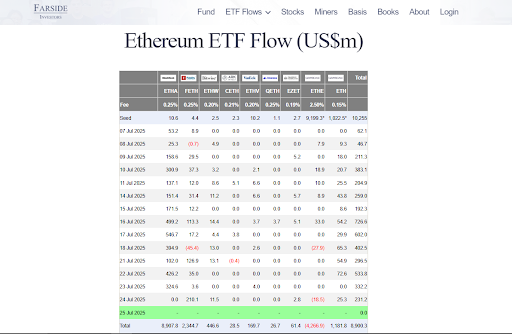

- Over $726 million flowed into Ethereum ETFs in a single day, which set a brand new report for inflows.

Ethereum (ETH) is gaining critical floor. In keeping with Galaxy Digital CEO Mike Novogratz, it could quickly beat Bitcoin in efficiency. Novogratz lately sat via an interview with CNBC, during which he pointed to institutional curiosity.

The crypto billionaire talked about this as a significant component that would drive ETH to check the $4,000 stage, and even past, over the following three to 6 months.

Ethereum’s $4,000 Breakout in Sight

Novogratz identified that Ethereum’s provide, particularly with the low circulating provide, is setting the stage for a worth surge. “There’s not quite a lot of provide of ETH,” he stated, suggesting that demand from main buyers might result in a provide shock.

🚀 Galaxy CEO Mike Novogratz:

“I feel $ETH in all probability has an opportunity to outperform Bitcoin within the subsequent 3 to six months.” 💡#Ethereum #Bitcoin #Crypto #ETH #BTC #CryptoNews #Investing pic.twitter.com/r6DALlWdfs— Crypto Information Hunters 🎯 (@CryptoNewsHntrs) July 25, 2025

“If ETH takes out $4,000, it goes into worth discovery,” Novogratz added. On the time of his feedback, Ether was buying and selling at about $3,618, which made the $4,000 goal an 8.5% climb.

Whereas ETH is just not but at its all-time excessive of $4,878 set in 2021, the cryptocurrency has bounced again strongly this 12 months and seems prepared for additional features.

Companies Are Shopping for ETH Like By no means Earlier than

A big a part of Ethereum’s rising momentum comes from company treasuries. Two firms, BitMine Immersion Applied sciences and SharpLink Gaming, have collectively accrued over $3.3 billion in ETH.

Particularly, BitMine is now the largest company Ethereum holder. The corporate has acquired 566,776 ETH, price roughly $2.03 billion at a median worth of $3,643.75 per coin.

SharpLink Gaming has additionally added 360,807 ETH (price about $1.29 billion) to its stability sheet. These purchases mark a brand new section within the institutionalization of Ethereum, and are just like the sooner pattern of Bitcoin adoption by corporations like MicroStrategy.

One other firm, Ether Machine, is even getting ready to go public on the Nasdaq beneath the ticker “ETHM,” with over 400,000 ETH ($1.5 billion) beneath administration at launch.

ETFs Are Pouring Gasoline on the Fireplace

Institutional confidence in Ethereum can be displaying within the efficiency of ETH-based ETFs. Since gaining approval from the U.S. SEC final 12 months, ETH ETFs have seen large curiosity to this point.

In simply someday final week, these funds obtained $726 million in web inflows, which is a record-setting determine. Over the whole week, complete inflows broke above $2.1 billion, in a present of robust demand from conventional finance sectors.

Such ETF exercise not solely strengthens Ethereum’s market efficiency but additionally makes it extra legit within the eyes of buyers and regulators.

Ethereum’s Power Towards Bitcoin Is Rising

Whereas Bitcoin is presently the biggest cryptocurrency by market cap, Ethereum is gaining floor by way of relative energy. The ETH/BTC ratio, which is used to measure Ether’s worth towards Bitcoin, has climbed 36.5% during the last 30 days.

This ratio presently sits at 0.03116, and the continued traction signifies that Ethereum is beginning to lead the market by way of efficiency metrics.

Regardless of this, Novogratz hasn’t written off Bitcoin completely. He believes BTC might attain $150,000 later this 12 months if the bullish narrative holds. That is very true in a macro surroundings with decrease rates of interest. “It seems like we’re destined to go increased,” he stated.