The crypto market has matured dramatically lately, pushed by robust institutional demand, the approval of spot ETFs, and the introduction of pro-crypto laws.

Whereas this maturation has elevated the legitimacy of the trade, it additionally signifies that the crypto market is now not the wild west. The explosive, unbridled rallies of earlier cycles have turn out to be rarer. In previous bull markets, significantly throughout the 2017 and 2021 cycles, even Bitcoin and high altcoins usually delivered 10x to 100x returns.

At the moment, such outsized beneficial properties are tougher to attain. Unsurprisingly, traders are attempting to find avenues to amplify their beneficial properties and high-leverage buying and selling is changing into more and more in style.

A brand new crypto futures buying and selling platform, CoinFutures, caters to this demand by providing quick execution, no-KYC onboarding, and superior danger administration instruments.

100x leverage buying and selling stays a double-edged sword. Whereas it might probably ship explosive returns on small value strikes, it additionally leads to heavy losses and will increase the danger of liquidation.

CoinFutures is provided to deal with the volatility, because of its intuitive interface, clear bust-price calculations, and automatic stop-loss and take-profit settings.

What Is 100x Leverage Crypto Buying and selling?

Crypto futures buying and selling permits merchants to wager on the worth motion of belongings with out proudly owning them immediately. By opening a futures place, merchants can speculate whether or not the worth of a cryptocurrency like Bitcoin will rise or fall.

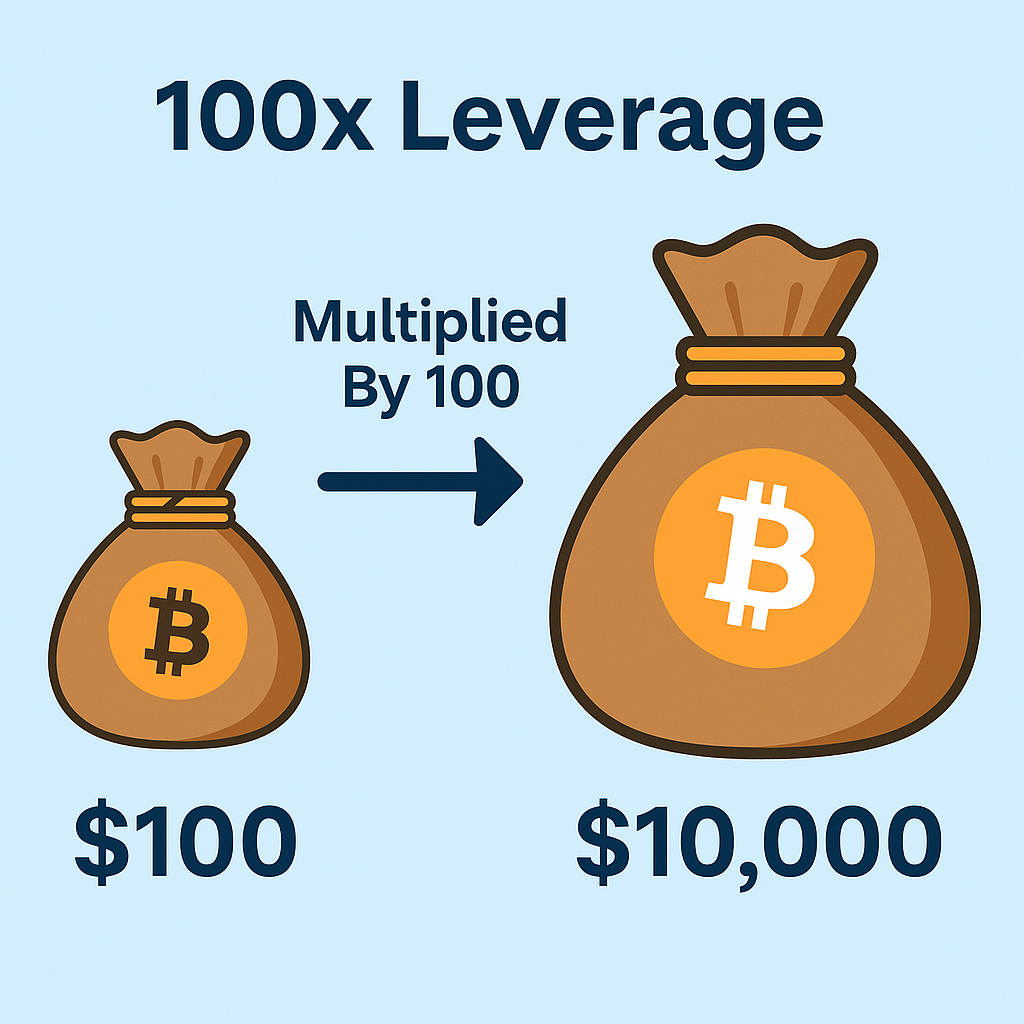

Leverage means borrowing capital to extend the dimensions of a commerce. The full dimension of the place is the same as the margin, which is the investor’s personal funds, multiplied by the leverage. For example, 100x leverage permits a dealer with simply $100 to manage a $10,000 place.

In consequence, traders can earn massive even by betting on large-cap belongings like Bitcoin, that are historically much less risky. It additionally affords small bankroll merchants to seize outsized returns.

For instance, if Bitcoin strikes up by 1%, a 100x leveraged place would ship a 100% return on the preliminary $100 wager. This capacity to extend returns is why excessive leverage appeals to merchants with smaller bankrolls.

Nonetheless, the dangers are equally massive. With 100x leverage, a value motion of simply 1% within the mistaken path would end in all the place being liquidated. Which means that whereas the upside might be explosive, the margin for error is extraordinarily small, making danger administration essential when buying and selling with such excessive leverage.

Methods To Safely Commerce 100x Leverage Crypto

As beforehand indicated, only a 1% value motion within the mistaken path might end result within the place being liquidated.

Which means that 100x leverage must be used just for the very best conviction bets. For example, a transparent breakout with excessive quantity might be excellent for high-leverage buying and selling.

Furthermore, traders ought to make 100x leverage trades utilizing a really small share of their complete capital.

Most significantly, each commerce ought to have tight stop-losses set. A stop-loss is a set value degree the place a commerce mechanically closes to restrict losses and shield the remaining capital. CoinFutures affords a classy stop-loss characteristic, which permits customers to set the worth or loss degree at which the commerce will shut.

Equally, 100x leverage crypto trades are supposed to stay open just for a brief interval. A place being in revenue just isn’t a cause to maintain it open indefinitely.

As soon as the goal is hit, it’s crucial to take income. Likewise, getting engaging returns on one commerce mustn’t result in FOMO on the following, as that is how beneficial properties are sometimes misplaced.

Lastly, traders ought to open 100x trades on low-volatility belongings like Bitcoin, Ethereum and XRP. Their short-term trajectory is barely simpler to wager on, particularly for traders with data of chart patterns, as in comparison with low-cap meme cash.

How To Commerce 100x Leverage Crypto With CoinFutures?

With its simple on-ramp, hassle-free person interface and cutting-edge options, CoinFutures is a superb platform to put safe 100x leverage crypto positions. Right here’s precisely how one can do it.

Step 1: Create an Account and Obtain The App

Register on CoinFutures with simply an e-mail and a username. No KYC or sophisticated kinds are required.

Then, obtain the CoinPoker app. CoinFutures is an offshoot of CoinPoker, which is a high crypto poker model.

Step 2: Add Funds

Deposit crypto like BTC, ETH, USDT, BNB, or SOL, or use fiat cost strategies reminiscent of Apple Pay, Google Pay, or Mastercard. There aren’t any charges for deposits or withdrawals.

Step 3: Choose the Asset

Select from a variety of supported cryptocurrencies, together with Bitcoin, Ethereum, XRP, Solana, Dogecoin, Pepe, and Bonk. As talked about, follow low-volatility belongings if going for top leverage.

Step 4: Decide Up or Down

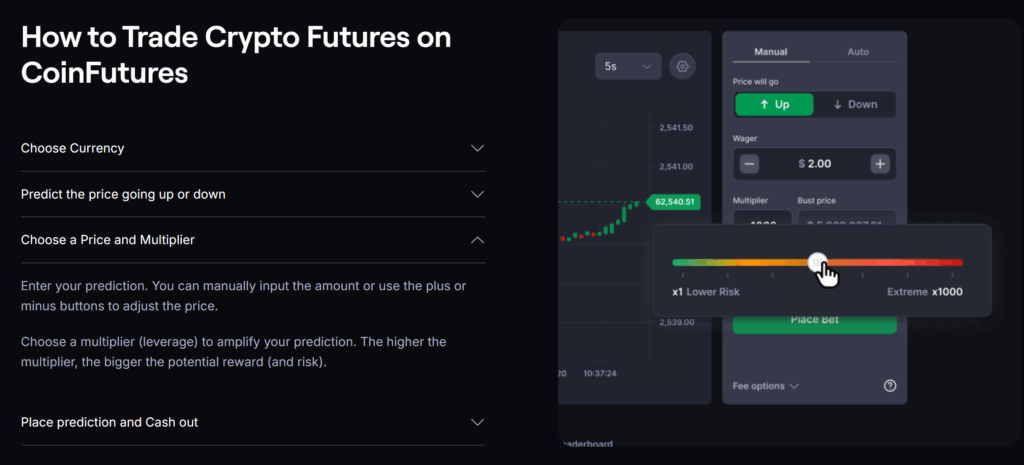

Resolve if the worth will transfer up or down. CoinFutures simplifies buying and selling by eradicating complicated order books.

Step 5: Set Leverage

Alter the leverage slider to 100x (CoinFutures permits as much as 1000x on some belongings). A clear bust value is proven so merchants know precisely the place the place will shut if the market strikes towards them.

Step 6: Handle Threat

Allow Auto Mode so as to add stop-loss and take-profit ranges. This ensures trades are closed mechanically when targets or limits are hit. That is an especially essential step.

Step 7: Verify and Monitor

Place the commerce, watch stay charts, and shut the place manually or let Auto Mode do the work. Money out as soon as the income are secured.

Go to CoinFutures

This text has been supplied by one among our industrial companions and doesn’t replicate Cryptonomist’s opinion. Please remember that our industrial companions could use affiliate packages to generate income by way of the hyperlinks on this text.