Key Takeaways

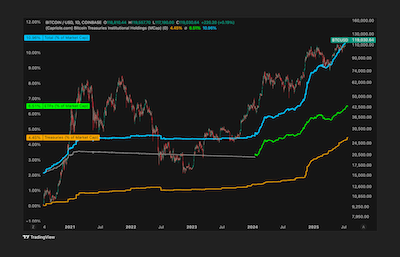

- Establishments now maintain greater than 10% of the entire bitcoin provide, up from 4% in 18 months.

- Each day institutional demand for bitcoin is ten occasions increased than the variety of new cash mined.

- Institutional exercise on exchanges like Coinbase is carefully linked to important bitcoin worth will increase.

Institutional adoption of bitcoin has reached report ranges, with over 10% of the entire provide now held by public corporations and exchange-traded funds (ETFs).

Charles Edwards, CEO of Capriole Investments, highlighted this development on July 24, noting that institutional holdings have climbed from 4% to greater than 10% in simply 18 months.

Information from Bitcoin Treasuries signifies that ETFs at the moment management about 1.62 million BTC, whereas publicly listed corporations maintain roughly 918,000 BTC.

At present costs close to $118,838 per coin, these institutional positions are valued at over $250 billion.

Demand outpaces mining provide

Edwards emphasised the unprecedented charge of accumulation:

The each day share of all Bitcoin in existence that’s being acquired by establishments per day (blue) is at the moment 10X increased than the Bitcoin mining Provide Development Price (purple)! Discover how each time institutional shopping for has exceeded the Provide Development Price, worth went VERTICAL.

This accumulation surge started in 2020, when companies like Technique (previously MicroStrategy) shifted their treasury property into bitcoin.

Since then, extra corporations have adopted go well with, notably throughout the Trump administration.

Correlation with bitcoin worth

Edwards additionally pointed to a robust hyperlink between institutional exercise—particularly buying and selling on Coinbase—and bitcoin’s worth actions.

Traditionally, when institutional buying and selling accounts for 10% to 50% of each day quantity on the change, bitcoin costs have seen sharp will increase.

It’s laborious to not be bullish with the exponential development within the variety of treasury corporations, the quantity of Bitcoin they’re shopping for, and the frequency at which they’re shopping for. … The demand these corporations have for Bitcoin is striping 1000% of the each day Bitcoin provide out of the market daily.