The crypto market is at present within the midst of a robust bull run, and seasoned merchants anticipate that even the massive caps nonetheless have important upside potential within the brief time period.

$200,000 for Bitcoin, $10,000 for Ethereum and $10 for XRP have gotten consensus worth targets.

Unsurprisingly, each good cash merchants in addition to retailers are trying to find avenues to maximise their beneficial properties, and crypto choices buying and selling has emerged as one of many high selections.

Choices buying and selling is already a big a part of the normal monetary markets. With establishments coming into the crypto house through ETFs and treasury performs, crypto choices are seeing explosive progress as effectively.

Nonetheless, choices aren’t at all times the most effective match for crypto’s extremely unstable surroundings, as they’re typically dominated by institutional gamers and contain advanced methods that may overwhelm common retail merchants

Quite the opposite, crypto futures supply a extra simple option to revenue from market swings, with easy lengthy or brief positions and versatile leverage.

CoinFutures, a fast-growing crypto futures platform, is gaining traction amongst retail merchants for its simplicity, instantaneous no-KYC entry, superior instruments, and excessive leverage. On this bull cycle, it might show to be a much more efficient option to seize outsized returns in comparison with advanced crypto choices buying and selling.

What Is Crypto Choices Buying and selling?

Crypto choices buying and selling is a type of derivatives buying and selling the place merchants buy contracts that grant them the proper, however not the duty, to purchase or promote a cryptocurrency at a set worth earlier than a specified expiration date.

These contracts are generally used on property like Bitcoin, Ethereum, or XRP, and are in style for his or her potential to hedge danger or revenue from volatility with out holding the underlying asset.

There are two main varieties of choices: calls, which revenue when the value of the underlying asset rises, and places, which revenue when the value falls.

For instance, if Bitcoin is buying and selling at $120,000, you may purchase a name possibility with a strike worth of $125,000 expiring in a single month. If Bitcoin rallies to $130,000, you’ll be able to train the choice to purchase Bitcoin at $125,000, securing a $5,000 acquire minus the price of the premium.

Nonetheless, choices buying and selling is dangerous, particularly within the extremely unstable crypto market. Within the earlier instance, if Bitcoin fails to cross $125,000, even when it comes shut, the choice expires nugatory, and the complete premium paid is misplaced.

A single assertion from President Donald Trump on tariffs or Fed Chair Jerome Powell on charge cuts might lead to important losses.

Premiums aren’t low cost in crypto as a consequence of excessive volatility. Repeatedly dropping the premium may end up in important losses, particularly for retail merchants. Choices additionally require an understanding of advanced elements like time decay, implied volatility, and strike pricing.

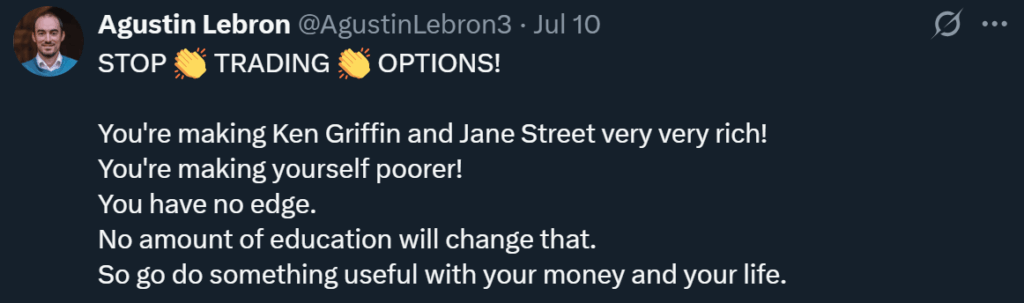

Distinguished choices dealer Agustin Lebron strictly warns buyers towards choices buying and selling, even in conventional finance, claiming that retailers can by no means compete with establishments like Jane Road.

For many merchants, these hurdles, together with the price of premiums, make crypto choices riskier and fewer accessible in comparison with easier, margin-based devices like crypto futures.

Futures enable merchants to seize related upside with out the burden of excessive upfront premiums. In addition they reward correct directional calls. For example, if Bitcoin rises from $120,000 to $124,800, a futures place would nonetheless generate sturdy returns, even when the value falls in need of the $125,000 mark.

With subtle but user-friendly platforms like CoinFutures, merchants can pursue outsized returns by means of excessive leverage whereas managing danger successfully with built-in stop-loss instruments.

How To Commerce Crypto Futures With CoinFutures?

Buying and selling crypto futures with CoinFutures is designed to be simple and user-friendly.

The platform eliminates the same old hurdles like prolonged registration processes, KYC checks, and pockets integrations. Anybody can create an account in seconds utilizing simply an electronic mail and a username, making it accessible for merchants worldwide. Obtain it right here.

As soon as registered, customers must fund their accounts. CoinFutures helps a variety of deposit strategies, together with in style cryptocurrencies equivalent to Bitcoin, Ethereum, BNB, Solana, MATIC, USDT, and USDC. For many who desire fiat, choices like Apple Pay, Google Pay, Mastercard, and PIX are additionally out there.

There aren’t any charges on deposits or withdrawals, making certain that merchants preserve extra of their capital for buying and selling.

Customers can now begin by deciding on the asset they wish to commerce after which select whether or not they consider the value will transfer up or down.

As soon as the asset is chosen, merchants predict whether or not the value will go up or down and select the quantity they wish to stake. Leverage could be adjusted with a easy slider, permitting merchants to see how their danger and reward change in actual time.

For the uninitiated, Leverage, or the multiplier, permits merchants to regulate a bigger place with a smaller quantity of capital, successfully multiplying each potential income and losses. For instance, utilizing 10x leverage means a 1% worth transfer ends in a ten% change in returns.

For danger administration, Auto Mode permits merchants to set stop-loss and take-profit ranges earlier than coming into a commerce. This ensures positions are routinely closed based mostly on pre-defined situations, even when the dealer is offline.

With its intuitive buying and selling interface, CoinFutures permits retailers to maximise their beneficial properties with hassle-free crypto futures buying and selling.

Whereas crypto choices buying and selling stays a gorgeous avenue for institutional buyers, retailers ought to contemplate being the place the true alternatives lie. With futures buying and selling on CoinFutures, easy up-or-down predictions, clear danger administration, and excessive leverage can ship outsized returns throughout this bull cycle.

Go to CoinFutures

This text has been supplied by one in every of our business companions and doesn’t mirror Cryptonomist’s opinion. Please remember that our business companions could use affiliate applications to generate income by means of the hyperlinks on this article.