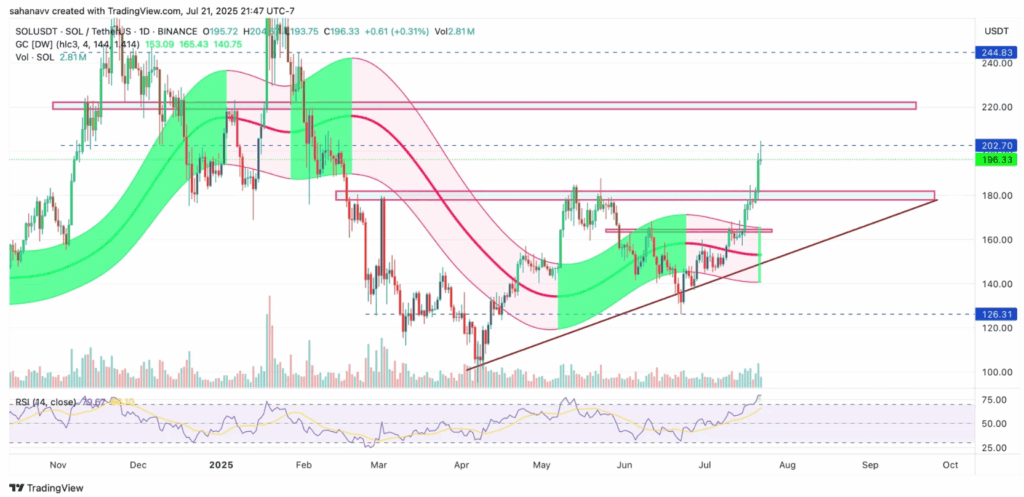

- Solana surged 20% to interrupt above $200, however analysts stay break up on whether or not it alerts a real breakout or one other short-lived pump.

- A significant protocol improve targets 60,000+ TPS, but previous outages proceed to solid doubt on community reliability.

- Broader market forces—like Bitcoin’s positioning, Fed coverage, and memecoin noise—are including strain to Solana’s unsure subsequent transfer.

Blended Indicators — Bulls vs Bears

So right here’s the place it will get messy. You’ve obtained individuals like Gert van Lagen throwing shade, saying Solana’s dropping floor towards BTC, ETH, and even XRP. He’s warning this might flip into one other LUNA-type mess if SOL retains bleeding like this. That’s… not what holders wanna hear.

However on the flip aspect, traders like Zyn (Web3 man) are like, “Nah, this $200 mark is a breakout affirmation,” and he’s already eyeing $260 prefer it’s subsequent week’s enterprise. Actually, the entire market’s divided — half full ship, half purple alert.

Tech Upgrades & Actual-World Noise

Behind the scenes, Solana’s cooking up a protocol improve. They’re in Epoch 821 now, bumping up block dimension by 20% and concentrating on over 60,000 TPS. On paper, that’s . However individuals nonetheless keep in mind these outages — like yeah, quick is cool however not if the entire thing goes offline.

Add to that every one the surface noise: Bitcoin hovering round $120K, Fed coverage, inflation drama, even SHIB popping off once more — it’s all including strain. There’s additionally a $200M credit score line from Mercurity Fintech that sounds nice however doesn’t actually have an effect on SOL’s value straight.

On the finish of the day, all of it comes right down to this: can Solana maintain that $200 stage, or is that this simply one other tease earlier than we drop to $180 once more? No one actually is aware of. Finest recommendation? Keep sharp, watch the charts, and don’t chase inexperienced candles blindly. Volatility’s nonetheless king.

Takeaway

Solana’s value transfer is thrilling, however the path forward’s nonetheless stuffed with noise. If it may possibly maintain $200, there’s room for extra upside—however don’t neglect how briskly sentiment flips on this house.

- If assist holds, $260 is perhaps in sight—however that’s a momentum sport, not a assure.

- If $200 fails, a visit again to $180 might come quick.

- Watch the macro strikes and tech stability—each are key.