The Bitcoin short-term holder steadiness has usually proven shifts close to market tops and bottoms. Right here’s what the metric’s development is signaling proper now.

Bitcoin Brief-Time period Holder Steadiness Hasn’t Seen Any Main Shifts Lately

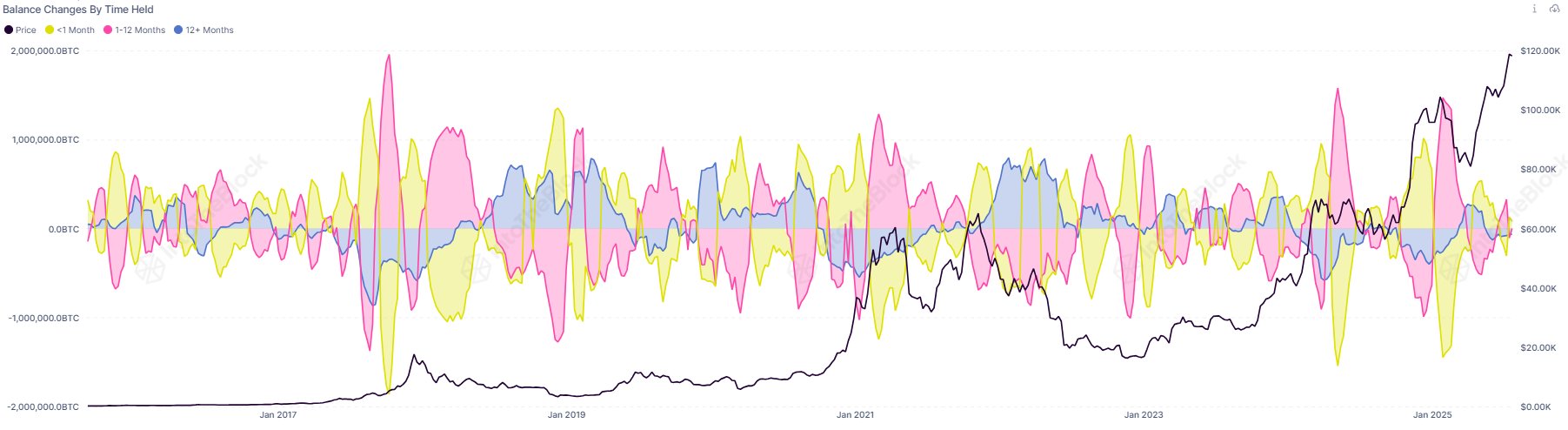

In a brand new submit on X, institutional DeFi options supplier Sentora (previously IntoTheBlock) has shared a chart that reveals how the holdings of the totally different Bitcoin investor teams has modified through the years. The cohorts in query have been divided on the idea of holding time.

The analytics agency classifies buyers into three teams: merchants, cruisers, and hodlers. The merchants embody the holders who’ve been carrying their cash for lower than a month. This group corresponds to the brand new entrants within the sector and the buyers who take part in excessive frequency trades.

The cruisers are buyers who’re now not that short-term minded, however additionally they haven’t constructed up sufficient resilience to be in it for the long-term but. Cruisers who handle to carry previous the one 12 months mark grow to be a part of the diamond palms of the community: the hodlers.

Now, beneath is the chart for the online change within the provide held by these three Bitcoin teams.

As displayed within the above graph, these cohorts have traditionally proven a sure sample close to inflection factors within the asset. “Fluctuations in short-term holder balances usually sign market turning factors,” notes the analytics agency.

Throughout main tops and bottoms, the merchants typically register a pointy spike of their steadiness, as cruisers and hodlers participate in revenue realization or capitulation. At any time when these older teams promote, the age of their cash resets again to zero and they’re put into the availability of the merchants.

From the chart, it’s obvious that whereas Bitcoin has noticed a pointy rally to new all-time highs (ATHs) not too long ago, there nonetheless hasn’t been any huge modifications within the provides of the merchants. “Apparently, we’re not seeing main shifts in the mean time,” says Sentora. It now stays to be seen whether or not which means the present rally nonetheless has room to develop.

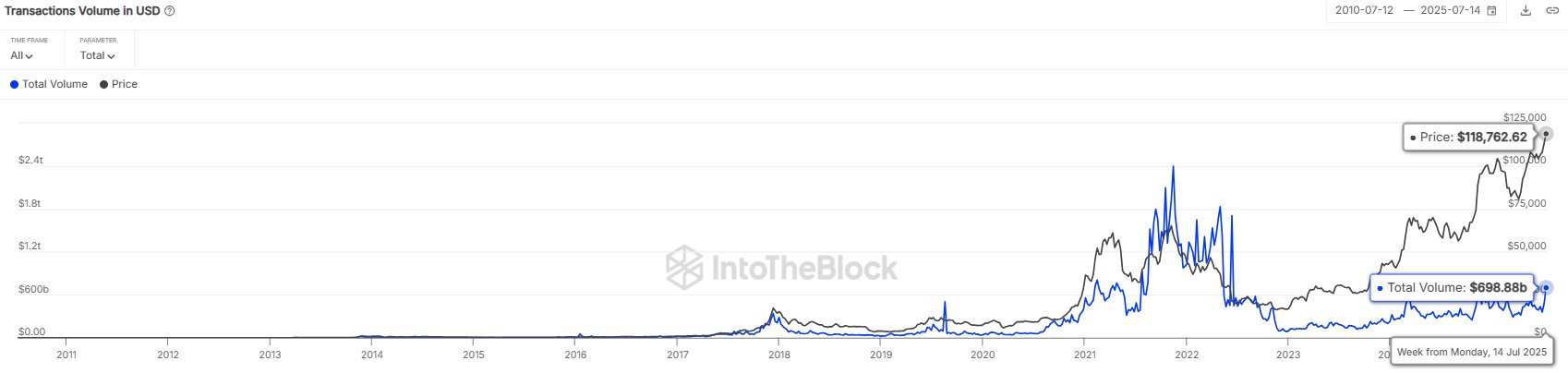

In another information, the cryptocurrency has seen an uptick in on-chain transaction exercise, because the analytics agency has identified in one other X submit.

The weekly Bitcoin transaction quantity reached virtually $700 billion final week, the best stage since 2022. Although, whereas this does point out exercise is as excessive because it’s ever been on this cycle, it’s nonetheless muted when in comparison with the highs of the 2021 bull run.

BTC Value

Bitcoin remains to be caught in sideways motion as its value is buying and selling round $119,000.