One of many defining options of this yr’s crypto rally has been the relentless accumulation by establishments. What started with a concentrated deal with Bitcoin has began to department out, as capital allocators put together for a future the place different digital belongings acquire related legitimacy. The rising dialog round altcoin ETFs, significantly for Ethereum, has added weight to this perception.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise, or different supplies on this web page.

Many fund managers now see diversification throughout blockchain ecosystems as a vital technique, not only a speculative play. As this pattern good points traction, retail traders are starting to take cues, anticipating that stronger initiatives will profit disproportionately. With volatility nonetheless current however the underlying narrative strengthening, the setup for a contemporary surge in token costs seems more and more seemingly.

Establishments Have Quietly Rewritten the Accumulation Narrative

Behind the scenes of market turbulence, institutional demand for Bitcoin has accelerated at a tempo few predicted.

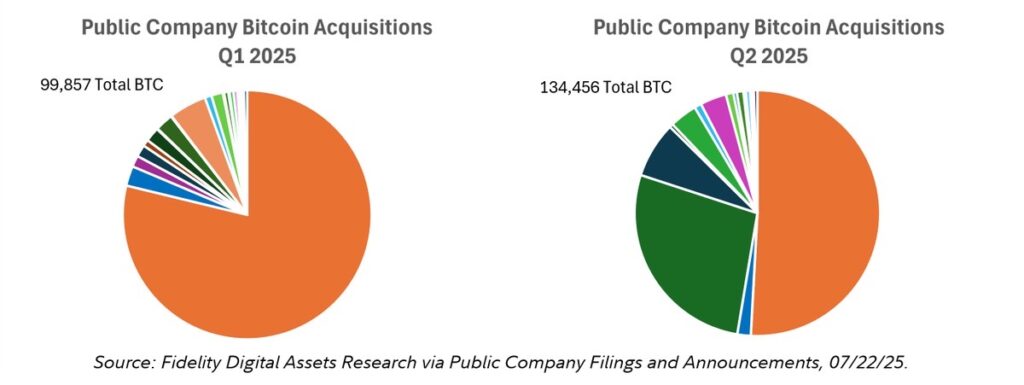

The variety of public corporations that maintain 1,000+ BTC continues to develop, doubtlessly signaling heightened institutional curiosity in bitcoin.

Analyst Zack Wainwright on our staff has been monitoring this carefully, significantly the businesses holding 1,000 BTC or extra.

We’ve got gone from… pic.twitter.com/lLXWra5kMq

— Chris Kuiper, CFA (@ChrisJKuiper) July 24, 2025

Based on Chris Kuiper of Constancy and analyst Zack Wainwright, the variety of publicly traded companies holding over 1,000 BTC jumped from 24 in Q1 to 35 in Q3 2025. This development is greater than symbolic.

In complete, these entities now personal near 900,000 BTC, with 134,456 of these cash acquired in Q2 alone. That marks a 35% improve over the earlier quarter, indicating that confidence just isn’t solely sustained however increasing.

What makes this significantly necessary for traders is the broader implication. These aren’t speculative strikes. These are treasury-level selections from firms that now deal with Bitcoin as each an asset and a reserve instrument. And as this conviction deepens, it naturally opens the door for different crypto belongings to enter related conversations.

This creates a uncommon alternative. Costs stay in a state of hesitation whereas institutional urge for food continues to construct within the background. For retail and personal traders prepared to look previous the noise, this could possibly be the final stretch earlier than valuations start catching up with fundamentals.

Tasks that provide actual infrastructure, scalability, or yield mechanics are particularly value watching. Their enchantment will solely develop as soon as capital rotation strikes past Bitcoin, which many now imagine is already underway.

Greatest Crypto to Purchase Now – Early Stage Altcoins That Might 10x Or Extra

Wall Avenue Pepe

In a yr when institutional habits is influencing crypto sentiment greater than ever, Wall Avenue Pepe finds itself strolling a wierd however well timed path. This meme coin doesn’t simply parody the monetary elite, but additionally attracts energy from their presence.

Impressed by the contradictions of excessive finance and retail insurrection, Wall Avenue Pepe is constructed for the sort of market second we are actually getting into. Buying and selling boards are as soon as once more lighting up with symbols of satire, and WEPE is among the many few tokens utilizing that power to create motion on-chain.

What separates it from empty meme cycles is its structured launch and comparatively centered liquidity technique. Wall Avenue Pepe has managed to remain in dialog not simply due to intelligent branding however due to its managed provide and token dynamics, which have prevented it from crashing throughout main corrections.

As meme tokens grow to be flashpoints for retail participation throughout risky cycles, WEPE advantages from the rising want amongst merchants to put low-cost, high-upside bets on tokens that also really feel early. The mission leans into its identification with out making an attempt to masquerade as one thing it isn’t, and that readability is a part of its enchantment.

Whereas institutional traders are unlikely to carry WEPE on their stability sheets, their presence out there fuels the hypothesis that this sort of asset thrives on. For these looking for publicity to a meme-driven asset with strategic execution, Wall Avenue Pepe is value watching, particularly whereas the price of entry stays low and the market’s focus is briefly elsewhere.

Snorter

Snorter is a Telegram-native mission that merges automation, hypothesis, and pace. It’s not a pockets, not a buying and selling terminal, and never a meme coin within the traditional sense. As an alternative, it features as an AI-enhanced bot designed to assist customers establish early token listings, significantly on-chain microcaps that always generate giant good points inside hours of launch.

In an period the place retail merchants try to front-run whales and beat market inefficiencies, Snorter suits immediately into that pursuit.

Its integration inside Telegram makes it uniquely positioned for retail habits. Most crypto merchants already spend time in teams, alerts channels, and bot-driven environments. Snorter doesn’t require new habits; it merely enhances present ones.

The bot scans sensible contracts, social mentions, and liquidity pair creation to inform customers of potential trades in actual time. In a buying and selling cycle pushed closely by event-driven hypothesis, this sort of device turns into a drive multiplier.

Snorter’s impression has been heard by high voices within the area as properly, with YouTubers like Cilinix Crypto and lots of others having claimed it to be a high-potential funding value trying out proper now.

What makes Snorter compelling proper now’s that it thrives throughout volatility. When institutional gamers dominate the massive caps and make secure traits tougher to search out, retail usually migrates to hurry and agility. That’s the place Snorter shines. Quite than compete with institutional cash, it avoids these battles completely. It permits smaller members to function in quick cycles, usually earlier than mainstream knowledge suppliers have caught up.

In a market the place precision and timing are more and more necessary, Snorter doesn’t simply supply alerts, it offers customers a tactical edge. As extra initiatives embrace Telegram-native infrastructure, Snorter’s relevance will solely improve.

Bitcoin Hyper

Bitcoin Hyper approaches the market with a really completely different intention than most memecoins. Constructed as a Layer 2 infrastructure answer for Bitcoin, it combines scalability structure with real-time incentive design.

As an alternative of promising summary decentralization or obscure token mechanics, the mission focuses on one thing exact, making Bitcoin’s ecosystem extra usable for functions past storage and easy transfers.

Bitcoin Hyper exists to unlock performance. It introduces quick finality, low charges, and sensible contract compatibility whereas staying anchored to the safety of the Bitcoin base layer. In a cycle more and more formed by institutional conviction in Bitcoin, a Layer 2 mission that makes the asset extra programmable with out compromising safety is probably going to attract critical consideration.

However utility is just one a part of the story. What makes Bitcoin Hyper well timed is the best way it connects to the present wave of capital curiosity. As extra companies look to carry Bitcoin on stability sheets, questions on the best way to make these holdings productive will comply with. Bitcoin Hyper supplies that route, not by turning BTC into one thing else, however by giving it expanded use inside a safe Layer 2 framework.

This can be a mission that advantages from Bitcoin’s institutional legitimacy whereas nonetheless providing speculative upside tied to adoption. If capital rotation does start shifting from storage-based belongings to yield-enabled methods, Bitcoin Hyper could possibly be one of many extra logical bridges. It’s a technical reply to a market query that has to this point lacked elegant options.

TOKEN6900

TOKEN6900 just isn’t pretending to be constructing a platform, launching an app, or teasing any roadmap. And that’s precisely what makes it harmful within the present surroundings.

This can be a pure memecoin, one which operates completely on social power, reflexive shopping for, and unapologetic chaos. In a market that always overengineers its narratives, TOKEN6900 thrives by rejecting all construction.

Born from Telegram tradition and fueled by degen participation, the token performs into the urge for food for quick flips and absurd good points. It doesn’t have a whitepaper or any acknowledged imaginative and prescient. What it does have is motion. And in a buying and selling environment the place speculative flows shift quickly, that’s typically sufficient. The meme itself has taken maintain in ways in which really feel acquainted to those that witnessed the early days of tokens like DOGE or PEPE. It’s numerical, it’s unserious, and it’s viral.

What makes TOKEN6900 particularly related now’s the backdrop of institutional capital getting into Bitcoin and different high belongings. As these flows drive the massive caps, retail merchants are trying additional out on the danger curve for pleasure. Memecoins like this grow to be the risky playground that lets them keep energetic whereas the massive cash consolidates.

No utility, no utility theater, and simply pure hypothesis. TOKEN6900 could not survive long run, however throughout moments like these, when market consideration fragments and social liquidity spikes, it will probably nonetheless ship explosive returns for many who perceive the sport.

Conclusion

Tasks like Wall Avenue Pepe, Snorter, Bitcoin Hyper, and even the totally degen TOKEN6900 symbolize the sort of early-stage altcoins that have a tendency to maneuver first when capital begins rotating outward. Their low market caps, artistic narratives, and energetic communities give them sturdy potential for development, simply making them a few of the greatest cryptos to purchase now.

These tokens aren’t but totally priced in by practical market expectations. That makes them dangerous, but additionally doubtlessly rewarding. For traders prepared to dig deeper, every of them brings one thing completely different to the desk, and that distinction could also be precisely the place the subsequent wave of upside begins.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to use of or reliance on any content material, items or companies talked about.