- BTC dominance drops to 60.83% as capital rotates into altcoins, not out of the market.

- Bitcoin faces heavy whale promoting, however Ethereum and Solana present sturdy community exercise and DeFi progress.

- Complete altcoin market cap holds at $1.44T; key help ranges recommend the market isn’t in panic mode.

Bitcoin’s been on a rollercoaster—sliding underneath $116K, whales dumping, and alternate inflows spiking. However right here’s the twist: altcoins aren’t collapsing with it. As a substitute, the overall altcoin market cap continues to be holding agency above $1.44 trillion, displaying some quiet energy regardless of BTC’s shaky legs.

Bitcoin Dominance Slips as Capital Rotates

Knowledge from CoinGlass exhibits BTC dominance falling to 60.83% on July 25, down from 62.1% earlier this week. Ethereum’s sitting regular with an 11.66% share, whereas Solana claims 2.54%. The “Different Cash” class? That’s as much as 17.87%, its highest in weeks. This isn’t a market-wide selloff—it’s capital rotation.

The 4-hour RSI heatmap backs this up. Bitcoin’s RSI is caught beneath 40, wanting weak, whereas ETH, BNB, and TRX hover close to impartial territory. Merchants are clearly maintaining their altcoin publicity regardless of Bitcoin’s tumble. It’s not panic; it’s reshuffling.

Total2 and Market Caps Nonetheless Robust

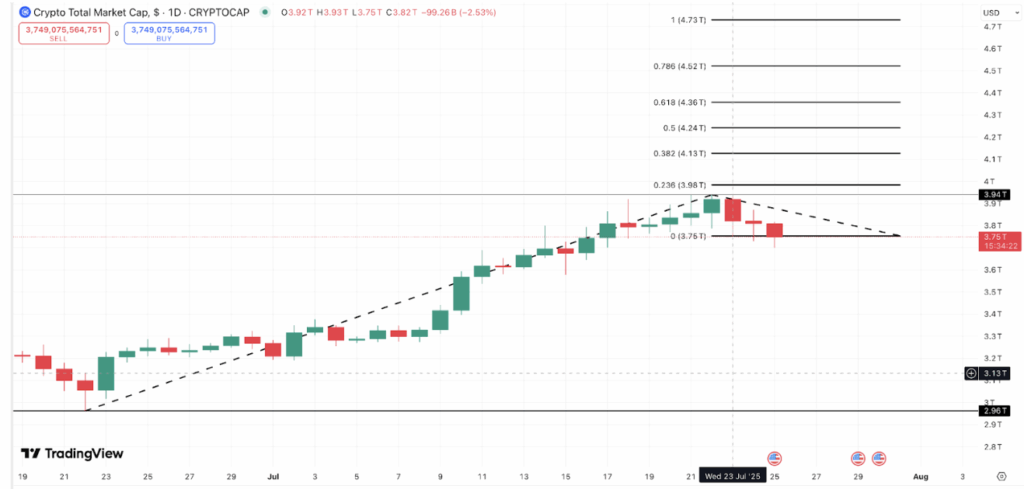

Even with as we speak’s dip, Total2—the altcoin market cap excluding BTC—is regular round $1.44 trillion. It’s barely down from a $1.46 trillion excessive. In the meantime, the general crypto market cap stands at $3.82 trillion, slightly below the 0.236 Fibonacci retracement at $3.98 trillion. Until we see a pointy drop underneath $3.75 trillion, the correction appears delicate.

Put merely, altcoins aren’t diving. They’re cooling off, however the important thing helps are holding. Merchants appear to be biking out of Bitcoin however sticking with sturdy alt tasks.

Whales Are Concentrating on BTC, Not Altcoins

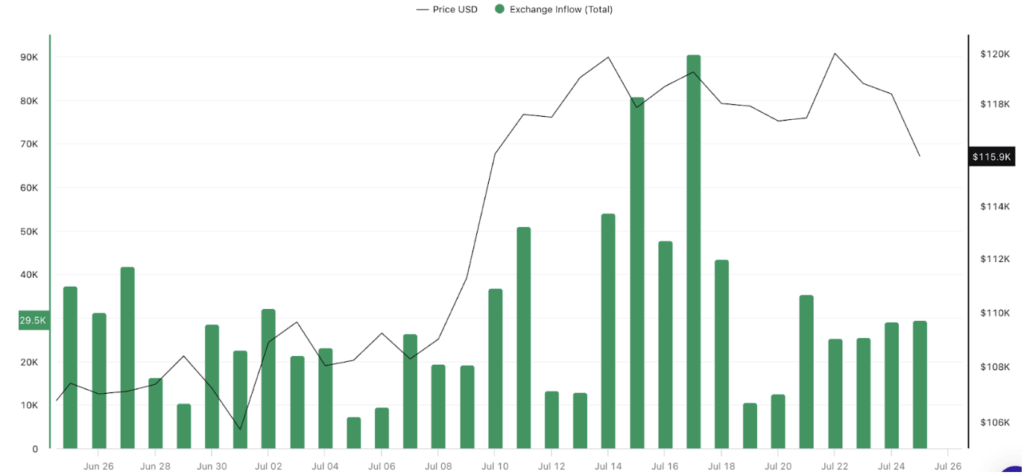

Bitcoin alternate inflows have surged, topping 80,000 BTC between July 14–17, with peaks close to 90,000. On July 24, inflows had been nonetheless excessive at round 30,000 BTC. Unsurprisingly, BTC’s value slid from $120K to $115K throughout this time.

However the altcoin story is completely different. Ethereum’s lively addresses are up 8.37% within the final week and 32.23% over the month. Solana wallets dipped 9.59% in a day however are nonetheless up 15.53% month-to-month. Tron’s up 21.32% month-on-month.

DeFi TVL information confirms the shift: Ethereum’s TVL sits at $80.99 billion, Solana’s at $9.73 billion (up 15.53% over 30 days), whereas Bitcoin lags at $6.72 billion. This isn’t a complete market exodus—it’s focused BTC promoting, doubtless from ETFs or massive institutional gamers.

Key Ranges to Watch

So long as Total2 stays above $1.44 trillion and the total market cap holds above $3.75 trillion, altcoins stay resilient. Bitcoin could be coping with heavy promote stress, however the broader market nonetheless has loads of life left.