Tron Inc. (Nasdaq: TRON), the publicly listed firm with the biggest holdings of the TRON (TRX) token, marked a serious milestone on Thursday with a ceremonial go to to the Nasdaq MarketSite in Occasions Sq.. Tron Founder and the corporate’s International Advisor, Justin Solar, rang the opening bell, signaling a brand new chapter for the blockchain agency.

Associated Studying

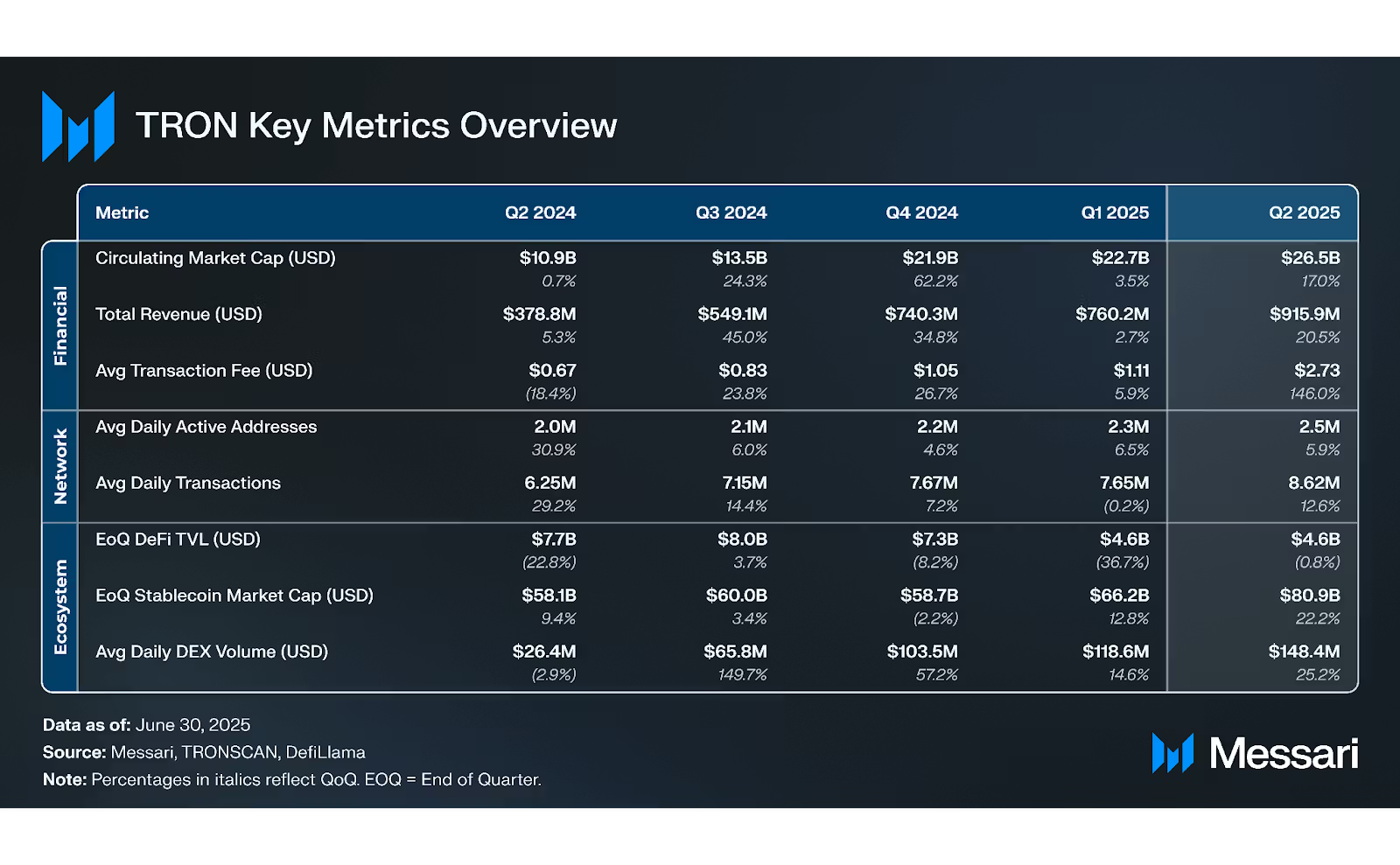

Coinciding with the occasion, TRON launched its Q2 2025 earnings report, revealing sturdy progress throughout key metrics. TRON’s market capitalization surged 17% quarter-over-quarter (QoQ) to $26.5 billion, whereas income jumped 20.5% QoQ to succeed in $915.9 million—each standing as multi-quarter highs. The report indicators rising institutional curiosity and rising adoption of the TRON ecosystem at a time when broader crypto markets face blended sentiment.

Because the blockchain sector matures, TRON’s mix of aggressive enlargement and robust fundamentals seems to place the corporate favorably within the eyes of each retail and institutional buyers. With this twin milestone—market debut and robust Q2 efficiency—TRON is sending a transparent message: it’s right here to guide.

TRON Stories Deflationary TRX Provide, Document Stablecoin Development In Q2

TRON’s Q2 report highlights a deflationary shift in TRX provide alongside robust community progress and stablecoin dominance. The circulating provide of TRX declined from 95.0 billion to 94.8 billion tokens, reflecting an annualized inflation charge of roughly -1.8%. Whereas this marks a barely increased inflation charge than Q1’s -1.6%, it nonetheless factors to deflationary strain on TRX, reinforcing its worth proposition amid broader market uncertainty.

Community exercise additionally confirmed stable progress through the quarter. Day by day common transactions rose 12.6% quarter-over-quarter (QoQ), growing from 7.7 million to eight.6 million, whereas day by day lively addresses climbed 5.9% QoQ from 2.4 million to 2.5 million. These metrics recommend rising person engagement and increasing utility throughout the TRON ecosystem.

Stablecoin exercise stays a cornerstone of the community’s success. TRON’s stablecoin market cap surged 22.2% QoQ, rising from $66.2 billion to an all-time excessive of $80.9 billion. Tether (USDT) continues to dominate, accounting for 99.2% of the stablecoin provide on TRON. By the top of Q2, the USDT market cap on TRON reached $80.3 billion, a 22.2% enhance from the earlier quarter. Notably, TRON now hosts 50.6% of all USDT in circulation, underscoring its function because the main blockchain for stablecoin exercise.

Associated Studying

TRX Worth Holds Above Key Assist

TRON (TRX) is exhibiting resilience following its robust Q2 efficiency, holding regular above key help ranges regardless of current market volatility. As of the most recent 8-hour chart, TRX is buying and selling at $0.3163, up 0.48% on the day. After reaching an area excessive close to $0.34 earlier this month, TRX skilled a light pullback however has since stabilized and is now consolidating in a decent vary.

Worth motion stays bullish, with TRX buying and selling above the 50-day ($0.3084), 100-day ($0.2935), and 200-day ($0.2840) shifting averages—a sign of robust medium- and long-term momentum. The current bounce from the 50-day MA suggests consumers are actively defending short-term help zones, reinforcing the general uptrend.

Associated Studying

A breakout above the $0.32–$0.325 zone may sign a push towards retesting the $0.34 excessive. A failure to carry above the 50-day MA may open the door to a retest of the $0.30 psychological degree. For now, the bias stays cautiously bullish.

Featured picture from Dall-E, chart from TradingView