Tron (TRX) has skilled a slight worth enhance, reflecting the asset’s affiliated agency’s itemizing on the Nasdaq change throughout the week. At the moment, Tron is bullish, significantly with over 90% of its holders in revenue. As per IntoTheBlock knowledge, an enormous 86.9 billion TRX are in revenue.

90% of Tron holders in revenue alerts market energy

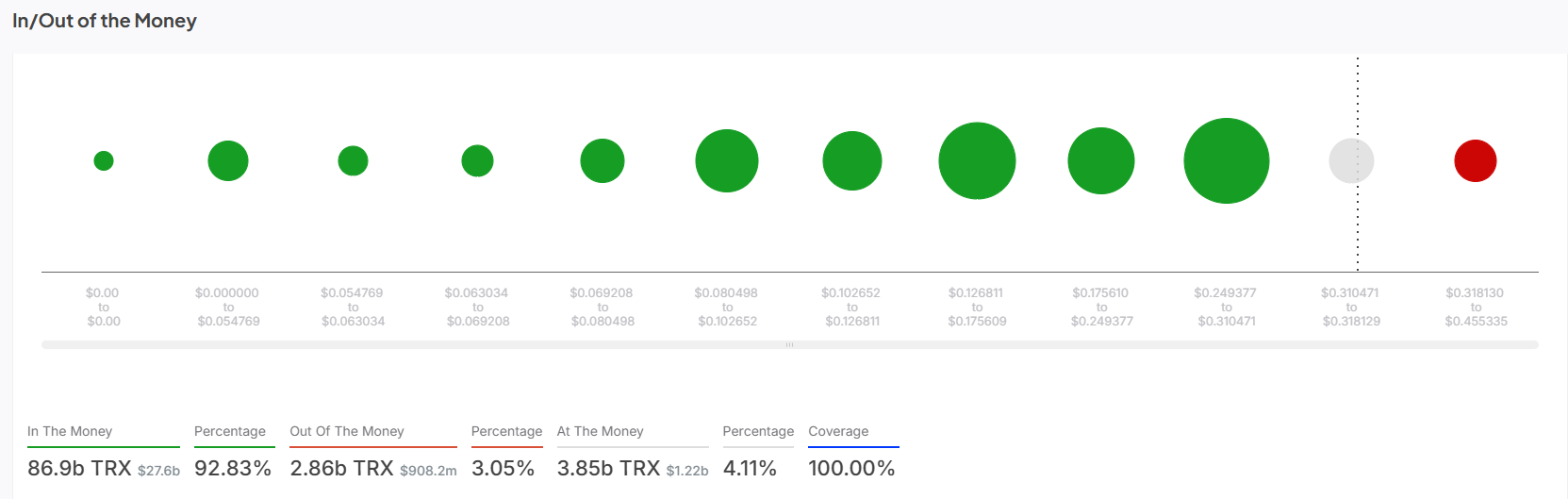

Notably, this represents 92.83% of its whole addresses in revenue, signaling robust market efficiency for the asset. These addresses are value $427.6 billion in fiat foreign money, indicating that holders of those addresses will not be at a loss.

It’s due to this fact unlikely that the Tron ecosystem will expertise vital volatility, as buyers might not be trying to dump their holdings available on the market. As a substitute, they’re nonetheless holding, anticipating additional worth positive factors.

Of the remaining addresses, 3.05% or 2.86 billion TRX valued at $908.2 million are “Out Of The Cash.” These are the holders who bought Tron at a worth larger than the present market worth. The remaining 3.85 billion TRX, or 4.11% of the entire addresses, value $1.22 billion, are “At The Cash,” or the breakeven level.

This set of buyers can be watching Tron’s worth motion to see how they will decrease their losses or take income. As of this writing, Tron is buying and selling at $0.3180, representing a 1.27% enhance over the past 24 hours.

Nonetheless, buying and selling quantity has dipped considerably by 40.41% to $949.19 million throughout the identical time-frame.

Tron faces resistance forward at $0.320

Tron’s current debut on the Nasdaq may increase institutional credibility and enhance adoption within the coming days. Along with the itemizing, Tron has additionally collaborated with the Kraken change in a transfer that might additional increase its credibility within the cryptocurrency area and the broader monetary sector.

These developments may positively influence the market worth of the asset. Nonetheless, Tron faces a vital resistance at $0.320. For the asset to check larger worth ranges, it should keep above the $0.30 worth mark. A breakout may push the value as much as $0.45 if it may overcome the resistance at $0.34.