High market analyst Ali Martinez has shared on-chain information that ideas Bitcoin to succeed in a $130,000 valuation, albeit on one situation. This bullish value prediction comes following a slight 2.6% value rebound over the previous two days, pushing Bitcoin inside the $118,000 value vary.

$110K Emerges As Essential Bitcoin Assist Zone – Right here’s Why

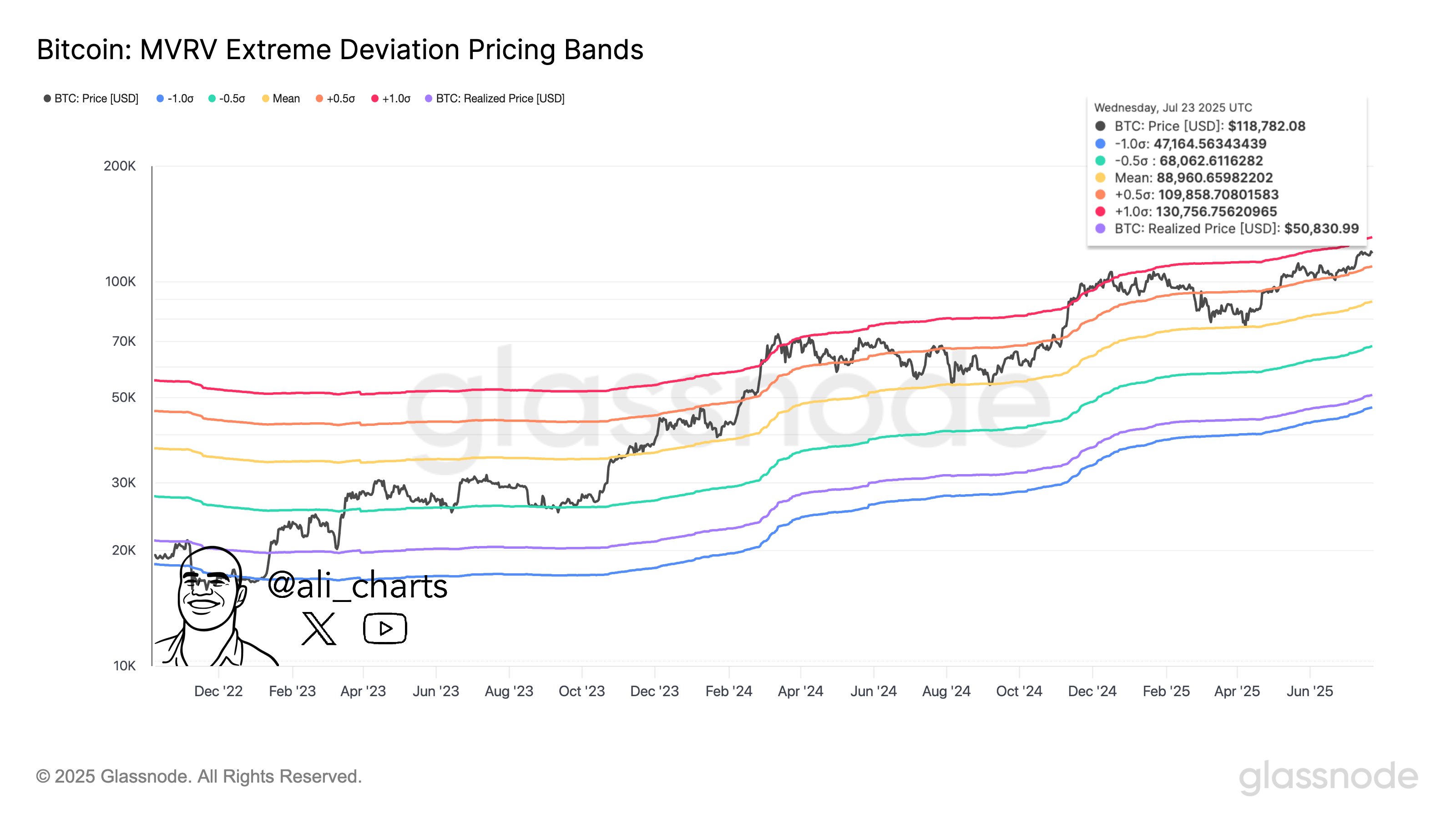

In an X publish on July 26, Ali Martinez postulates that Bitcoin could also be on observe for a big leg greater primarily based on current information from the MVRV pricing bands by Glassnode. Nevertheless, the premier cryptocurrency should keep away from shedding a sure help zone to forestall an invalidation of this bullish thesis.

The MVRV bands, derived from Market Worth to Realized Worth (MVRV) ratios, assist visualize when Bitcoin is both overvalued or undervalued relative to its historic realized value. These bands perform like Bollinger Bands however are grounded in on-chain fundamentals, monitoring statistical deviations across the imply MVRV worth.

As of July 23, 2025, Bitcoin was buying and selling at roughly $118,782, following a gradual climb over current weeks. In accordance with the MVRV pricing mannequin, the cryptocurrency was hovering simply beneath the +1.0σ deviation band, marked at $130,756, representing the subsequent main value resistance and goal. Notably, the +1.0σ band can also be interpreted as a key zone of maximum market optimism, usually previous native tops (+2.0σ)

Then again, the mannequin’s +0.5σ band sat at $109,858 beneath the present market costs, serving as a significant help threshold. Ali Marinez explains that Bitcoin should keep its value stage above this band to retain a excessive likelihood of continuation towards the +1.0σ stage goal primarily based on historic patterns. Nevertheless, a breakdown beneath $110,000 might sign a deeper correction, doubtlessly all the way down to the imply band at round $88,960, or decrease towards $68,062 (-0.5σ).

Bitcoin Traders Take Earnings With Rising Market Confidence

In accordance with extra information from the MVRV mannequin, the rising distance between BTC’s realized value, round $50,831, and its current market value displays rising investor conviction. For context, the realized value represents the common value foundation of all cash in circulation, thereby indicating how deeply in revenue the common Bitcoin holder is in the intervening time.

At press time, the premier cryptocurrency trades at $118,178 following a 0.73% up to now day. Nevertheless, the day by day buying and selling quantity is considerably down by 53.39% and valued at $47.98 billion. In accordance with value prediction website Coincodex, the Bitcoin market sentiment stays largely bullish, with the Worry & Greed Index nearing excessive greed at 72.

Coincodex analysts challenge the main cryptocurrency to keep up its present rebound, rising to $122,019 in 5 days and $141,075 in a month.