- Ethereum ETFs noticed $2.4B in inflows final week, surpassing Bitcoin’s $827M and driving ETH towards $4,000.

- Analysts, together with Mike Novogratz, see ETH breaking $4K quickly, with projections of $5K–$6K by 2025.

- Bullish sentiment, ETF momentum, and robust value motion counsel ETH may outperform BTC within the coming months.

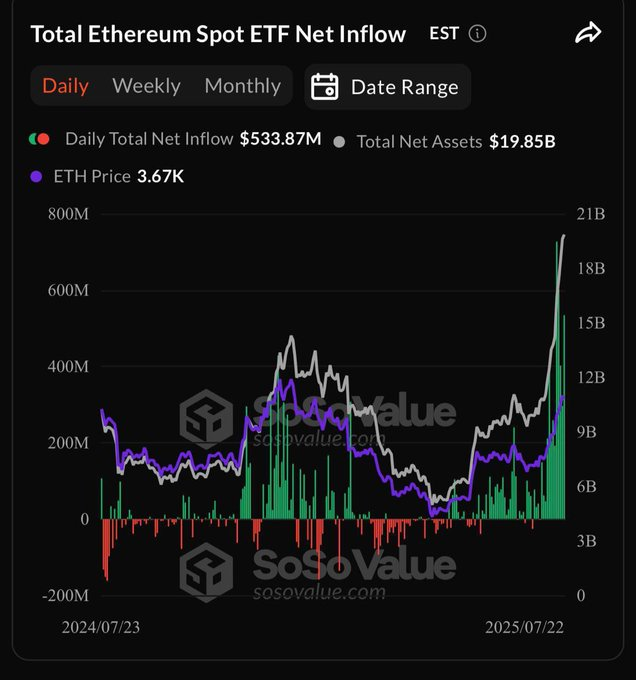

Ethereum has been stealing the highlight recently, leaving even Bitcoin a bit within the shadows. Spot Ethereum ETFs pulled in an enormous $2.4 billion in inflows final week, whereas Bitcoin ETFs solely managed $827 million. That’s a reasonably clear signal of the place investor pleasure is shifting. ETH has outperformed BTC by almost 4% in worth development and is pushing nearer to the $4,000 mark. Resistance is there, however the shopping for frenzy round Ether ETFs simply retains rising, with inflows hitting document highs day after day.

Report-Breaking Inflows and Analyst Buzz

The Kobeissi Letter lately reported that Ethereum ETFs noticed $533.9 million in internet inflows on a single day—Tuesday, to be actual. That’s their greatest single-day influx ever. This wave of demand has analysts whispering (or shouting) that ETH may doubtlessly outperform Bitcoin for the remainder of 2025. Galaxy Digital’s CEO, Mike Novogratz, even informed CNBC that ETH is more likely to “knock on the $4,000 ceiling a number of occasions” and will head into full-on value discovery after that. He made it clear he owns each BTC and ETH, however the best way he talks about Ethereum? Feels like he’s betting on its mainstream second.

Can ETH Smash $5,000?

A handful of analysts consider Ethereum may attain $5,000, possibly before folks anticipate. Changelly’s August forecast places ETH at round $4,274 by the tip of subsequent month, and if the ETF momentum doesn’t decelerate, there’s room for an even bigger run. CoinCodex, looking a bit longer, suggests Ethereum may climb to $6,184 by October 2025—a few 60% achieve from the place it’s now. Contemplating ETH is already up almost 50% in simply the previous month, that focus on isn’t precisely a wild dream.

Sentiment and Market Circumstances

Based on CoinCodex indicators, Ethereum’s present sentiment is firmly bullish. The Concern & Greed Index is flashing 71, which leans closely towards greed, and ETH has posted 21 inexperienced days out of the final 30. With volatility holding round 16.3%, merchants are sensing this might be the time to strike. If the ETF influx streak holds and ETH breaks via $4,000, the stage is perhaps set for the following leg up—possibly even towards that $5K milestone everybody’s speaking about.