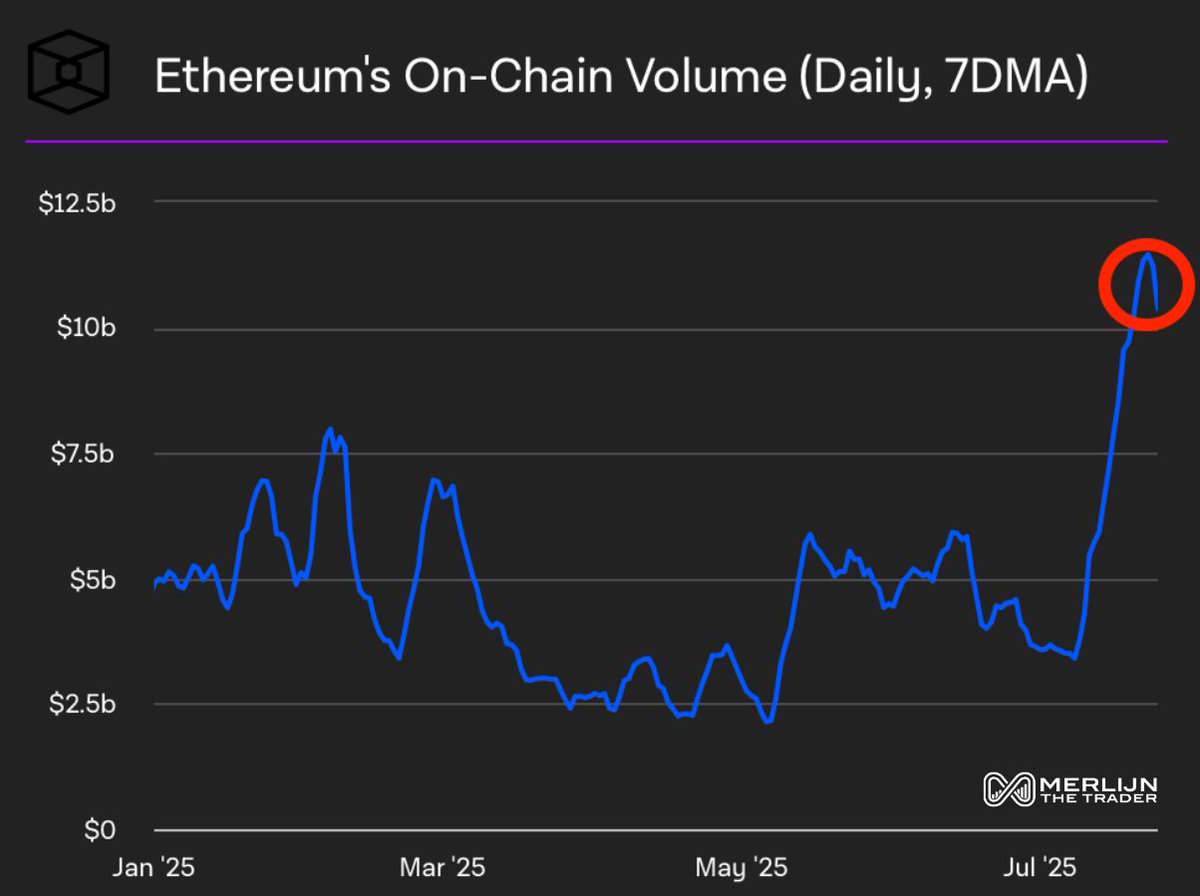

Ethereum’s community simply witnessed a seismic shift in exercise.

In response to crypto analyst Merlijn The Dealer, Ethereum’s on-chain quantity has exploded 288% prior to now three weeks, marking some of the aggressive spikes in community utilization this 12 months. However this isn’t only a random surge—it may sign a major worth transfer forward.

Traditionally, fast will increase in on-chain quantity are likely to precede main rallies. Rising quantity usually displays rising demand, elevated pockets exercise, and institutional repositioning. In Ethereum’s case, such a quantity spike suggests capital is rotating into ETH, probably in anticipation of an upcoming ETF approval, Layer 2 development, or broader altcoin breakout.

Merlijn notes: “This isn’t a spike, it’s a sign. The cash is transferring. Capital is rotating.” His take implies that the current quantity rise is a structural shift, not simply speculative noise. Ethereum is at the moment buying and selling close to the $3,100–$3,200 vary, but when this quantity development continues, analysts count on a push towards the $3,800–$4,000 resistance zone, with some eyeing $4,500 as a pre-ETF breakout degree.

Including to the bullish case, Ethereum can also be outperforming Bitcoin in a number of metrics, together with community charges and NFT volumes. DeFi exercise is rebounding, and staking development stays robust post-merge.

Whereas short-term volatility can’t be dominated out, Ethereum’s rising on-chain quantity would be the first signal {that a} new accumulation section is underway—doubtlessly setting the stage for the subsequent main leg up in worth.