A sweeping new commerce settlement between the US and the EU (European Union) may mark a turning level in international danger sentiment, and probably assist Bitcoin (BTC) and different danger property.

In the meantime, crypto markets eye one other hiatus relating to tariff insurance policies between the US and China.

Trump Broadcasts US-EU Commerce Deal: All You Have to Know

The newest US-EU settlement, valued at roughly $1.35 trillion, consists of sweeping commitments from the European bloc.

Underneath the phrases of the deal, the EU will buy $750 billion price of US vitality, make investments $600 billion into the US economic system, and purchase tons of of billions price of American-made navy tools.

In change, a uniform 15% tariff will likely be utilized throughout all US-EU traded items, changing beforehand fragmented tariff charges.

Trump emphasised the size of the deal, revealing that American items would enter EU markets at zero tariffs. This alerts a dramatic reversal from years of commerce rigidity between the 2 allies.

“This cope with the European Union is the largest I’ve made to this point. However we’re simply getting began,” he said.

Thomas Lee, Head of Analysis at Fundstrat International Advisors, known as the deal a elimination of a key “tail danger” for markets.

“This removes a destructive ‘tail danger’ occasion = good for equities,” Lee posted on X (Twitter).

Historically, lowered macro fears have a tendency to profit equities and weaken the bullish case for Bitcoin as a hedge or risk-off asset.

Nonetheless, in at present’s hybrid market construction, the place Bitcoin is more and more handled as a danger asset by establishments, it will possibly additionally profit within the quick time period when danger urge for food returns.

Lowering geopolitical uncertainty and international commerce friction typically ends in a extra risk-on atmosphere for crypto markets, significantly Bitcoin.

Bitcoin’s rising integration into institutional portfolios implies that macro catalysts, similar to lowering tail dangers, can amplify capital flows into the asset.

Furthermore, the worldwide tariff reshuffling might affect forex markets, greenback energy, and inflation dynamics, that are macro variables intently watched by crypto merchants.

With new tariff charges on nations like Canada (35%), Mexico (30%), and Brazil (50%) set to take impact on August 1, and a brief 90-day extension on US-China tariffs, international capital flows may see significant reallocation within the coming months.

This improvement may provide a uncommon second of readability for crypto traders dealing with an unsure macro backdrop.

It may ship a calmer commerce atmosphere, stronger dollar-aligned capital flows, and a possible tailwind for danger property like Bitcoin.

“President Trump simply unlocked one of many greatest economies on this planet. The European Union goes to open its 20 Trillion greenback market,” commented Howard Lutnick, US Secretary of Commerce.

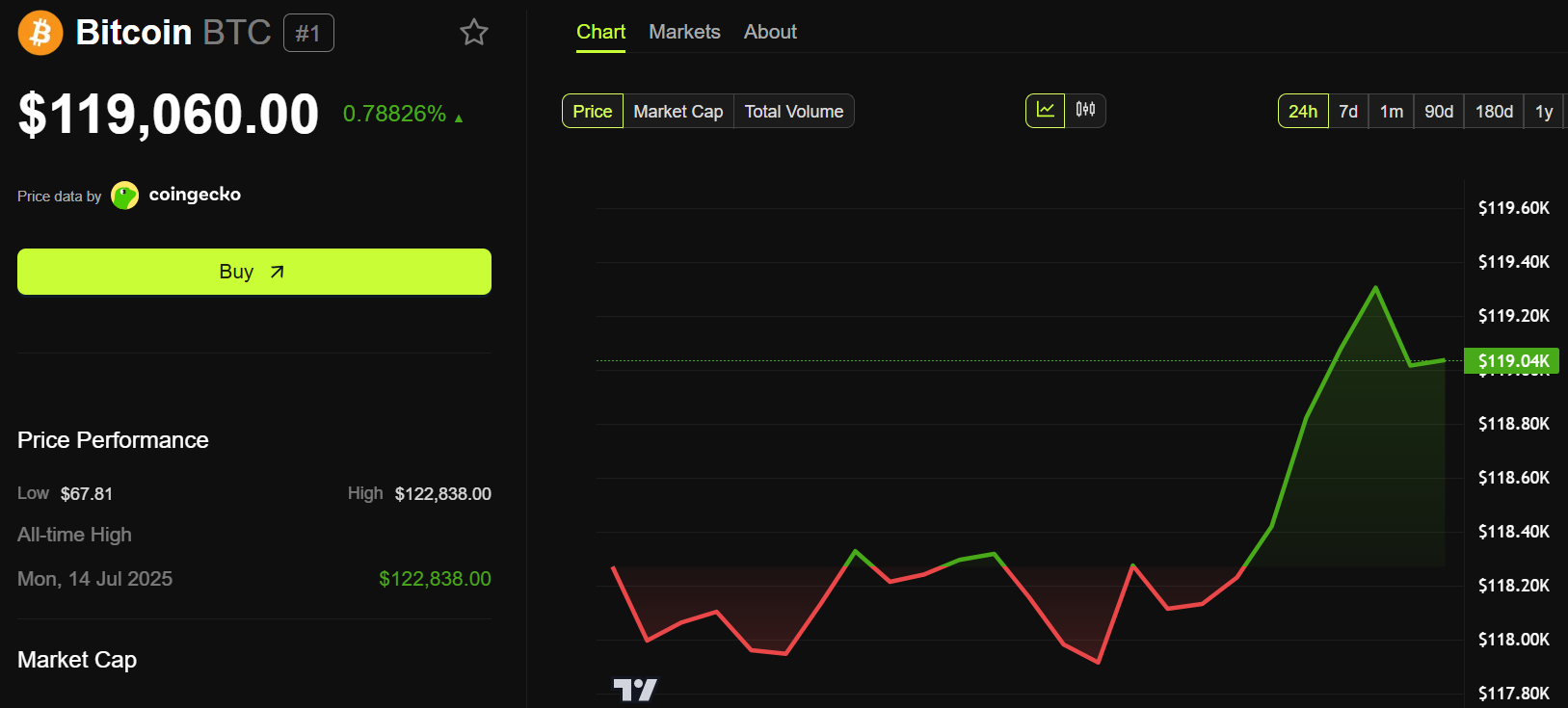

Bitcoin was buying and selling for $119,060 as of this writing, up by a modest 0.78% within the final 24 hours.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.